Image Shown: We include Crown Castle International Corp as an idea in our High Yield Dividend Newsletter portfolio. Image Source: Crown Castle International Corp – October 2021 IR Presentation

By Callum Turcan

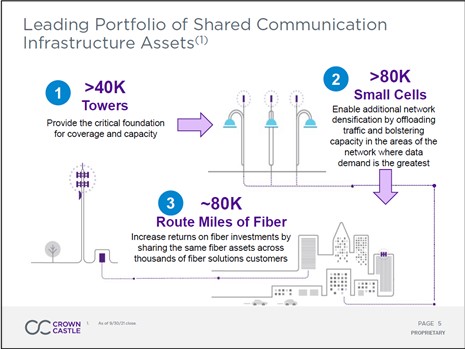

Crown Castle International Corp (CCI) is a real estate investment trust (‘REIT’) that owns and operates cell towers, fiber networks, and small cell nodes in the US. These assets form the backbone of wireless infrastructure and are key to enabling the domestic rollout of 5G networks and supporting existing 4G networks. We include shares of CCI in our High Yield Dividend Newsletter portfolio as we are big fans of its strong dividend coverage (when taking its ability to tap capital markets into account), impressive growth outlook, and high-quality cash flow profile.

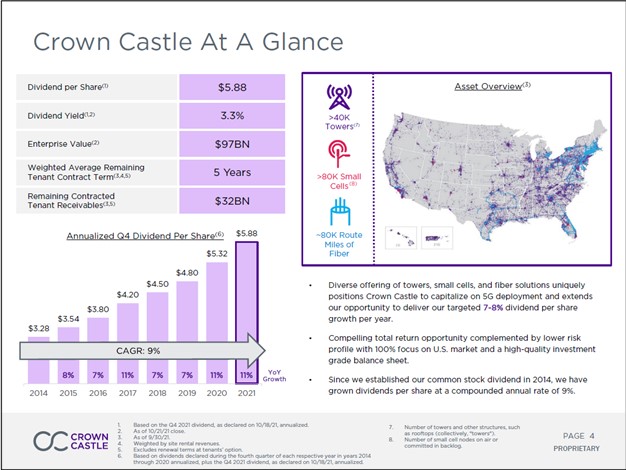

Shares of CCI yield ~2.9% as of this writing after the REIT boosted its quarterly dividend by 11% sequentially in October 2021, bringing its annualized payout up to $5.88 per share. Over the long haul, Crown Castle targets 7%-8% annual dividend growth.

The REIT’s expansive asset base stretches across the US with operations in virtually every major metropolitan market. Crown Castle’s long-term contracts with its tenants (namely telecommunications giants) provide substantial visibility as it concerns its future cash flow performance. Additionally, Crown Castle generates substantial free cash flows, something we like a lot.

Image Shown: Crown Castle aims to grow its annual dividend by 7%-8% over the long haul, highlighting its commitment to income seeking shareholders. Image Source: Crown Castle International Corp – October 2021 IR Presentation

Growth Trajectory Picking Up Steam

When reporting its third quarter 2021 earnings in October 2021, Crown Castle noted that its site rental revenues (used to gauge its underlying sales performance) grew 8% year-over-year to reach $1.5 billion. Its non-GAAP adjusted funds from operations (‘AFFO’), used to gauge its underlying cash flow performance, grew 15% year-over-year to reach $0.8 billion. On a per share basis, Crown Castle’s AFFO grew 13% year-over-year to reach $1.77 in the third quarter of 2021.

AFFO is a key industry-specific metric that can help indicate the strength of a REIT’s dividend coverage and ability to push through payout increases in the near term. Please note that REITs are capital-market dependent entities that need to continuously tap debt and equity markets for funds to meet their funding needs (ideally at attractive rates).

Crown Castle maintained its full-year guidance for 2021 during its third-quarter earnings update, which calls for ~$5.7 billion in site rental revenues and AFFO of $6.78-$6.89 per share. If realized, this would represent roughly 7% annual growth in its site rental revenues and roughly 12% annual AFFO per share growth at the midpoint of guidance versus its 2020 performance after making some big adjustments (namely when removing the impact of recent consolidation in the US wireless industry). Crown Castle’s latest guidance for 2021 is an improvement versus the guidance it released when reporting its fourth-quarter 2020 earnings in January 2021.

