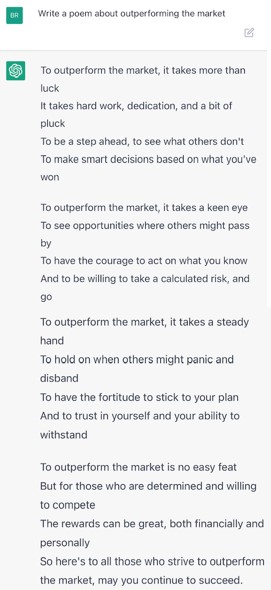

Image: ChatGPT is taking the Internet by storm. A poem generated by the AI-driven chatbot in a matter of seconds about outperforming the stock market. Image Source: ChatGPT

By Brian Nelson, CFA

We weren’t just having fun when we tested a new chatbot asking it to write a poem about outperforming the market.

In case you haven’t heard yet, making the rounds on social media is a new artificial intelligence [AI] tool called ChatGPT. The Internet is literally abuzz on the potential prospects of this chatbot phenomenon, and after trying it out for ourselves, we think it has the long-term potential to be the real deal.

ChatGPT can do a lot of things. It can write poems pretending to be a talking cat, deliver essays on topics based on unique parameters, draw up complicated legal documents with specific terms, simulate debates between late and current Presidents alike — all in a matter of seconds — and the list goes on and on.

So what is ChatGPT?

The Guardian has done a lot of background work on the topic. ChatGPT was created by an independent research body called the OpenAI foundation, which Tesla (TSLA) CEO Elon Musk co-founded (Musk no longer is on the board, however). GPT stands for “Generative Pre-Trained Transformer.”

The chatbot is pretty unique in that it, from our perspective, can truly understand the ins and outs of human language, picking up subtle nuances in requests, as if you’re really talking to a person or asking your very, very intelligent friend a question. Frankly, we were impressed when we tried it out, and we’re not the only ones.

Though there are skeptics out there on this current AI iteration and perhaps some may have already found some bugs (it only has data going up to late last year), others are calling it “scary-good, crazy-fun,” and Mashable noted that “OpenAI is a huge step toward a usable answer engine.” Whether or not the current iteration of this AI-driven chatbot is ready for the real world, however, is not necessarily the question when it comes to investors.

The reality is that ChatGPT showed us something, and we think it has shown a lot of people, that even with its flaws, AI, in the long run, is going to change a lot of industries, and perhaps no other feature may be more comparable to AI-driven chatbots than Alphabet’s (GOOG) (GOOGL) search engine, Google.

Meta Platforms (META) experienced a major disruption when TikTok emerged, and ChatGPT or something similar to it, if or when it establishes a revenue model, may be a huge disruptor to Google. Though it’s not something that is going to happen overnight, of course, we think long-term investors of Alphabet should take note.

We’re not going to overreact, however.

It has taken nearly two decades for Alphabet to establish its search dominance, and one tool in its early innings may be something to keep one’s eyes on, but not panic over. We also can’t be completely sure what’s included in Alphabet’s ‘Other Bets’ segment, and it’s possible Alphabet may have something even better in that area, whether it is in AI or other.

Concluding Thoughts

ChatGPT is really, really interesting, and while there are impending–but not immediate threats–from AI-driven chatbots to ad-driven social media equities, we’re not making any changes to the fair value estimates of equity coverage at this time. Alphabet remains one of our favorite ideas for long-term capital appreciation.

Tickerized for stocks in the SOCL.

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.