Image Source: Hut 8 Mining Corporation – November 2021 IR Presentation

By Callum Turcan

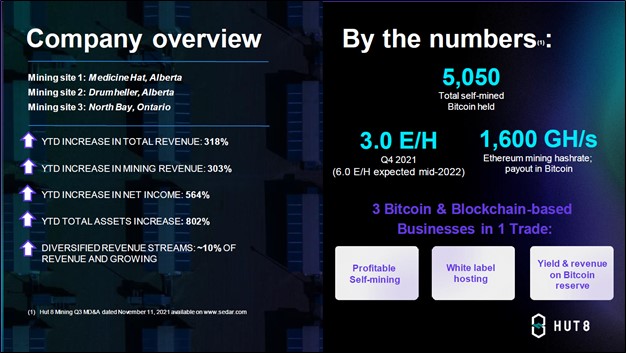

Hut 8 Mining Corporation (HUT) is headquartered in Toronto, Canada (in the province of Ontario), and “mines” digital assets from two operations in Alberta, Canada (in the city of Medicine Hat and town of Drumheller). The firm is in the process of developing a third mining operation in Ontario, Canada, at the small city of North Bay, having secured a long-term power purchase agreement with Validus Power Corp.

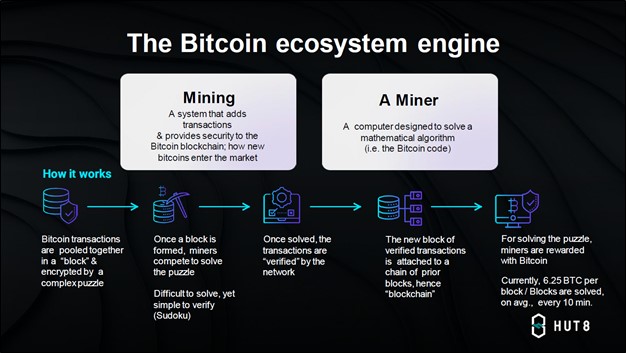

Overview

Though Hut 8 Mining mines for both bitcoin (BITO) and ether, two of the most popular cryptocurrencies, when it mines for Ether it historically has preferred to get paid in bitcoin. Hut 8 Mining has built up a sizable bitcoin hoard that will we cover in just a moment. What makes Hut 8 Mining’s business model novel is that instead of selling the digital assets that it mines, the company lends out a good chunk of that bitcoin to generate “fiat yield” (income from lending alternative digital assets) to fund its operations. Hut 8 Mining also generates revenue from other offerings such as providing white-label hosting services, though the lion’s share of its revenues is from lending out bitcoin.

Image Shown: An overview of Hut 8 Mining’s business model. Image Source: Hut 8 Mining – November 2021 IR Presentation

First, some quick housekeeping items. Hut 8 Mining reports its financials in accordance with IFRS accounting practices and reports its financial statements in Canadian dollars (‘CAD’). Hut 8 Mining is listed on both the Toronto Stock Exchange (‘TSE’) and as of June 2021, the NASDAQ Global Select Market as well. In the recent past (in June 2021 and September 2021), Hut 8 Mining has pursued secondary equity offerings to provide the firm with funds to scale up its digital asset mining operations.

Its September 2021 offering raised just under USD$0.2 billion in gross proceeds while its June 2021 offering raised a little under USD$0.1 billion in gross proceeds based on current CAD/USD exchange rates. Listing on the NASDAQ was a good decision, in our view, as it broadened the potential investor base that Hut 8 Mining could appeal to.

Please note that digital mining operations are voracious consumers of electricity. The company’s digital asset mining operations are in Canada due primarily to the country’s relative economical electricity rates, especially in the parts of Alberta and now Ontario that Hut 8 Mining operates in.

