Image: Honeywell continues to put together a long resume of ESG highlights. Image Source: Honeywell’s Environmental, Social and Governance Report

By Valuentum Analysts

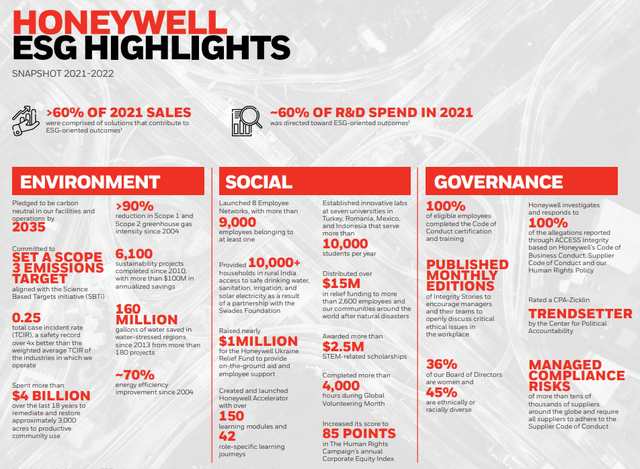

Honeywell International Inc. (HON) has been one of our favorite dividend growth ideas for some time, but the company has also been doing a good job with respect to environmental, social, and governance, commonly referred to as ESG, too. Let’s evaluate Honeywell’s public ESG documents, including CEO Darius Adamczyk’s letter, as we dig into how Honeywell focuses on each one of these dynamics in this note.

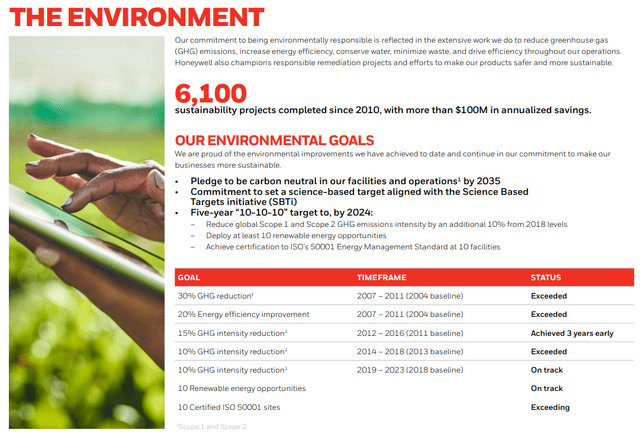

As it relates to Environmental considerations, the executive team at Honeywell remains committed to becoming carbon neutral by 2035 and is investing quite a bit of capital each year to help it meet that goal. Some of the projects that it is working on include electrifying its fleet of vehicles, converting to renewable energy sources and using carbon offsets. The company believes that by 2024, it will also be able to reduce its greenhouse gas emissions intensity to the tune of 10%. It’s great to see Honeywell set what we believe are achievable goals.

Image: Honeywell continues to meet or exceed its environment goals. Image Source: Honeywell

On the Social front, Honeywell calls its workers, Futureshapers, and that’s perhaps how most businesses should view their workforce. It’s so rewarding for employees to think about how they can shape the future of not only their lives, but also the lives of their companies (and how their companies can positively impact the world). More recently, Honeywell employees helped raise nearly $1 million in a Honeywell Ukraine Relief fund.

Honeywell does have some legacy asbestos issues, which impacts our assessment of the firm’s ESG assessment. The company paid $163 million, $229 million and $240 million in asbestos-related matters the past three years, and while these are comparatively small outlays, we think asbestos-related liabilities are an important part of the ESG context when it comes to people.

