Image: Korn Ferry’s shares still look cheap by our estimates. Image Source: Korn Ferry

By Brian Nelson, CFA

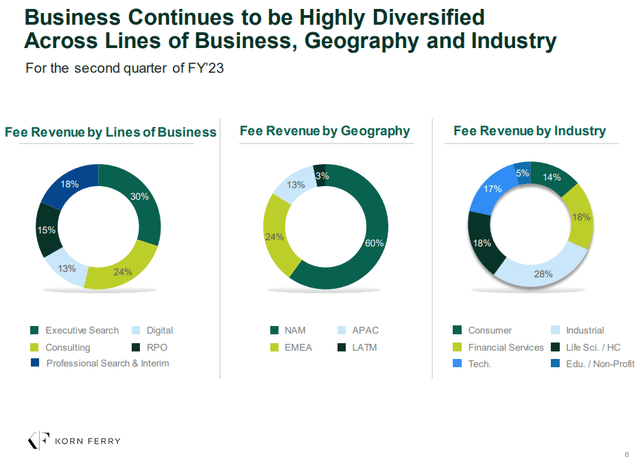

On December 8, Best Ideas Newsletter portfolio holding Korn Ferry (KFY) reported better-than-expected second-quarter fiscal 2023 results for the period ending October 31, 2022. Fee revenue in the quarter advanced 14% (20% on a constant-currency basis), while operating income came in 15% higher thanks in part to a modest improvement in its operating margin. The global consulting firm is well-positioned, in our view, to capture opportunities as companies continue to adjust their workforces amid economic uncertainty.

COVID-19 was nothing less than an absolute shock to the world. People cocooned in their homes. Businesses were shut down. Employees had to find a way to deliver in new ways. New companies sprung to life; others faded away. Now, in a largely post COVID-19 world, everything seems different while a lot of it is the same. As an important participant in consulting, professional search, digital and executive search, Korn Ferry is there for customers looking to navigate a changed market environment, perhaps with new personnel or a new strategy.

According to its latest Annual Report, Korn Ferry works with 97% of the S&P 100 and 85% of the S&P 500. The company works with 92% of the Euronext 100, and 85% of the FTSE 100, and many of the companies that are scattered all over the most-admired lists that you see in popular magazines. In all, during fiscal 2022, the company partnered with ~15,000 organizations, large and small, private and public. The firm helps deliver across the “talent lifecycle,” while helping with some of the most challenging issues from workface transformations to ESG matters and beyond.

The company’s strategy is five-fold, per its Annual Report:

1. Drive a One Korn Ferry go-to-market strategy through our Marquee and Regional Accounts and integration across solutions and geographies.

2. Create the Top-of-Mind Brand in Organizational Consulting – Lead innovation through relevant market offerings and evolve our thought leadership around talent strategy.

3. Deliver Client Excellence and Innovation and diversify our offerings into fully integrated, scalable and sustainable client engagements.

4. Advance Korn Ferry as a Premier Career Destination – Attract and retain top talent through continued investment in building a world-class organization through a capable, motivated, and agile workforce.

5. Pursue Transformational M&A Opportunities at the Intersection of Talent and Strategy.

We think Korn Ferry is largely delivering on its strategic initiatives, and management is working hard to stay ahead of emerging trends in the post COVID-19 economy. Korn Ferry CEO Gary Burnison noted in the company’s fiscal second quarter 2023 report that “it’s clear that the global economy has been in transition for several months…” and it’s “seeing change on every front — from over a decade of high liquidity and historically low interest rates to changes in Central Bank policies, significant shifts in global trade lanes and persistent inflationary pressures.” This is the type of environment in which Korn Ferry is well-positioned to excel, in our view.

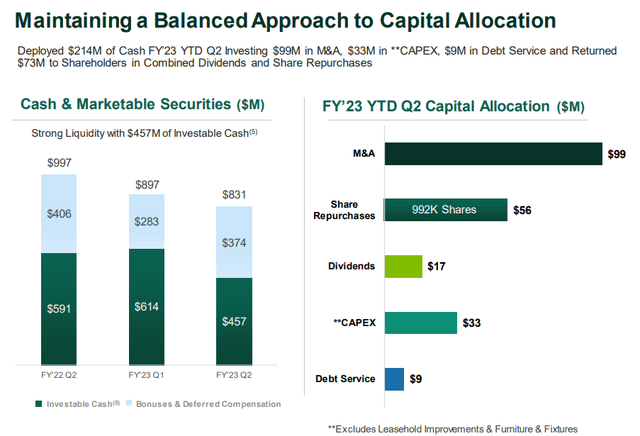

Image: We’re huge fans of Korn Ferry’s liquidity position. Image Source: Korn Ferry

Here’s what management had to say about its outlook for 2023 on the conference call:

“No doubt there’s economic uncertainty as we enter 2023. But this transitory time like others in the past is also the proving grounds for the effectiveness of our strategy, the strength of our culture, the resilience of our colleagues, the relevance of our solutions and our offerings and the potency of the Korn Ferry brand. The truth is that great companies make their best moves in times like these. And Korn Ferry is a great company.

Looking forward to 2023, we’re going to continue to refine our account strategy to take advantage of changing global trade lanes, putting further emphasis on our regional accounts. We’re going to pursue a larger addressable market, almost $100 billion in the U.S. alone of interim and transition management, particularly around the skilled positions of finance and accounting, digital and technology, supply chain and legal, just to name a few.

We’re going to build on our health care expertise, particularly in the RPO area. We’re going to further develop our partner ecosystem to distribute our consulting and digital capabilities globally. We’re going to invest in our professional and leadership development offerings, especially our digital platforms, upskilling technologists as well as sales professionals. And we’re also going to pivot towards cost optimization solutions that will be even more relevant in the current environment.

We’re going to carefully balance our cost structure and profitability to seize both short and midterm opportunities. And finally, we’re going to continue to deploy a systematic and balanced approach to capital allocation between share repurchases, dividends and M&A. I’m confident that we’ve built a company that provides a suite of core and integrated solutions that line up perfectly with the talent and organizational issues our clients are wrestling with today.”

Concluding Thoughts

Businesses around the world are dealing with new challenges in a post COVID-19 world, and global consulting firm Korn Ferry is working hard to build solutions for them. We continue to include Korn Ferry as an idea in the simulated Best Ideas Newsletter portfolio and remain huge fans of its enormous free cash flow generation and its pristine balance sheet that holds a material net cash position. We’re sticking with our $75 per-share fair value estimate, which implies upside potential to where shares are trading.

Tickerized for KFY, ADP, DLX, EFX, JOBS, MAN, NSP, PAYX, RHI, HURN

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.