Image Source: Kohl’s Corporation – Second Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

In this article, we cover the recent earnings reports of two US department stores as the domestic economy steadily emerges from the worst of the coronavirus (‘COVID-19’) pandemic, keeping headwinds from the “delta” variant in mind. The department store business model continues to lose share from e-commerce and specialty retailers. Amazon (AMZN) is also considering opening large physical retail operations that would largely resemble department stores, starting with locations in California and Ohio. The long term remains ominous for department-store retail, in our view.

Kohl’s

On August 19, Kohl’s Corporation (KSS) reported second quarter earnings for fiscal 2021 (period ended July 31, 2021) that easily beat consensus top- and bottom-line estimates. The company’s GAAP revenues surged higher by 31% year-over-year and its GAAP operating income almost rose five-fold year-over-year last fiscal quarter, signs that Kohl’s turnaround strategy is starting to take shape. Kohl’s boosted its share buyback target up to $500-$700 million for fiscal 2021 in conjunction with its earnings update, versus $200-$300 million previously. Shares of KSS yield ~1.8% as of this writing.

During the firm’s latest earnings call, management noted that sales of Kohl’s ‘active’ offerings grew by more than 40% year-over-year and represented 24% of its sales in the fiscal second quarter. The firm’s digital sales represented roughly a quarter of its total sales last fiscal quarter according to recent management commentary, though that was down from fiscal year-ago levels as the retailer’s customers returned to its physical store locations.

Management recently noted that digital sales at Kohl’s were up 35% last fiscal quarter versus levels seen during the same period in fiscal 2019. Roughly 40% of digital sales at Kohl’s were fulfilled through its stores last fiscal quarter according to recent management commentary, including “ship from store and customer pickup” fulfillment options.

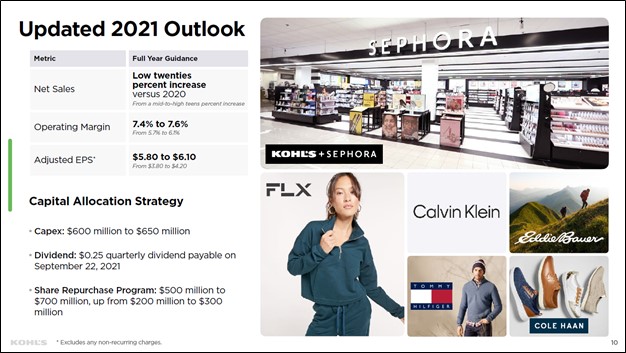

Kohl’s is leaning heavily on strategic partnerships and the launch of new private label brands to remain relevant going forward. For instance, in October 2020, Kohl’s announced the launch of a new private label athleisure wear brand, FLX, which became available online and in certain stores in March 2021 (according to the press release). Additionally, Kohl’s announced a long-term strategic partnership with Sephora in December 2020 to add “Sephora at Kohl’s” stations in at least 850 Kohl’s locations by 2023. These stations are going to be located near the front of the store and the first 200 locations are set to open in the fall of 2021. For reference, Sephora is owned by the French firm LVMH Moët Hennessy Louis Vuitton (LVMUY).

Furthermore, Kohl’s raised its full fiscal year guidance in conjunction with its latest earnings report. Now the firm aims to post annual net sales growth in the “low-twenties percentage range compared to the previous expectation of mid-to-high teens percentage range increase,” an operating margin “in the range of 7.4% to 7.6% compared to the previous expectation of 5.7% to 6.1%,” and non-GAAP adjusted EPS growth in “the range of $5.80 to $6.10, excluding any non-recurring charges, compared to the previous expectation of $3.80 to $4.20” in fiscal 2021 in light of its strong performance during the first half of this fiscal year.

Image Shown: A look at the updated guidance Kohl’s put out for fiscal 2021 in conjunction with its latest earnings report. Image Source: Kohl’s – Second Quarter of Fiscal 2021 IR Earnings Presentation

Management aims to push Kohl’s operating margin up to 7%-8% by fiscal 2023, though it appears the firm will achieve that goal this fiscal year. Kohl’s reported a great earnings report, in our view, and shares of KSS rocketed higher by 7% during normal trading hours on August 19.

Macy’s

On August 19, Macy’s Inc (M) reported second quarter earnings for fiscal 2021 (period ended July 31, 2021) that smashed past consensus top- and bottom-line estimates. Additionally, Macy’s raised its full fiscal year guidance for fiscal 2021 while reinstating its quarterly dividend program at $0.15 per share and initiating a $0.5 billion share buyback program in conjunction with its earnings update. Management noted that Macy’s had “successfully reengaged core customers and attracted new, younger customers with new brands and categories” within its earnings press release.

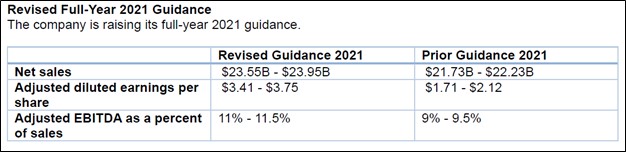

In the fiscal second quarter, Macy’s reported that its comparable sales at owned stores on an owned basis were up over 61% year-over-year and that comparable sales at its licensed stores were up over 62% year-over-year. That enabled the retailer to grow its GAAP revenues by almost 59% year-over-year while its GAAP operating income flipped to a profit of $0.6 billion last fiscal quarter versus a loss of $0.6 billion during the same period in fiscal 2020. Macy’s noted that its digital sales fell by 6% year-over-year last fiscal quarter but were up 45% from the same period in fiscal 2019 as customers returned to its physical stores. The upcoming graphic down below highlights its updated guidance for fiscal 2021.

Image Shown: Macy’s has really hit it out of the park recently as its business continues to rebound strongly from the worst of the COVID-19 pandemic. Image Source: Macy’s – Second Quarter of Fiscal 2021 Earnings Press Release

Shares of Macy’s rocketed higher by almost 20% on August 19 during normal trading hours as investors cheered the earnings beat, guidance boost, share buyback program, and the resumption of its quarterly dividend program. We were pleased with what we saw in the company’s latest earnings update, but it may not alter a challenging long-term picture. Macy’s reported that the average customer spending levels of those participating in its loyalty programs has been shifting higher of late (up 15% last fiscal quarter versus levels seen during the same period in fiscal 2019, and up on a sequential basis as well) and that its digital channels have been doing a solid job bringing in new customers.

On a forward-looking basis, shares of M yield ~2.8% as of this writing.

Concluding Thoughts

We were pleased with the performance of both Kohl’s and Macy’s and view their latest earnings reports as a sign that the US economy is steadily recovering from the worst of the COVID-19 pandemic. Variants of the pandemic will create significant near term headwinds, though we remain optimistic that the domestic economy will continue to recover over the coming quarters. Long term, we have little interest in department-store retail.

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Related: KSS, M, LVMUY, AMZN

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.