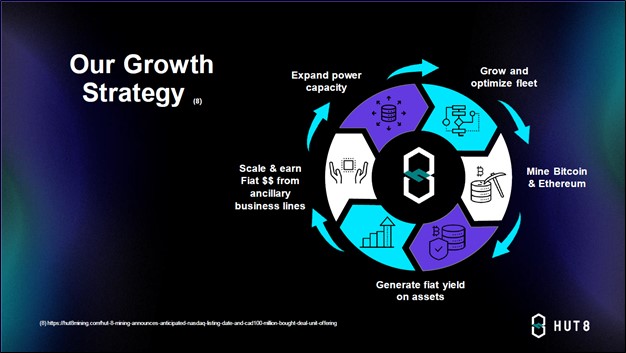

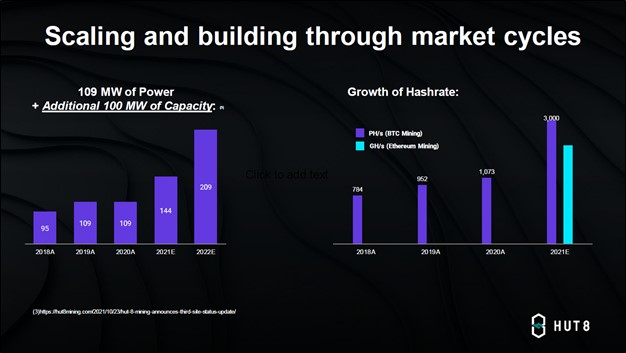

Image Shown: Hut 8 Mining is a voracious consumer of electricity and is steadily scaling up the computing power of its company-wide operations to bolster its ability to produce alternative digital assets. Image Source: Hut 8 Mining – November 2021 IR Presentation

Growth Ambitions

Here is what Hut 8 Mining’s third quarter of 2021 earnings press release had to say on its growth ambitions:

Based upon the capital flexibility afforded by the Company’s public offering of equity securities in September 2021, Hut 8 executed on a US$58.7 million purchase of 12,000 new MicroBT M30S, M30S+ and M30S++ miners, representing a cost of approximately $50/Terahash, with aggregate incremental production of 1.17 EH/s. The miners are expected to be delivered starting in January 2022, at a delivery rate of approximately 1,000 machines per month, with full deployment anticipated by December 2022.

On October 23, 2021, the Company announced that development of its third mining site, in conjunction with Validus Power Corp. (‘Validus’), was underway in North Bay, Ontario, Canada. This site will begin with 35MW of capacity and expected to be online by the end of December 2021. Power will be available on a physical off-take basis under the Company’s power purchase agreement with Validus, with a power rate of $0.0274/kWh subject to an annual adjustment mechanism.

Hut 8 Mining announced during its third quarter 2021 earnings update that it had received the final delivery of all 10,000 “chips” from Nvidia Corporation (NVDA). The firm noted in its latest earnings press release that “as of November 10, 2021, the entire fleet of high-performance NVIDIA chips has been received at Hut 8’s site in Medicine Hat, Alberta, and 91% of the servers have been installed and powered up, with full deployment expected in the next week.” Ramping up the additional computing capacity here supports Hut 8 Mining’s near term outlook.

Additionally, Hut 8 Mining noted that it “has deployed the NVIDIA GPUs to mine the ethereum network via Luxor pool, and consistent with our HODL strategy, is receiving payouts in Bitcoin. Based on current mining economics this equates to approximately 1.8 – 2.0 Bitcoin per day, with an average cost to mine each Bitcoin of less than $3,000, making this NVIDIA GPU fleet the most profitable portion of Hut 8’s self-mining operation.” Looking ahead, these expansion efforts are expected to enable Hut 8 Mining to churn out more bitcoin on a daily basis starting this quarter.

Image Shown: Hut 8 Mining intends to steadily expand its daily bitcoin mining capabilities over the coming years. Image Source: Hut 8 Mining – November 2021 IR Presentation

In terms of its hash rate capacity, Hut 8 Mining expects to have 3.0 E/H (that is 3 quintillion hashes per second) in capacity in the fourth quarter of 2021 which it forecasts will hit 6.0 E/H by the middle of 2022 as it brings new digital mining “rigs” online. During the third quarter of this year, the company mined over 900 bitcoins and had a bitcoin balance of over 4,700 as of September 30, 2021, with a market value of north of USD$0.2 billion at the time. According to Hut 8 Mining’s latest earnings press release, “this balance consisted of 2,729 Bitcoin held in custody and 2,000 held under lending arrangements.” By November 10, 2021, Hut 8 Mining had a bitcoin balance north of 5,050 with a market value of ~USD$0.35 billion at the time.

