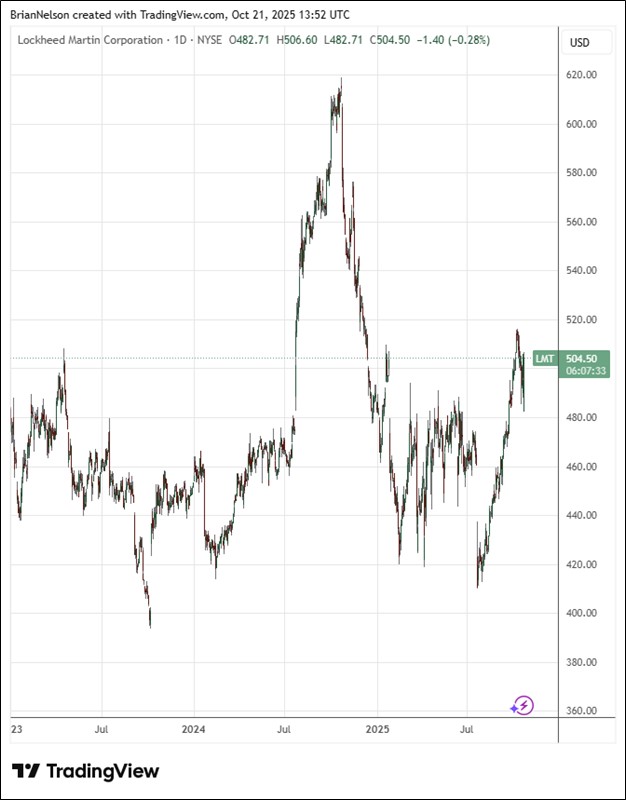

Image Source: TradingView

By Brian Nelson, CFA

On October 21, Lockheed Martin (LMT) reported better than expected third quarter results, with revenue and GAAP earnings per share exceeding the consensus forecasts. Third quarter sales of $18.6 billion increased compared to $17.1 billion in the third quarter of 2024. Net earnings in the third quarter were $1.6 billion, or $6.95 per share, compared to $1.6 billion, or $6.80 per share in the third quarter of last year. Cash flow from operations was $3.7 billion in the third quarter, compared to $2.4 billion in the third quarter of 2024. Free cash flow was $3.3 billion in the third quarter, compared to $2.1 billion in the third quarter of last year.

Management had the following to say about the results:

Based on the effectiveness and reliability of our products and systems, strong demand from Lockheed Martin’s customers—both in the United States and among our allies—continues. As a result of this unprecedented demand, we are increasing production capacity significantly across a wide range of our lines of business. Our record $179 billion backlog—more than two and a half years of sales—underscores the trust our customers place in us and underpins our company’s long‑term growth prospects. Major contract awards for the CH‑53K and PAC‑3 MSE programs are the largest ever for our Rotary and Mission Systems and Missiles and Fire Control businesses, respectively. Additionally, in close collaboration with our customers, we finalized the contracts covering Lots 18 and 19 of the F‑35 early in the fourth quarter. Lockheed Martin has delivered a record 143 F‑35 Lightning II jets through the end of the third quarter.

Looking ahead, we are investing aggressively in both new digital technologies and physical production capacity needed to meet the top defense priorities of the United States and its allies—and we are doing so in partnership with a number of leading technology partners, large and small. Major national‑defense initiatives like the Golden Dome for America demand proven leadership in a wide range of skills, including integrated air and missile defense, space warfare and highly secure command‑and‑control systems. Lockheed Martin is the capable leader and integrator across industry for these types of initiatives. Moreover, our disciplined capital deployment continues to provide robust, reliable rewards for our shareholders, highlighted by 23 consecutive years of dividend increases. Together, these results reflect a company built for performance today and poised for growth tomorrow.

Looking to all of 2025, Lockheed Martin raised its guidance. Sales are now expected in the range of $74.25-$74.75 billion, up from $73.75-$74.75 billion previously. Business operating profit is targeted in the range of $6.675-$6.725 billion, up from $6.6-$6.7 billion previously. Diluted earnings per share for 2025 are expected in the range of $22.15-$22.35, up from $21.70-$22.00 previously. Cash from operations for the year is expected at $8.5 billion, while free cash flow is targeted at $6.6 billion. Lockheed Martin’s board authorized the repurchase of its common stock up to an additional $2 billion, increasing the total authorization for potential future stock buybacks to $9.1 billion. The company raised its dividend payment to $3.45 per share, up 5% over its prior quarterly dividend payout. We continue to like Lockheed Martin as a holding in the Dividend Growth Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.