Sprint was bought out by T-Mobile US Inc (TMUS) in a deal that closed in April 2020. This move prompted T-Mobile to cancel a deal with Crown Castle. Here is what Crown Castle had to say on the issue within its fourth quarter 2020 earnings press release (lightly edited):

In December 2020, T-Mobile notified Crown Castle it was cancelling approximately 5,700 small cells contracted with Sprint Corporation prior to its merger with T-Mobile. The majority of the cancelled small cells were not yet constructed and, upon completion, would have been located at the same locations as other T-Mobile small cells. The Sprint Cancellation resulted in T-Mobile accelerating payment of all contractual rental obligations associated with the approximately 5,700 small cells as well as the payment of capital costs incurred to date.

Crown Castle was able to secure new deals to preserve its growth trajectory. Back in November 2020, Crown Castle announced a major deal with DISH Network Corp (DISH) to help the firm get its nascent wireless business off the ground. DISH Network acquired Boost Mobile in July 2020 for $1.4 billion from T-Mobile (which enabled T-Mobile to get the regulatory approved needed to acquire Sprint), and the deal marked DISH Network’s entrance into the US wireless industry. The November 2020 press release from Crown Castle noted that (emphasis added):

DISH and Crown Castle today announced a long-term agreement through which Crown Castle will lease DISH space on up to 20,000 communication towers. As part of the agreement, DISH will receive certain fiber transport services and also have the option to utilize Crown Castle for pre-construction services. The agreement encompasses leases on towers located nationwide, helping DISH facilitate its buildout of the first open, standalone and virtualized 5G network in the U.S.

Crown Castle is the first infrastructure partnership DISH has announced. Over the past several months, DISH has made several wireless vendor announcements, including software, core, BSS/OSS, and 5G radios. These agreements provide a clear path toward DISH’s rollout of a nationwide 5G network.

Furthermore, in January 2021, Crown Castle announced a major deal with Verizon Communications Inc (VZ) where the telecommunications giant “committed to lease 15,000 new small cells from Crown Castle over the next four years. Once installed, the small cell leases will have an initial term of 10 years.” Effectively, Crown Castle and Verizon agreed to extend and expand their existing strategic partnership for their mutual benefit.

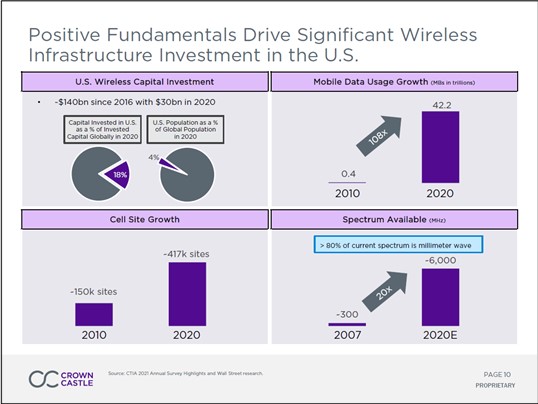

Crown Castle operates in an industry that has grown robustly over the past decade or so. Looking ahead, the rollout of domestic 5G wireless offerings underpins its promising growth trajectory in the medium-term. Longer term, surging domestic mobile data traffic and the rise of edge computing underpins the REIT’s bright outlook.

The entrance of DISH Network into the US wireless industry is another huge opportunity for Crown Castle, and one that should help offset the “lost” growth potential from Sprint getting acquired by T-Mobile. However, please note that Crown Castle still does plenty of business with T-Mobile.

At the end of September 2021, T-Mobile, Verizon, and AT&T Inc (T) represented almost three-quarters of Crown Castle’s site rental revenues (as of the first nine months of 2021). Customer concentration risk is prevalent with Crown Castle, which we caution is a major downside risk, though the REIT has shown it can adapt to the changing industry landscape in rapid fashion. Going forward, Crown Castle’s deal with DISH Network should add another major wireless player to its tenant base once that agreement starts generating meaningful site rental revenues for the REIT.

