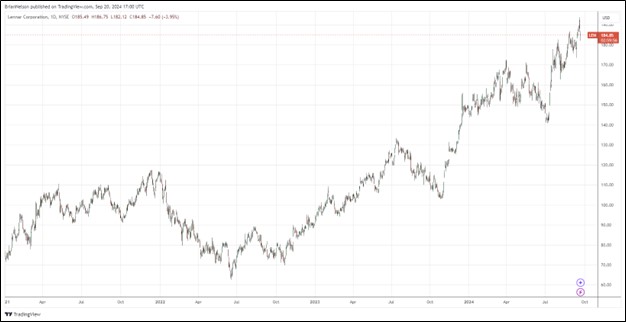

Image: Lennar’s shares have done quite well the past several years.

By Brian Nelson, CFA

Lennar (LEN) reported better than expected fiscal third quarter 2024 results on September 19 with revenue and GAAP earnings per share coming in ahead of the Street’s forecast. Total revenue advanced 7.9% in the quarter, while net earnings per diluted share increased 10%, to $4.26, up from $3.87 per diluted share in the same period a year ago. Deliveries increased 16% in the quarter, new orders increased 5%, while its backlog stood at 16,944 homes with a dollar value of $7.7 billion at the end of the period. Lennar’s homebuilding gross margin was 22.5% in the quarter, lower than expectations, however.

Management commentary was upbeat in the press release, but pointed to incentives and mortgage rate buydowns as key levers of demand:

We are pleased to report another solid quarter backed by an economic environment that remains very constructive for homebuilders. Employment was strong, housing supply remained chronically short due to production deficits of over a decade, and demand was solid driven by strong household formation. Although affordability continued to be tested during the quarter, purchasers remained responsive to increased sales incentives, resulting in a 16% increase in our deliveries and a 5% increase in our new orders year over year.

This week, the Fed decreased interest rates which should start to enhance affordability and accelerate the already strong demand for both new and existing homes. While strong demand, enabled by incentives and mortgage rate buydowns, has driven the new home market over the past two years, we fully expect an even stronger, and more broad-based demand cycle, as rates move lower. Lower rates and controlled inflation will likely boost confidence.

For the fiscal fourth quarter of 2024, Lennar expects new orders in the range of 19,000-19,300, deliveries of 22,500-23,000 with an average sales price of about $425,000. Lennar ended the fiscal third quarter with $4.04 billion of cash and cash equivalents and $2.26 billion in senior notes and other debts payable, net, good for a nice net cash position on the balance sheet. Though the company’s gross margin guidance for its fiscal fourth quarter came up short, with expectations of it being flat with the fiscal third quarter (22.5% versus consensus of 24.3%), the backdrop for the housing market remains strong and may grow stronger as the Fed engages in a rate-cutting cycle.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.