Image Shown: In the face of major exogenous shocks, Philip Morris International Inc was still able to put up solid operational and financial performance in the first quarter of 2022. Image Source: Philip Morris International Inc – First Quarter of 2022 IR Earnings Presentation

By Callum Turcan

There are a lot of reasons to like Philip Morris International Inc (PM) as a high-yielding income growth opportunity. Its portfolio includes numerous top selling cigarette brands including Marlboro, L&M, Chesterfield, Parliament, and others. After splitting with Altria Group Inc (MO) back in 2008, Philip Morris has the right to sell these cigarette brands in international markets while Altria Group has the right to sell these branded tobacco products in the US market.

Philip Morris is a free cash flow generating powerhouse that utilizes its immense pricing power, along with ongoing cost structure improvement initiatives to offset secular declines in cigarette unit volumes to support its financial performance. We appreciate that Philip Morris is transitioning towards sales of alternative tobacco products such as its IQOS heated tobacco unit (‘HTU’) offering to support its longer term growth outlook.

We include Philip Morris as an idea in the High Yield Dividend Newsletter portfolio and shares of PM yield a nice ~4.8% as of this writing. Sales of its IQOS products have grown robustly in recent years, and in our view, there is ample room for additional upside potential here. Before covering that upside, let’s first go over the developing legal situation in the US as it concerns marketing its IQOS product.

IQOS Legal Update

Philip Morris is marketing its IQOS products internationally, and in the US, the company is working with Altria Group to market its IQOS offerings. However, we will caution that due to a legal dispute between the Philip Morris and Altria partnership and British American Tobacco PLC (BTI) involving alleged patent infringement and an unfavorable ruling from the International Trade Commission (‘ITC’) in 2021, the IQOS product line-up is no longer available in the US marketplace. Legal proceedings are ongoing, and please note that sales of Philip Morris’ IQOS products are continuing to take place overseas. Philip Morris aims to reach a resolution on this issue soon so sales of its IQOS offerings can resume in the US by the first half of 2023.

Taking a step back from the legal dispute, Philip Morris is encouraging traditional cigarette smokers to switch to an alternative tobacco offering that in the view of regulators is a healthier choice.

On March 11, the US Food and Drug Administration (‘FDA’) issued a modified risk granted order that allows the partnership to market the ‘IQOS 3 System Holder and Charger’ offering with certain reduced exposure information. That includes the following: “the IQOS system heats tobacco but does not burn it,” “this significantly reduces the production of harmful and potentially harmful chemicals,” and “scientific studies have shown that switching completely from conventional cigarettes to the IQOS system significantly reduces your body’s exposure to harmful or potentially harmful chemicals.” This follows in the footsteps of a similar authorization made in July 2020 from the US FDA covering different IQOS products.

Adjusted Earnings Update

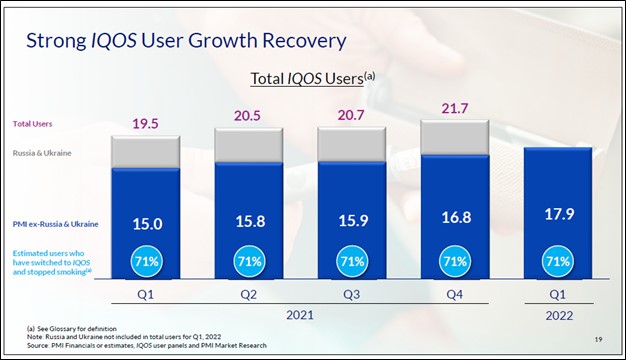

Now let’s go over Philip Morris’ latest earnings. Philip Morris reported its first quarter 2022 earnings on April 21 that beat consensus top- and bottom-line estimates due in large part to its IQOS products selling quite well. Supply chain hurdles have negatively impacted its ability to produce IQOS products, though Philip Morris is steadily working towards resolving these issues. When removing the impact of the Ukraine-Russia crisis from its performance (Philip Morris refers to this as its pro forma performance), the company estimates that its IQOS user base stood near 17.9 million at the end of the first quarter, up approximately 1 million from the end of December 2021 on a pro forma basis.

Image Shown: Philip Morris’ IQOS user base, excluding the Russian and Ukraine markets, is growing robustly. Image Source: Philip Morris – First Quarter of 2022 IR Earnings Presentation

At the end of December 2021, Philip Morris estimates its IQOS user base in Ukraine and Russia stood near 4.8 million. The company announced in February 2022 that it was suspending its operations in Ukraine in light of the Russian invasion of the country. In March 2022, Philip Morris announced it was exiting the Russian market and later that month the firm followed up with another announcement highlighting the steps it intended to make to do so.

