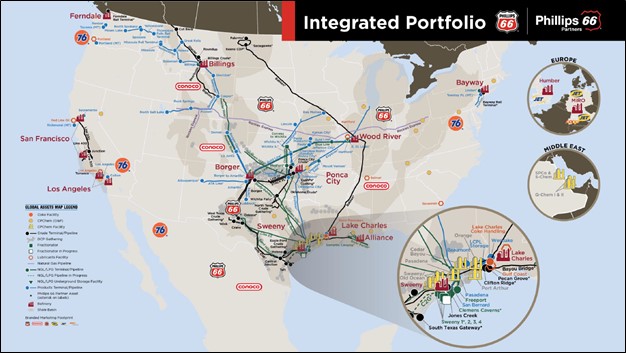

Image Shown: An overview of Phillip 66’s expansive asset base. Image Source: Phillips 66 – November 2021 IR Presentation

By Callum Turcan

Demand for diesel and gasoline has largely recovered from the worst of the coronavirus (‘COVID-19’) pandemic, though kerosene demand (jet fuel) has a way to go given depressed levels of international travel. The refining giant Phillips 66 (PSX) took advantage of the rebound seen over the past year to pare down its debt levels on a consolidated basis. At the end of December 2020, Phillips 66 had $13.4 billion in net debt (inclusive of short-term debt) on a consolidated basis, which fell down to $12.0 billion in net debt (inclusive of short-term debt) at the end of September 2021. Going forward, Phillips 66 now wants to focus on returning cash to shareholders as communicated during a January 2022 investor conference. Shares of PSX yield a nice ~4.6% as of this writing.

Corporate Structure and Pending Changes

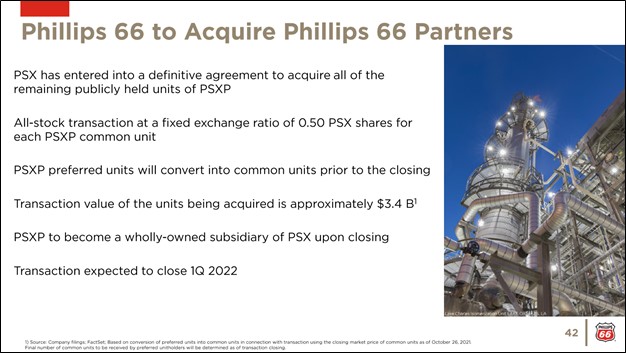

First, some quick housekeeping items. Note that Phillips 66 owns a large economic interest in Phillips 66 Partners LP (PSXP) which is its main midstream master limited partnership (‘MLP’) spinoff. The financial performance of the midstream MLP is consolidated with Phillips 66’s performance. Phillips 66 is getting ready to acquire Phillips 66 Partners through an all-stock deal that is expected to close in the first quarter of 2022, which was announced back in October 2021. When the deal was first announced, the transaction value was pegged at ~$3.4 billion. When the deal closes, Phillips 66 Partners will become a wholly-owned subsidiary of Phillips 66.

Image Shown: Phillips 66 is acquiring the remaining economic interests in Phillips 66 Partners that it does not already own through an all-stock deal that is set to close in the first quarter of 2022. Image Source: Phillips 66 – November 2021 IR Presentation

Additionally, Phillips 66 owns 50% the equity of DCP Midstream which in turn owns the general partner (‘GP’) of the publicly traded DCP Midstream LP (DCP), another publicly traded midstream MLP (DCP Midstream also owns a sizable economic stake in the publicly traded midstream MLP). Furthermore, Phillips 66 owns half of the Chevron Phillips Chemical Company (‘CPChem’) joint-venture, with its partner Chevron Corporation (CVX) owning the remaining stake. Phillips 66 is a giant in the refining, petrochemical, and midstream industries and is well-positioned to capitalize on the ongoing recovery in the global energy complex.

Capital Allocation Priorities

Pivoting back to Phillips 66’s plan to return more cash to shareholders, the firm aims to spend $1.9 billion on its capital expenditures in 2022 versus $2.9 billion in capital expenditures in 2020 and plans for $1.7 billion in adjusted capital expenditures in 2021 (its adjusted and actual capital expenditures are roughly the same). The company is keeping a lid on its capital investments to maximize its free cash flow generating abilities. Phillips 66 is targeting mid-cycle annual operating cash flows of ~$6.0-$7.0 billion.

Though Phillips 66 notes that its sustaining level of capital expenditures is estimated to be roughly $1.0 billion on an annual basis (both in 2022 and over the long haul), we are always cautious with that type of commentary given the eventual need to replace aging assets with new operations (especially in the rapidly changing global energy complex).

