Image Source: Honeywell International Inc – Second Quarter of 2021 IR Earnings Presentation

By Callum Turcan

We view Honeywell International Inc (HON) as one of the best industrial plays out there and include shares of HON as an idea in the Dividend Growth Newsletter portfolio. Honeywell has exposure to the aerospace and downstream energy markets–industries that were hit hard by the coronavirus (‘COVID-19’) pandemic but are now recovering in earnest–and to the proliferation of e-commerce and “smart buildings.”

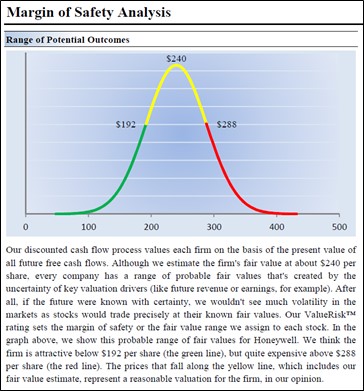

Furthermore, in the event that a bipartisan infrastructure bill currently awaiting approval in the US House of Representatives gets signed into law, Honeywell has exposure to the expected surge in domestic infrastructure investments. Our fair value estimate for Honeywell sits at $240 per share with room for upside as the top end of our fair value estimate range sits at $288 per share. As of this writing, shares of HON yield ~1.7%.

Image Shown: Our fair value estimate for shares of Honeywell sits at $240 per share with room for upside.

Favorable Outlook

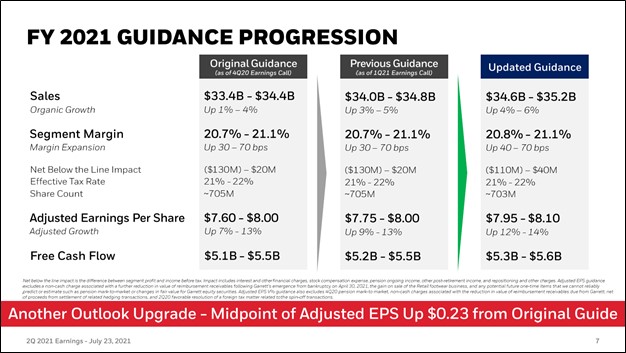

When Honeywell reported its second-quarter 2021 earnings in late July, the company raised its guidance across the board by increasing its expected organic sales growth, segment margin expansion, adjusted earnings per share, operating cash flow, and free cash flow forecasts for 2021. Honeywell had previously increased its full-year guidance for 2021 across these ares back during its first quarter earnings report, highlighting the sustained momentum of its recovery from the worst of the COVID-19 pandemic.

Image Shown: Honeywell has increased its full-year guidance for 2021 multiple times this year. Image Source: Honeywell – Second Quarter of 2021 IR Earnings Presentation

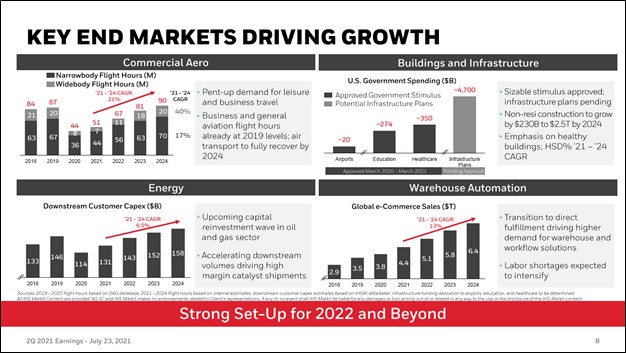

Looking ahead, management has identified numerous growth opportunities in several key end markets including commercial aerospace, building and infrastructure, energy, and warehouse automation. The eventual recovery in commercial air traffic, particularly international air traffic once pandemic-related restrictions and quarantine measures are eased worldwide, should help support the demand outlook for Honeywell’s commercial aerospace offerings. In the building and infrastructure space, Honeywell views its growth opportunities at education and healthcare facilities quite favorably.

Pivoting to energy markets, Honeywell forecasts investments in downstream facilities (such as refineries and petrochemical plants) should recover in the coming years as its customers capitalize on the resumption of daily commutes, international and domestic air travel, and the return of the growing global middle class. In turn, that supports the outlook for Honeywell’s offerings geared towards those downstream operations. Finally, the proliferation of e-commerce supports the outlook for Honeywell’s offerings in the realm of warehouse automation. These opportunities should support Honeywell’s cash flow growth trajectory in the coming years and beyond.

