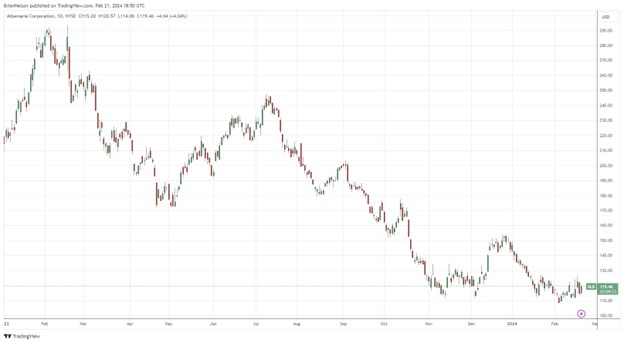

Image: Albemarle’s shares have faced significant pressure as a result of depressed lithium prices.

By Brian Nelson, CFA

The Financial Times reported February 16 that Albemarle (ALB) had reduced its 2030 demand forecast for lithium due to a reduced pace of electric-vehicle adoption in the U.S. and Europe. According to reports from Seeking Alpha, Albemarle now believes that 3.3 million tons of lithium carbon equivalent [LCE] will be in demand across the globe by the end of this decade, a pace that is meaningfully lower than the 3.7 million tons it had projected previously. Albemarle is also dealing with plunging lithium prices, which have punished its cash flow more recently. We think most of the bad news is priced into Albemarle’s shares, however, and we’re not overreacting to the disappointing news.

Albemarle’s fourth-quarter results, released February 14, weren’t that bad, as the company beat expectations. Net sales dropped more than 10% in the quarter as the pricing environment for lithium remains soft at the moment, but the company experienced 35% volume growth in its Energy Storage division. Excluding a lower of cost or net realizable value [LCM] pre-tax charge, adjusted EBITDA came in at $289 million in the period, while adjusted diluted earnings per share came in at $1.85 per share. Though weakness in the last quarter of 2023 was prevalent, net sales for the full year 2023 was the highest in the company’s history and revealed 21% volume growth. The executive team remains positive on its long-term prospects:

Albemarle’s full-year 2023 result marks the second highest earnings year in company history, made possible by the disciplined focus of our global teams. Looking ahead, we are taking actions to enhance our financial flexibility, while advancing near-term growth and preserving future opportunities to create value. As a global leader for the end-markets we serve, we remain confident about the projects in our portfolio and our ability to leverage our world-class resources and industry-leading technologies.

Looking ahead to all of 2024, Albemarle provided a rather wide guidance range for net sales and adjusted EBITDA based on average market lithium prices ($/kg LCE). For example, at ~$15/kg LCE, net sales and adjusted EBITDA are targeted in the range of $5.5-$6.2 billion and $0.9-$1.2 billion, respectively. At ~$25/kg LCE, net sales and adjusted EBITDA are targeted in the range of $6.9-$7.6 billion and $2.3-$2.6 billion, respectively. Management cut its capital spending outlook for 2024 to the range of $1.6-$1.8 billion, which is below the ~$2.1 billion mark in 2023, and the firm is targeting additional cash-flow positive maneuvers regarding costs and working capital to bolster free cash flow, moves that we view as necessary.

Albemarle’s shares have been under significant pressure of late due to volatile lithium prices, and the firm’s cash flows have faced weakness as a result. Operating cash flow dropped to ~$1.325 billion in 2023 from ~$1.91 billion in 2022, as capital spending soared. Unless lithium prices start to better reflect the underlying demand profile ahead of it, Albemarle will likely be free cash flow negative in 2024 as well. Right now, Albemarle is facing a tough road ahead with its fundamentals largely tied to lithium prices, but the firm is positioned well for a potential lithium-price rebound. Regardless, we view Albemarle as a speculative stock and one only for the most aggressive, risk-seeking investors.

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

———-

Tickerized for ALB, SGML, ATLX, LAC, SLI, ALTM, IONR, PLL, SQM, LIT

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.