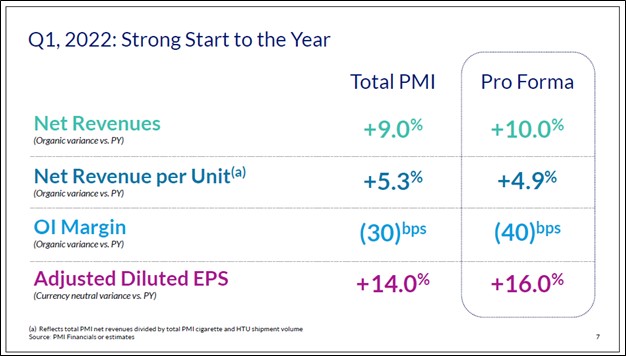

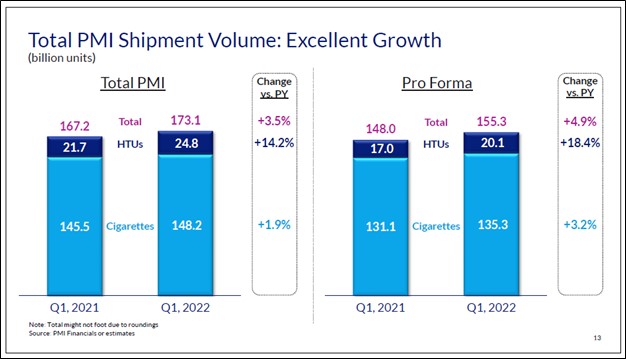

Keeping these exogenous shocks in mind (supply chain hurdles and the Ukraine-Russia crisis), Philip Morris has been able to effectively adjust its business accordingly. HTU shipment volumes grew by 14% year-over-year last quarter, which played an outsized role in growing total shipment volumes by just under 4% year-over-year as its total cigarette shipment volumes rose by 2% year-over-year. The firm’s non-GAAP net revenues on an organic basis grew 9% year-over-year in the first quarter, aided by unit shipment volume growth and a 3% pricing increase at its combustible products. Pricing increases are going a long way in helping Philip Morris navigate inflationary pressures. Revenues from smoke-free products represented 31% of Philip Morris’ total sales last quarter, and 30% on a pro forma basis.

Image Shown: Philip Morris is steadily growing its HTU shipment volumes and sales of its traditional cigarette brands are holding up well. Image Source: Philip Morris – First Quarter of 2022 IR Earnings Presentation

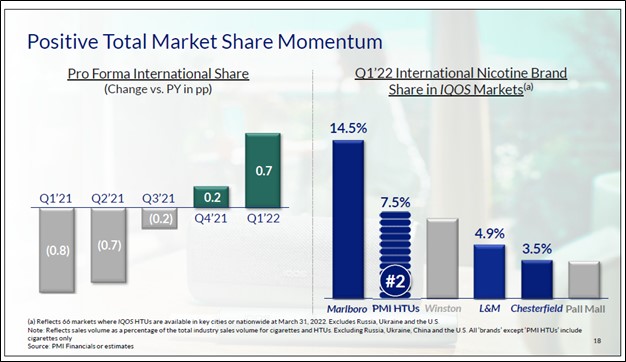

In what Philip Morris deems “IOQS markets” which excludes the US, the firm noted the market share of its IQOS products rose by 110 basis points year-over-year to reach 7.5% last quarter. Along with modest market share gains at its traditional cigarette products (up 20 basis points year-over-year), Philip Morris grew its total market share of the tobacco market (excluding markets in the US and China) to 26.7% in the first quarter of 2022. Philip Morris has been firing on all cylinders of late.

Image Shown: Utilizing a combination of innovation and brand strength, Philip Morris has been able to grow its market share of the tobacco industry in relevant regions in recent quarters. Image Source: Philip Morris – First Quarter of 2022 IR Earnings Presentation

The company’s pro forma non-GAAP adjusted operating margin declined 40 basis points year-over-year in the first quarter of 2022 as inflationary headwinds and supply chain hurdles took their toll, though please note that this excludes sizable foreign currency headwinds and the impact of the Ukraine-Russia crisis. All in all, Philip Morris put up solid performance last quarter in the face of major exogenous shocks and has a plan in place to continue growing the business.

