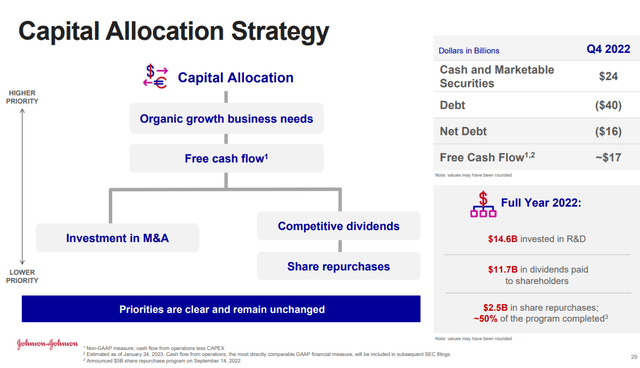

Image: Johnson & Johnson’s free cash flow generation remains far in excess of its cash dividends paid. Image Source: J&J

By Brian Nelson, CFA

Johnson & Johnson (JNJ) reported messy fourth-quarter 2022 results January 24 with GAAP revenue falling 4.4% and reported earnings per share dropping 24.9%. On an adjusted basis, operational growth excluding COVID-19 vaccine sales advanced 4.6%, while adjusted earnings per share advanced 10.3%, to $2.35 per share. The top line missed the consensus estimate modestly, while adjusted earnings per share came in slightly better than expected. Looking ahead to 2023, J&J expects adjusted operational sales growth, excluding COVID-19 vaccine, of 3.5%-4.5%, and adjusted operational earnings per share of $10.40-$10.60, which reflects 3.5% expansion at the midpoint. We value shares of J&J at $183 each.

Johnson & Johnson’s non-GAAP adjustments make things quite messy relative to GAAP presentation. For example, on a reported basis, worldwide sales advanced 1.3% during 2022, but on an adjusted operational basis, worldwide sales advanced 6.2%. On a GAAP basis, diluted earnings per share came in at $6.73 per share for 2022 versus the adjusted earnings per share number of $10.15. These are rather large discrepancies for a company as widely-held as J&J. For this, we’ve grown incrementally more cautious on the company, meaning that we’re paying very close attention to its cash flow generation these days.

According to J&J’s slide deck (relevant slide above), management indicated that it hauled in ~$17 billion in free cash flow for the fourth quarter (but this is likely a full year number, as it hauled in only $15.8 billion in cash flow from operations for the first three quarters of the year). The ~$17 billion mark, if for the full year 2022, was still in excess of the company’s reported cash dividends paid during the full year, but the presentation wasn’t great, and again, it has us a bit cautious on shares. J&J said it ended the fourth quarter with net debt position of ~$16 billion. The company remains a fantastic credit.

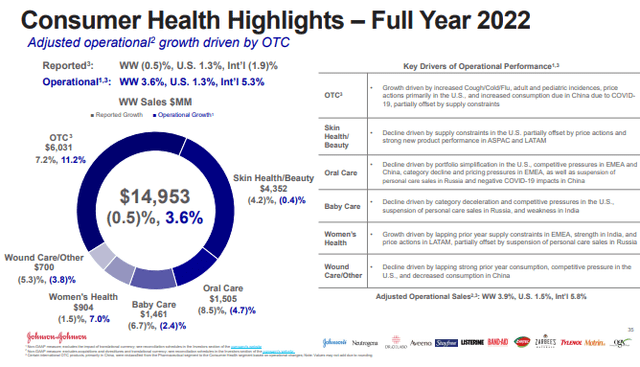

Image Source: J&J will be splitting into two publicly traded companies, spinning off its Consumer Health business in late 2023. Image: J&J

We’re not exactly excited about J&J as much as we once were, in light of the difference between GAAP and non-GAAP reporting and that free cash flow presentation seems to be a bit incorrect (we’re awaiting the firm’s 2022 10-K for clarity on the matter). Johnson & Johnson also expects to spin off its Consumer Health division during 2023, which adds another degree of complexity to the analysis. Its soon-to-be standalone Consumer Health division will be named Kenvue (KVUE) and will include brands such as Motrin, Tylenol, Imodium, Neutrogena, and Sudafed. Expectations are for the spin off to be complete by November 2023, but we’re not sure that J&J will remain in the newsletter portfolios for that long.

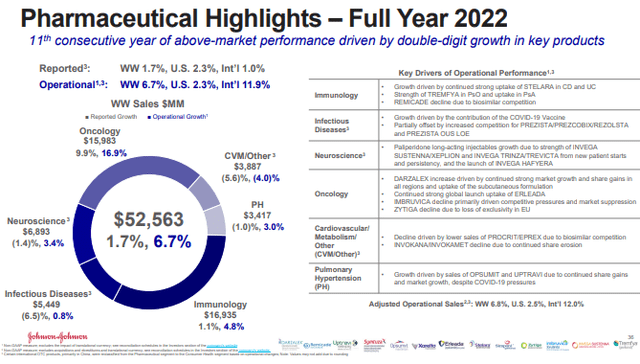

Image Source: J&J’s pharma business continues to deliver. Image: J&J

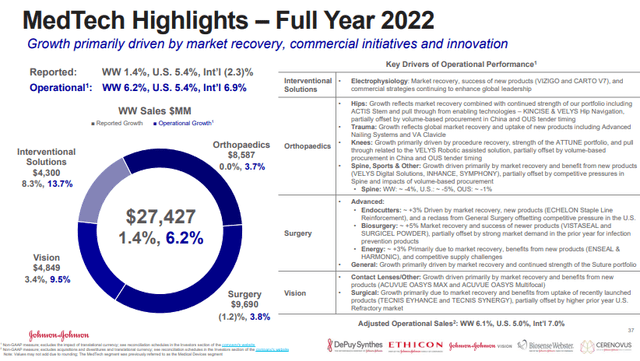

Image Source: J&J’s MedTech operations continue to benefit from a recovery in procedure volumes. Image: J&J

Concluding Thoughts

Johnson & Johnson reported messy fourth-quarter 2022 results that showed a large difference between GAAP and non-GAAP reporting. The company’s free cash flow presentation wasn’t great either, and we can’t help but feel management is a bit distracted given that the firm is working to spin off its Consumer Health division (Kenvue) later during 2023.

J&J will retain its two larger divisions, Pharma and MedTech, including its key drugs Stelara, Darzalek, Tremfya, Erleada, and Uptravi, as well as its MedTech operations that have exposure to a number of areas including electrophysiology, wound closure, procedures for knees and hips, as well as surgical vision and trauma.

We continue to like J&J’s coverage of the dividend with free cash flow, but we doubt the company will stay in the newsletter portfolios for much longer in light of the messy presentation and impending Kenvue split, expected in November 2023. We like to keep things simple. Shares yield ~2.7%.

Tickerized for JNJ, KVUE, XLV.

Updated March 3, 2023, 12:25pmCT, to include that JNJ may not remain in both the Dividend Growth Newsletter portfolio and Best Ideas Newsletter portfolio for much longer.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.