Image Shown: Surging mobile data consumption in the US over the past decade enabled Crown Castle to rapidly scale up its business. Going forward, the rollout of domestic 5G wireless services should keep the momentum going in the right direction. Image Source: Crown Castle – October 2021 IR Presentation

2022 Guidance

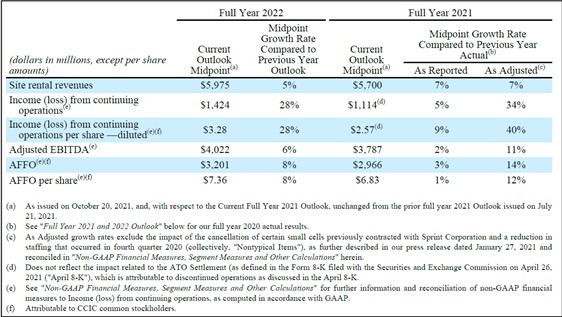

Looking ahead, Crown Castle aims to kick its growth trajectory into high gear starting in 2022, aided by its recent deals with DISH Network and Verizon. As one can see in the upcoming graphic down below, the REIT aims to grow its site rental revenues by 5% and its AFFO per share by 8% in 2022 at the midpoint of its guidance versus expected 2021 levels (at the midpoint of its guidance).

The cancellation of its deal with Sprint stung, but Crown Castle quickly adjusted by securing new deals, and its growth trajectory remains quite bright. At the midpoint of its 2022 guidance, Crown Castle’s forward-looking dividend payout ratio (annualized dividends per share divided by forecasted AFFO per share) stands at just below 80% at its current payout rate.

Image Shown: A look at Crown Castle’s guidance for 2022, which calls for decent growth in its underlying sales performance and underlying cash flows on a per share basis. Image Source: Crown Castle – Third Quarter of 2021 Earnings Press Release

During Crown Castle’s third quarter of 2021 earnings call, management had this to say regarding the REIT’s capital expenditure and asset development programs for both 2021 and 2022 (emphasis added, lightly edited):

“…[We] expect to deploy an additional 5,000 small cells in 2022, which is the same number we expect to build in 2021. We expect discretionary Capex to be approximately $1.1 billion to $1.2 billion in 2022, including approximately $300 million for towers and $800 to $900 million for fiber, similar to what we expect in 2021…

Based on the expected growth in cash flows for full-year 2022 and consistent with our investment-grade credit profile, we expect to fund our discretionary Capex with free cash flow and incremental debt capacity without the need for new equity for the [fourth] consecutive year. In addition, we believe our business and balance sheet are well positioned to support consistent AFFO growth through various economic cycles, including during periods of higher inflation and interest rates.” — Daniel Schlanger, EVP and CFO of Crown Castle

We appreciate that the REIT prefers to utilize debt instead of equity to fund its growth ambitions. As an aside, Crown Castle expects to receive a sizable amount of prepaid rent in 2022, as historically is the case each year. Please note that Crown Castle’s outstanding share count has grown modestly in recent years due to its stock-based compensation, growing by just over 2% from 2018 to 2020 on a weighted-average diluted basis.

ESG Considerations

The proliferation of Environmental, Social, and Governance (‘ESG’) investing extends to the REIT industry. In December 2021, within the press releasing announcing that its latest ESG report had been published, Crown Castle noted that “the 2020 ESG Report expands upon the prior two Corporate Sustainability Reports by adding EEO-1 data and a Task Force on Climate-Related Disclosures (‘TCFD’) index, while continuing to provide Global Reporting Initiative (‘GRI’) and Sustainability Accounting Standards Board (‘SASB’) disclosures.” We appreciate the additional disclosures.

Furthermore, Crown Castle announced in October 2021 that it aimed to achieve carbon neutrality by 2025 as it concerns its Scope 1 and Scope 2 emissions. The October 2021 press release noted that this would be achieved “through a combination of continued investment in energy reduction initiatives, sourcing renewable energy, and, to a lesser extent, utilizing carbon credits or offsets.” Its December 2021 press release noted that “we have contracted to source more than 60% of our anticipated 2022 electricity consumption with renewable energy, putting us well on our way to reaching our goal” indicating Crown Castle is making serious headway on this front.