Outlook

By 2025, Philip Morris aims to generate over half of its revenues from smoke-free products and the company is well on its way to achieve its target. Growing the sales of its IQOS products represents the bedrock of this strategy. Additionally, the company aims to generate “at least” $1.0 billion in revenue by 2025 from non-nicotine products with an eye towards inhaled therapeutics and selfcare wellness offerings. Philip Morris is utilizing acquisitions to make that possible and recently acquired OtiTopic, Fertin Pharma, and Vectura Group to grow its exposure to inhaled therapeutics and selfcare wellness offerings.

Philip Morris also aims to realize $2.0 billion in annualized cost savings by 2023 using 2020 as a baseline. Scaling up its HTU operations to realize economies of scale, particularly on the manufacturing front, is a key part of its strategy here.

As it concerns its capital allocation priorities, Philip Morris aims to pay out ~75% of its adjusted diluted EPS as dividends over the long haul. In 2021, the firm launched a three-year share buyback program worth $5.0-$7.0 billion. Improving its cost structure and targeting revenue growth outside the realm of traditional cigarette sales will be crucial in enabling Philip Morris to grow its free cash flows in the coming years.

We caution that the firm exited March 2022 with a net debt load of $24.7 billion, though with $4.6 billion in cash and cash equivalents on hand at the end of this period, Philip Morris has ample liquidity to meet its near term funding needs. Philip Morris has a nice ‘A-rated’ investment grade credit rating (A2/A/A), which supports its ability to tap debt markets at attractive rates as needed. Shares of PM have held up quite well of late, though the firm has historically turned to debt markets for its financing needs.

Due to the Ukraine-Russia crisis, Philip Morris issued updated pro forma guidance for 2022 during its latest earnings report that can be viewed in the upcoming graphic down below. We appreciate that the firm’s organic net revenues are expected to grow nicely, and its adjusted operating margin is expected to expand at a decent clip this year versus 2021 levels, though we caution that these pro forma non-GAAP figures are heavily adjusted. The company’s non-GAAP adjusted diluted EPS is also expected to grow robustly on an annual basis in 2022. Additionally, please note that these figures remove foreign currency movements from the picture, which have represented sizable headwinds of late.

Image Shown: When excluding the impact of foreign currency headwinds and the Ukraine-Russia crisis, Philip Morris’ underlying business is expected to grow at a nice clip this year. Image Source: Philip Morris – First Quarter of 2022 IR Earnings Presentation

Philip Morris expects to generate ~$10.0 billion in operating cash flow and spend ~$1.0 billion on its capital expenditures in 2022, allowing for approximately $9.0 billion in free cash flow. On a pro forma basis, Philip Morris expects its total shipment volumes will either come in flat or grow by 1% annually in 2022. We appreciate that the company forecasts that it will remain a free cash flow cow this year.

Philip Morris did not include a cash flow statement in its latest earnings report, though for reference, the firm generated $11.2 billion in free cash flow in 2021. The company spent $7.6 billion covering its dividend obligations and another $0.6 billion on ‘payments to noncontrolling interests and other’ last year along with $0.8 billion buying back its stock and $2.1 billion on acquisitions. We appreciate the company’s rock-solid cash flow profile.

Concluding Thoughts

Given the major exogenous shocks Philip Morris is contending with, we are impressed with its results. Shares of PM have regained their upward momentum in recent weeks and the company remains incredibly shareholder friendly. From 2021-2023, Philip Morris is targeting a 5%+ CAGR in its organic net revenues and a 9%+ CAGR in its adjusted diluted EPS which in turn is expected to enable the firm to keep growing its dividend going forward.

We continue to like Philip Morris as an idea in the High Yield Dividend Newsletter portfolio and appreciate that the firm is adapting to the volatile economic and geopolitical backdrop well, while continuing to grow its alternative tobacco product sales. The company’s free cash flow growth outlook over the long haul is bright.

—–

Our Reports on Stocks in the Recession Resistant Industry – BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT, CHD, SYY, ADM, LANC, CASY

Tickerized for PM, CG, VDC, VEGPF, MO, JAPAY, BTI, SWM, TPB, VGR, IMBBY, OGI, RLX, BCS

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares in DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Philip Morris International Inc (PM) and Vanguard Consumer Staples Index Fund ETF (VDC) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.