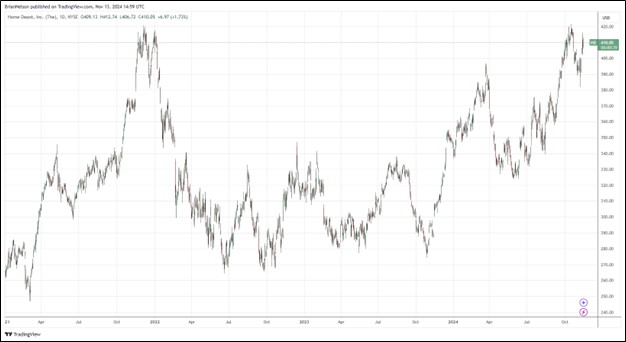

Image: Home Depot’s shares are flirting with all-time highs.

By Brian Nelson, CFA

On November 12, Home Depot (HD) reported better than feared third quarter results with both revenue and non-GAAP earnings per share coming ahead of the consensus forecast. Total sales increased 6.6% from the third quarter of fiscal 2023, while comparable store sales in the third quarter of fiscal 2024 fell 1.3% (consensus was at -3.27%), while comparable store sales in the U.S. fell 1.2% (consensus was at -3.3%). Customer comp transactions fell 0.6%, while comp average ticket dropped 0.8% in the third quarter versus last year.

Home Depot’s adjusted operating income for the third quarter of fiscal 2024 was $5.6 billion on an adjusted operating margin of 13.8%, compared with adjusted operating income of $5.5 billion and an adjusted operating margin of 14.5% for the third quarter of fiscal 2023. Adjusted diluted earnings per share for the third quarter of fiscal 2024 came in at $3.78, beating the consensus forecast of $3.65 and compared with adjusted diluted earnings per share of $3.85 in the same period a year ago. Sales per square foot dropped 2.1% in the quarter on a year-over-year basis.

Management had the following to say about the quarter:

While macroeconomic uncertainty remains, our third quarter performance exceeded our expectations. As weather normalized, we saw better engagement across seasonal goods and certain outdoor projects as well as incremental sales related to hurricane demand. I would like to thank all of our associates for their dedication in serving our customers and communities.

Through the nine months ended October 27, cash flow from operations came in at $15.1 billion versus $16.4 billion in the year-ago period. Capital spending was roughly flat at $2.4 billion. Free cash flow totaled $12.8 billion for the nine months ended October 27, down from $14.1 billion in the same period last year. At the end of the quarter, Home Depot had $1.5 billion in cash versus $51.4 billion in short- and long-term debt. Though we don’t like Home Depot’s net debt position, its free cash flow generation remains robust. Consumers continue to be cautious with big ticket comp transactions over a $1,000 down 6.8% on a year-over-year basis.

Looking to fiscal 2024 guidance, Home Depot expects total sales to increase 4% including SRS Distribution and the 53rd week, up from the prior forecast of 2.5%-3.5%. The 53rd week is expected to add $2.3 billion to total sales, while its SRS acquisition is expected to contribute roughly $6.4 billion in incremental sales. Comparable sales are expected to decline roughly 2.5% for the 52-week period compared to fiscal 2023 and down 3%-4% previously. Adjusted diluted earnings per share is expected to decline roughly 1% from $15.25 in fiscal 2023, including the 53rd week and better than prior expectations calling for a 1%-3% decline. Shares yield 2.2% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.