Image Shown: An overview of Hut 8 Mining’s recent financial performance, near term capacity expansion outlook, and its overall business. Image Source: Hut 8 Mining – November 2021 IR Presentation

Financial Overview

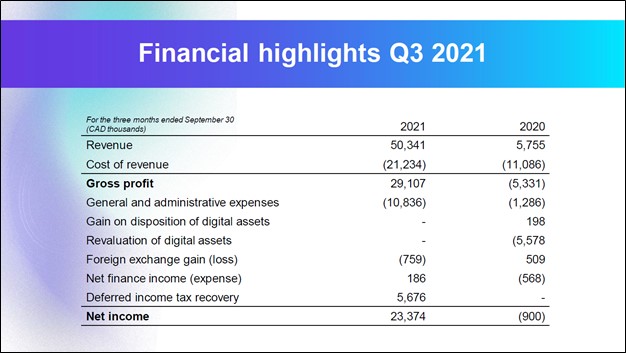

During the third quarter of 2021, Hut 8 Mining generated CAD$50 million in IFRS revenues, up many-fold from year-ago levels, while generated CAD$23 million in IFRS net income (versus a small loss during the same period in 2020). Please note that ~95% of its revenues during this period came from lending out bitcoin, with the remainder generated primarily via hosting services. During the first nine months of 2021, Hut 8 Mining generated CAD$116 million in IFRS revenues (up over four-fold versus year-ago levels) and CAD$38 million in IFRS net income (versus a net loss in the same period last year). Hut 8 Mining’s financials are trending in the right direction.

Image Shown: Hut 8 Mining’s financial performance on an IFRS basis has been trending in the right direction of late. Please note that the above figures are in Canadian dollars. Image Source: Hut 8 Mining – November 2021 IR Presentation

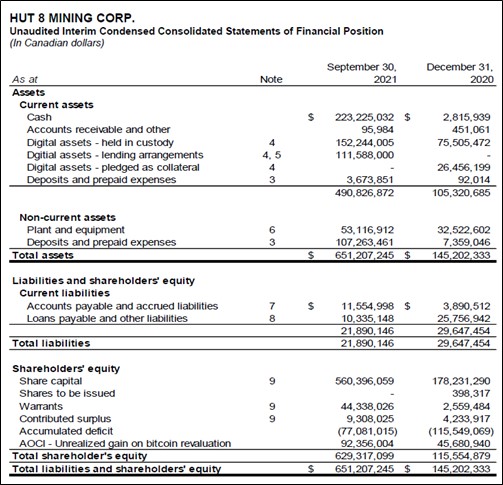

Hut 8 Mining’s balance sheet is rock-solid. The firm had minimal liabilities on the books versus a sizable cash and bitcoin hoard at the end of September 2021, providing Hut 8 Mining ample financial firepower to scale up its business. Hut 8 Mining’s efforts to list on the NASDAQ supported its ability to tap equity markets, given the popularity of all things cryptocurrency across the US investing space.

Image Shown: At the end of September 2021, Hut 8 Mining’s balance sheet was quite strong as the firm had minimal liabilities and plenty of cash and bitcoin on hand. Please note that the above figures are in Canadian dollars. Image Source: Hut 8 Mining – Third Quarter of 2021 Financial Statement Supplement

During the first nine months of 2021, Hut 8 Mining generated negative free cash flows due to the firm generating negative net operating cash flows. However, that is almost entirely due to its bitcoin mining activities being viewed as a drain on cash.

When adding back the roughly CAD$0.1 billion in non-cash movements relating to its bitcoin mining activities (bitcoin added to the balance sheet) to its net operating cash flows of approximately negative CAD$0.05 billion during this period, Hut 8 Mining would have generated both positive net operating cash flows and free cash flows during the first nine months of 2021.