Image Shown: A look at the end markets that Honeywell expects will drive its financial performance higher over the coming years. Image Source: Honeywell – Second Quarter of 2021 IR Earnings Presentation

Rock-Solid Financials

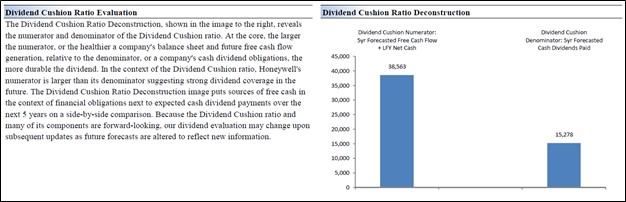

Honeywell’s promising cash flow growth outlook underpins our forecasts that the company will steadily grow its payout on a per-share basis going forward. During the first half of 2021, Honeywell generated ~$1.85 billion in free cash flow and spent $1.3 billion covering its dividend obligations. We give Honeywell a “GOOD” Dividend Safety rating as its Dividend Cushion ratio sits well above parity at 2.5, and please note these metrics incorporate our expectations the company will steadily grow its per-share dividend at a brisk pace going forward as the firm has an “EXCELLENT” Dividend Growth rating.

Image Shown: Honeywell’s forward-looking dividend coverage strength is rock-solid and supports our expectations that the firm will steadily grow its per share payout over the coming years.

During the first half of this year, Honeywell also spent ~$1.85 billion buying back its stock. In our view, stock buybacks in moderation represent a good use of shareholder capital given that shares of HON have been trading well below their intrinsic value throughout 2021. Honeywell’s share repurchases were primarily covered by its large cash position on hand.

At the end of June 2021, Honeywell had $12.3 billion in cash, cash equivalents, and short-term investments on hand combined versus $5.2 billion in short-term debt and $16.1 billion in long-term debt. The firm’s net debt load of $9.0 billion at the end of the second quarter of this year is manageable, in our view, given Honeywell’s ample liquidity, stellar free cash flow generating abilities, and promising growth outlook. Over time, we would prefer Honeywell pare down its net debt load as its various business segments continue to rebound.

Supply Chain Hurdles

Management noted during Honeywell’s second-quarter 2021 earnings call that the firm was facing hurdles from ongoing supply chain disruptions across the globe and the related inflationary pressures. Here is what Honeywell’s management team had to say on the issue during that call (emphasis added):

“One area to keep in mind is that, we have been facing supply chain constraints as the sourcing environment for direct materials and components such as semiconductors and resin has been very tight. As we mentioned last quarter, we proactively partnered with distributors and alternative suppliers to mitigate these impacts and have had success, but the situation remains very fluid, as global supply chains ramp up.

We continue to work through this issue, but it will continue to be a constraint on our growth potential, particularly in SPS [Safety and Productivity Solutions] and HBT [Honeywell Building Technologies], and to a lesser degree in Aerospace.” — Greg Lewis, CFO and Senior VP of Honeywell

Later on, Honeywell’s management team had this to say in response to an analyst’s question on the issue during the call (emphasis added, lightly edited):

“And so, everywhere in our books of business that we can, we continue to pass through the inflation, that’s being seen and materials and also in the labor, because in the projects business, labor is also important as well. So, I would say, as we’re looking at our margin and backlog, we’re not seeing any material challenges to them…

So, I think, what we’re doing is, we’re finding success in being able to price with the inflationary environment, that we’re seeing. And we’re going to continue to manage through that, I think quite well, and in all of our project businesses, but it is something to keep an eye on.” — CFO and Senior of Honeywell

In our view, Honeywell has the operational capacity and pricing power to adeptly navigate these supply chain and inflationary headwinds going forward. When these hurdles begin to abate, that should provide another tailwind to Honeywell’s cash flow growth trajectory. Please note that while these hurdles are slowing Honeywell’s growth ambitions (and remain a very real concern), the firm is doing a great job maintaining its margins according to recent management commentary.

Concluding Thoughts

We are big fans of Honeywell and view the industrial giant’s free cash flow and dividend growth trajectory quite favorably, which is why we include shares of HON as an idea in the Dividend Growth Newsletter portfolio. Honeywell offers investors a combination of capital appreciation and income growth upside, and a way to indirectly play several attractive industries (some that are supported by secular growth tailwinds, such as e-commerce via its automated warehouse offerings, and some that are recovering from the worst of the COVID-19 pandemic via its offerings in the realm of commercial aerospace and downstream energy markets).

Honeywell’s 16-page Stock Report (pdf) >>

Honeywell’s Dividend Report (pdf) >>

—–

Industrial Leaders Industry – MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW

Tickerized for HON, HXL, WWD, GE, AER, AAL, RYCEF, RCKZF, SIEGY, ROK, BA, TGI, MTUAY, SAFRY, REZI

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT) and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.