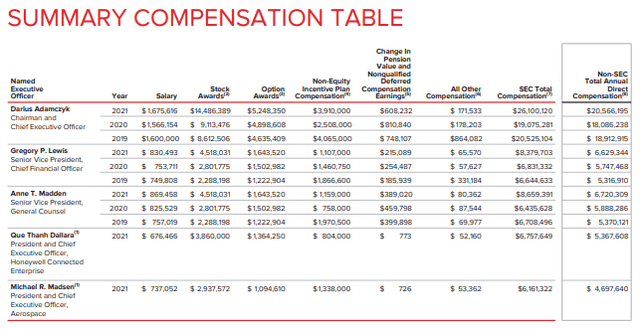

Image Source: Honeywell’s Proxy Statement

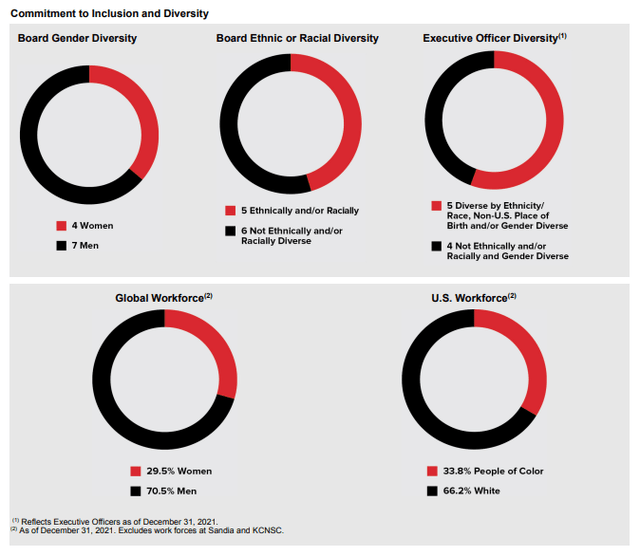

When it comes to Governance, well, Honeywell’s equity price performance and history largely tells this story. The company is well-managed, in our view, and it has navigated a market environment that has continued to ebb and flow the past number of years. Honeywell could do a better job by adding more women to its board, as 36% of the Board of Directors are women, and it could add more diversity, as 45% are ethnically or racially diverse. CEO Darius Adamczyk made over $20 million in total annual direct compensation in 2021, and while we think that’s too much for a non-founder, a large percentage is tied to stock options and restricted stock units.

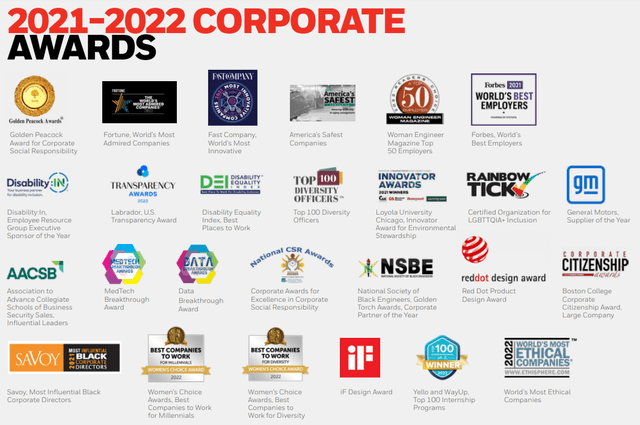

Image: Honeywell continues to deliver when it comes to ESG-related awards. Image Source: Honeywell

The list of awards Honeywell has won is a long one. Honeywell is one of Fortune’s World’s Most Admired Companies, Fast Company’s World’s Most Innovative Companies, and Woman Engineer Magazine Top 50 Employers. Honeywell is a certified organization for LGBTTQIA+ inclusion and was the National Society of Black Engineers, Golden Torch Awards, Corporate Partner of the Year. It also brought in the Women’s Choice Awards for Best companies to Work for both Millennials and Diversity.

There are a few things that we think are particularly interesting when it comes to Honeywell’s ESG-related efforts, too. The company’s Ecofining technology can make renewable jet fuel from vegetable oils, animal fats and even algae. Honeywell teamed up with United Airlines (UAL) to invest in a firm called Alder Fuels that is converting forest and crop waste into oil that can be refined into jet fuel. Honeywell is also working hard to push forward hydrogen fuel cell technology, which only has water as a byproduct. Honeywell has been at the forefront of innovation for a very long time.

Concluding Thoughts

Image Source: Honeywell

Honeywell’s 100+ page Environmental Social and Governance Report for 2022 is a tremendous resource that indicates Honeywell means business when it comes to ESG-related efforts. The firm has a lot of work to do to get to carbon neutral by 2035, and we’d like to see a more diverse board and perhaps more reasonable compensation at the top, but the trajectory for ESG considerations at Honeywell is moving in the right direction. Prior asbestos-related issues weigh heavily on our ESG assessment of Honeywell, but we expect continued improvement across all areas of ESG in the years to come at the firm.

———-

We think the Valuentum ESG Newsletter is a must-have for those following the work of our newsletter portfolios, but it is something that is important to everyone. The inaugural edition of the ESG newsletter was released September 15, 2021, and it has been released on the 15th of the month thereafter. Make sure you know where companies stand with respect to ESG. Valuentum’s ESG newsletter helps identify which stocks have strong ESG scores, and which ones come up short. Subscribe to the monthly Valuentum ESG Newsletter today by selecting the ‘Subscribe’ button below (12 editions, $1,000/year).

Tickerized for HON, UAL, ESGU, ESGV, ICLN, ESGD, NUMG, USSG, VSGX, ESGE, NUSC, QCLN, KRMA, EAGG, ESGG, RSX

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.