Image Shown: Phillips 66 lays out plans for its capital allocation priorities over the long haul, with debt repayment being a near term priority as it repairs its balance sheet from the damage sustained during the worst of the COVID-19 pandemic. Image Source: Phillips 66 – November 2021 IR Presentation

Management noted during the January 2022 investor event that the goal would be to bring Phillips 66’s debt load down to pre-pandemic levels of roughly $12.0 billion before resuming share buybacks in earnest. That appeared to be a reference to total debt, which stood at $14.9 billion at the end of September 2021 when including short-term debt. In the eyes of management, Phillips 66 should be able to pare down its total debt load quickly given the firm’s improving outlook, relatively modest capital expenditure budget, and strong cash flow generating abilities. That, in turn, will allow Phillips 66 to resume share repurchases this year, a move management is “anxious” to begin doing.

Our fair value estimate sits at $79 per share of Phillips 66, roughly where the company is trading at as of this writing, though the high end of our fair value estimate range stands at $99 per share. We appreciate Phillips 66’s plan to further pare down its debt load in the near term before resuming share buybacks considering shares of PSX are fairly valued as of this writing, in our view. Phillips 66’s run-rate payout obligations stood at $1.9 billion in 2020 (dividends to common shareholders plus distributions to noncontrolling interests), though its pending deal to acquire Phillips 66 Partners may change the total figure modestly. In October 2021, Phillips 66 announced a modest sequential increase in its quarterly payout of ~2%. Looking ahead, Phillips 66’s annualized dividend now sits at $3.68 per share.

Green Growth

Though Phillips 66 is a powerhouse in the fossil fuel industry, management is pushing aggressively into new arenas. For instance, Phillips 66 is working towards converting its San Francisco Refinery in Rodeo, California (which is right next to San Francisco), to one that produces renewable fuels through its Rodeo Renewal project. For reference, the Rodeo Refinery has 120,000 barrels of daily crude throughput capacity (140,000 barrels of total throughput capacity per day) and the facility dates back to the 1890s (though the current refinery is much more modern). The renewable fuels project would see the refinery no longer process crude oil.

By 2024, the goal is to enable the refinery “to produce 800 million gallons per year of renewable diesel, renewable gasoline and sustainable jet fuel from used cooking oils, fats, greases and soybean oils” which includes output from a previous endeavor along with the 680 million gallons of annual renewable fuel capacity the Rodeo Renewal endeavor would bring online. Phillips 66 is already producing a modest amount of renewable biodiesel at the Rodeo Refinery as it recently completed a small renewable fuel conversion project at the refinery that commenced operations in July 2021.

Here we must stress that the Rodeo Refinery was recently defined as a “perennial underperformer” by Phillips 66’s management team. While this upgrade is considered a growth endeavor, it really is all about ensuring that the refinery does not become a stranded asset due to its unappealing economics. There is a lot of existing infrastructure at the facility along with a dedicated workforce, but the asset does not have the kind of economic profile that refineries in the US Gulf Coast and Midwest regions have (refineries in these regions have ample access to cost-advantage crude oil and other supplies from major shale plays and Canada’s oil sands patch). Phillips 66 is making the right call by upgrading the Rodeo Refinery instead of simply letting the asset fade into irrelevancy, in our view.

By utilizing existing infrastructure at the refinery, and the feedstock operations already set up via its recently completed hydrotreater conversion project, Phillips 66 aims to bring down development costs while ensuring that ongoing operating expenses will be tame. Having access to global bio-feedstocks due to the Rodeo Refinery’s proximity to various Pacific Coast ports along with ample domestic bio-feedstock supplies should support the project’s economics over the long haul. Additionally, please note that boosting its domestic biofuel production capacity will help Phillips 66 comply with the Renewable Fuels Standard Program that is run by the US Environmental Protection Agency (‘EPA’).

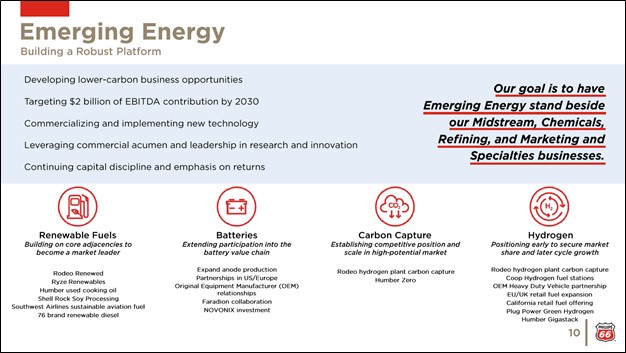

Management noted during the January 2022 investor presentation that Phillip 66 was considering “everything from soybean oil to corn oil, canola, oil, use cooking all animal fats, anything that that we can get our hands on across the planet to process.” Furthermore, Phillips 66’s management team noted that “Rodeo Renewed is the cornerstone of our renewables efforts” while the firm’s recently “established an Emerging Energy group” will support its future efforts in this space. The Emerging Energy group was announced back in January 2021.