At the end of September 2021, Crown Castle had an undrawn $5.0 billion unsecured revolving credit facility that matures in June 2026 (the maturity date was extended in June 2021), providing the REIT with ample access to liquidity. This extension also covered Crown Castle’s Senior Unsecured Term Loan A Facility (together the unsecured revolving credit facility and the term loan make up the REIT’s “Credit Facility”), which had an outstanding balance at the end of September 2021. Part of this extension and revision also factored in Crown Castle’s commitment to ESG policies, especially as it concerns its net zero emissions targets, which could potentially reduce the REIT’s interest rate spread on those facilities. From the June 2021 press release:

The amendment extends the maturity of the Credit Facility to June 2026 and incorporates specified annual sustainability targets. The Credit Facility pricing is subject to adjustment based on Crown Castle’s performance against those targets.

Crown Castle’s management team had this to say on the issue in the June 2021 press release (lightly edited):

“We appreciate the continued support from our strategic lending partners and are excited to add targets to our Credit Facility that reflect our efforts to reduce our net emissions… Our business model is built on the concept that sharing a single asset among multiple users creates long-term shareholder value and is a sustainable means of meeting the growing demand for connectivity. Incorporating sustainability targets into our Credit Facility furthers our commitment to build upon the strong foundation our business model provides.” — Jay Brown, CEO of Crown Castle

According to its 10-Q SEC filing covering the third quarter of 2021, Crown Castle had this to say regarding its revolving credit facilities (moderately edited, emphasis added):

…[Reductions] to the interest rate spread [currently the LIBOR benchmark, though that benchmark is getting phased out on a global level and will be replaced with another benchmark] and unused commitment fee percentage upon meeting specified annual sustainability targets and increases to the interest rate spread and unused commitment fee percentage upon the failure to meet specified annual sustainability thresholds… With respect to the specified annual sustainability targets, the applicable interest rate spread is subject to an upward or downward adjustment of up to 0.05% and the unused commitment fee is subject to an upward or downward revision of up to 0.01% if the Company achieves, or fails to achieve, certain specified targets.

Here, we stress that companies that commit to meeting ESG goals are finding its easier to tap capital markets at more attractive rates. With that in mind, committing to these goals and later failing to deliver on these targets comes with financial consequences, though in our view, Crown Castle should be up to the challenge. To read more about our thoughts on the proliferation of ESG investing and the high-quality firms out there that meet rigorous ESG standards, please check out our ESG Newsletter (link here).

Capital Market Access and Free Cash Flow

As noted previously, as a REIT, Crown Castle is a capital market dependent entity. Its large debt load combined with the requirement that it pays out virtually all its earnings as dividends means Crown Castle needs to constantly issue debt and/or equity to fund its growth ambitions (acquisitions and investments in the business), dividend payouts, and meet its refinancing needs. This represents another huge risk for the REIT, though a risk that is manageable, in our view.

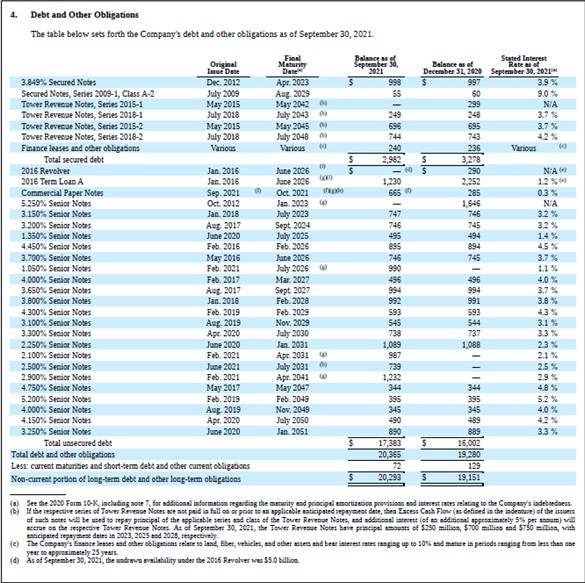

Crown Castle had a total debt load of $20.4 billion (inclusive of short-term debt) at the end of September 2021 along with sizable current and non-current lease operating liabilities to be aware of, modestly offset by $0.4 billion in cash and cash equivalents on hand (exclusive of restricted cash) at the end of this period. The REIT had a well-staggered debt maturity schedule at the end of September 2021, which should make future refinancing activities an easier task.

Image Shown: Crown Castle had a well-staggered debt maturity schedule at the end of September 2021. Image Source: Crown Castle – 10-Q SEC filing Categories Member Articles