Image Source: TradingView

By Brian Nelson, CFA

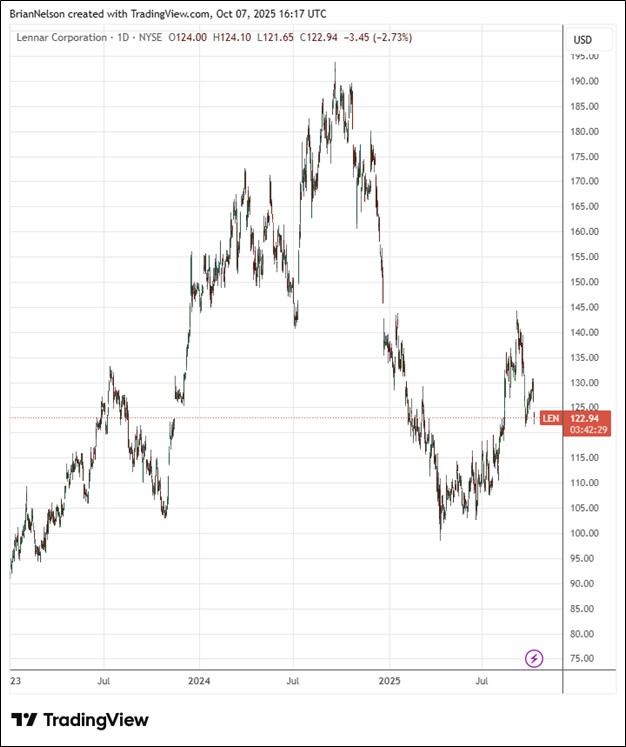

Lennar Corp. (LEN) recently reported third quarter fiscal 2025 results that missed expectations on both the top and bottom lines. Total revenues declined 6.4% as revenues from home sales decreased 9% primarily due to a decline in the average sales price of homes delivered. Deliveries of 21,584 homes were consistent with the prior year, and the company ended the quarter with a backlog of 16,953 homes with a dollar value of $6.6 billion. Management had the following to say about the results:

Our third quarter results reflect both the continued pressures of today’s housing market and the consistency of Lennar’s operating strategy. This quarter, we delivered 21,584 homes and recorded 23,004 new orders. Achieving these results required additional incentives, resulting in a reduced average sales price of $383,000, and our gross margin drifted down to 17.5%, while our SG&A expenses came in at 8.2%, reflecting the soft market conditions.

While our current results reflect incentives and price adjustments to match market conditions, our scale and technology investments are building the foundation for structural cost efficiencies. Backed by a strong balance sheet and disciplined execution, we remain confident in our ability to build margin as conditions stabilize and to create sustained value.

Interest rates remained elevated throughout the third quarter, but then declined towards the quarter’s end. This downward trend, paired with the Fed’s recent rate cut, gives us optimism as we head into the fourth quarter. Therefore, we believe that now is a good time to moderate our volume and allow the market to catch up. Accordingly, for the fourth quarter of 2025, we expect new orders of 20,000 – 21,000 homes, deliveries of 22,000 – 23,000 homes, and gross margin of approximately 17.5%, consistent with the third quarter, depending on market conditions.

In the fiscal third quarter, Lennar’s new orders increased 12% to 23,004 homes. Excluding mark-to-market gains, fiscal third quarter net earnings were $516 million, or $2.00 per diluted share, compared to $1.1 billion, or $3.90 per diluted share in the prior year quarter. The average sales price of homes delivered was $383,000 in the third quarter of 2025, compared to $422,000 in the third quarter of last year. Gross margins on home sales were $1.4 billion, or 17.5%, in the third quarter of 2025, down from 22.5% in the third quarter of 2024. Lennar is navigating weakness in a housing market that is requiring additional incentives, hurting margins, while it deals with higher land costs. We’re not interested in Lennar’s shares at this time.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.