Looking ahead, its Emerging Energy group will focus on renewable fuels, batteries, carbon capture and storage, and hydrogen technologies. By 2030, Phillips 66 aims to have this part of its business generate $2 billion in EBITDA, and in our view, its growing renewable fuels operations will likely be the main way the company achieves its longer term goals. Phillips 66’s renewable fuels business is currently rather small. Once the Rodeo Renewed endeavor is fully operational, its Emerging Energy group will start to become a meaningful (albeit still small) part of Phillips 66’s business profile.

Image Shown: An overview of the various new energy technologies Phillips 66 intends to invest in via its nascent Emerging Energy unit. Image Source: Phillips 66 – November 2021 IR Presentation

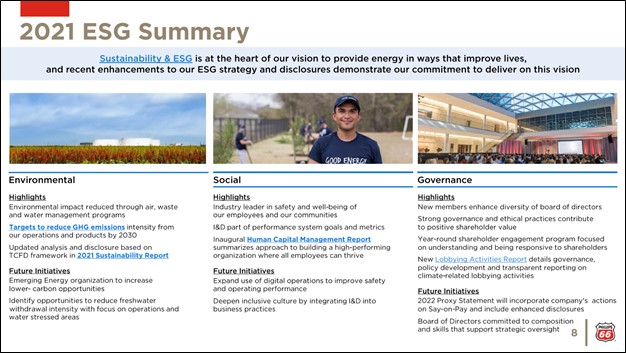

Phillips 66 is more committed to green ambitions than its long and storied history may have some believe. The company publishes annual sustainability reports, focuses and reports on ESG (environmental, social, and governance) issues, and has its aforementioned renewable biofuel growth ambitions. Over time, Phillips 66 will likely continue to expand its ability to produce renewable gasoline, diesel, and jet fuel using bio-feedstocks.

We would not include a company like Phillips 66 in our ESG Newsletter portfolio (more on that here) given its vast exposure to fossil fuels, but we are intrigued by its pivot. Please note that we include Chevron and Exxon Mobil Corporation (XOM) as ideas in several of our newsletter portfolios given the improving outlook for the global energy complex. The oil and gas industry represents an attractive space right now as it concerns both capital appreciation and dividend growth opportunities, but it does not meet ESG investing criteria.

Image Shown: Phillips 66 is adapting to the changing investing landscape by placing a greater emphasis on ESG issues and sustainability practices, as best as it can considering the firm is a juggernaut in the fossil fuels industry. Image Source: Phillips 66 – November 2021 IR Presentation

Concluding Thoughts

Phillips 66 has laid out a sound long-term capital allocation strategy. We appreciate the company’s plan to continue deleveraging in the near term. Farther out, keeping its capital expenditures contained will better enable Phillips 66 to generate substantial free cash flows throughout the business cycle. Its renewable fuels project in California is intriguing, though what matters most is the ongoing recovery in the global energy complex, particularly as it concerns refined petroleum products demand.

The recovery in the global energy complex seen over the past year is what enabled Phillips 66 to boost its dividend and reduce its net debt load in recent quarters. As the recovery is expected to continue, management had the confidence to communicate that Phillips 66 will soon resume share repurchases after bringing its debt load down further. Things are looking up for Phillips 66.

Though we may grow interested in PSX in the High Yield Dividend Newsletter portfolio, we do not intend to add Phillips 66 to our newsletter portfolios at this time, though we continue to be huge fans of Chevron and Exxon Mobil. To read more about why we like Exxon Mobil, please check out this article here.

—–

Oil and Gas Complex Industry – BKR, HAL, SLB, BP, CVX, COP, XOM, RDS, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX

Tickerized for PSX, PSXP, DCP, CVX, XOM, BNO, RDS.A, RDS.B, USO, XLE, XOP, CRAK, MPC, VLO, HFC, PBF, FRAK, OIH, GHAAX, CVI, DK, CVR, FANG, UCO, SCO, DBO, USL, USOI

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Energy Select Sector SPDR Fund ETF (XLE) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Chevron Corporation (CVX) and ExxonMobil Corporation (XOM) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio, simulated Dividend Growth Newsletter portfolio, and simulated High Yield Dividend Newsletter portfolio. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.