In summary, its free cash flow statement is a messy read, though things are trending in the right direction on this front, at least for now. Hut 8 Mining’s future financial performance is still heavily tied to the trajectory of bitcoin’s value in USD and CAD terms.

Image Shown: Hut 8 Mining’s cash flow statement is a messy read, though things are trending in the right direction on this front. Please note that the above figures are in Canadian dollars. Image Source: Hut 8 Mining – Third Quarter of 2021 Financial Statement Supplement

During Hut 8 Mining’s latest earnings call, management had this to say regarding the firm’s vision for its business:

“We strive to deepen our relationships and operations across Canada, from Alberta to North Bay, operating cutting edge and profitable compute centers and continuing to expand this — this business with — with an innovation lens on everything we do. We are not just miners; we are business building technologists. We are believers in decentralized systems, open access, and financial inclusion. Through innovation, imagination, and passion, we’re helping to power the Fourth Industrial Revolution to create value for generations to come.” — Jaime Leverton, CEO of Hut 8 Mining

The world of cryptocurrencies is an interesting creation of the 21st century as the realm of decentralized finance (‘DeFi’) continues to grow.

Concluding Thoughts

We are intrigued by Hut 8 Mining’s business model. By growing its bitcoin balance over time and covering its operating expenses by lending out its bitcoin hoard, generating so-called fiat yield, Hut 8 Mining is effectively a bet that a combination of growth in the price of bitcoin and growth in its bitcoin hoard will provide a major boost to its net asset value (‘NAV’) over time.

Should the price of bitcoin tank, however, that would weigh negatively on its business, though things would likely not be as bad as it first appears given that Hut 8 Mining is set up to make money in almost every bitcoin pricing environment. As long as there is investor demand out there to borrow its bitcoins, and that broad interest in cryptocurrencies holds up well going forward, Hut 8 Mining should be able to continue growing its revenue as it grows the amount of bitcoin it can lend out on average per quarter.

Obviously, of course, the firm would do better if the price of bitcoin stays the same (currently at roughly USD$64,700 for one bitcoin as of this writing) or increases. From our perspective, Hut 8 Mining is better positioned to capitalize on the cryptocurrency craze, in our view, than many of the other firms out there that are mining and continuously selling off their bitcoin holdings or actively buying bitcoin on the open market seeking to flip those alternative digital assets for a profit down the road (the “greater fool theory” in action). We are keeping an eye on Hut 8 Mining, though in this particular case, we must caution that the intrinsic value of alternative digital currencies like bitcoin is zero. The value is entirely in the eyes of the beholder.

In our view, the best way to gain exposure to the proliferation of cryptocurrencies and alternative digital assets is through PayPal Holdings Inc (PYPL) and Visa Inc (V), which are steadily expanding deeper into this space. Both firms are stellar free cash flow generators with promising long-term growth outlooks. PayPal offers cryptocurrency wallets and transaction (buying/selling) services while Visa is partnering up with dozens of firms to support cryptocurrency spending activities. To read more about our thoughts on PayPal, click here, and our thoughts on Visa, click here. Shares of PYPL and V are both included as ideas in our Best Ideas Newsletter portfolio.

Note: Hut 8 Mining is a speculative investment consideration. Cryptocurrencies and the share prices of those with operations tied to them can experience tremendous volatility. Investors could lose their entire investment if cryptocurrencies fail to live up to the hype.

—–

Banks & Money Centers – AXP, BAC, BBT, BK, C, DFS, FITB, GS, HBC, JPM, KEY, MS, NTRS, PNC, RF, STI, TCF, USB, WFC

Related: BITO, HUT, GBTC, RIOT, MARA, BITF, BTBT, MSTR, COIN, NVDA, PYPL, V, ETHE, SI, BRPHF, XPDI, SQ, MGTI, HIVE, ARBK, ISWH, CAN, NCTY, ANY, HSSHF, BBIG, YVR, CSCW, HMBL, DLPN, HOOD, BTCM, CLSK, ETHE, BKKT, CME, BTF

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc Class B shares (BRK.B), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.