By Brian Nelson, CFA

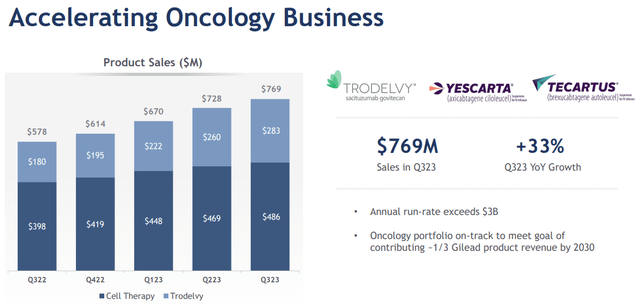

On November 7, Gilead Sciences (GILD) reported better-than-expected third-quarter results with revenue and non-GAAP earnings per share handily beating the consensus estimates. Gilead was once a market darling having cured hepatitis C, but success in this area has forced the company to reinvent itself, and it continues to make solid progress in HIV product sales and oncology (Trodelvy and Cell Therapy). We have Gilead on our radar for consideration, and the company’s dividend yield of ~3.7% pays investors to wait for its promising pipeline to flourish. We value Gilead north of $100 per share, far above where it is currently trading.

Image: Gilead’s potential in oncology speaks to long-term sustainability.

Here is what CEO Daniel O’Day had to say about the quarter in the press release:

Gilead has now delivered two years of consistent growth in our base business. In the third quarter, this continued growth was driven by both Virology and Oncology. Our clinical momentum also remains strong, and highlights this quarter included new data on Trodelvy with pembrolizumab in first-line metastatic non-small cell lung cancer. In Virology, we completed enrollment for Phase 3 trials of lenacapavir for HIV prevention and oral obeldesivir for COVID-19. We are looking forward to advancing these and other potential new options for patients over the coming months.

Through the first nine months ended September 30, Gilead hauled in $5.8 billion in operating cash flow and spent just $370 million in capital expenditures, good for free cash flow generation of ~$5.5 billion. Though free cash flow declined modestly from the same period a year ago, Gilead remains a strong free cash flow generator, supporting our fair value estimate. The company ended the third quarter with ~$5.7 billion in cash and ~$1.2 billion in marketable securities versus short-term debt of ~$1.8 billion and long-term debt of ~$23.2 billion, so it does hold a rather large net debt position.

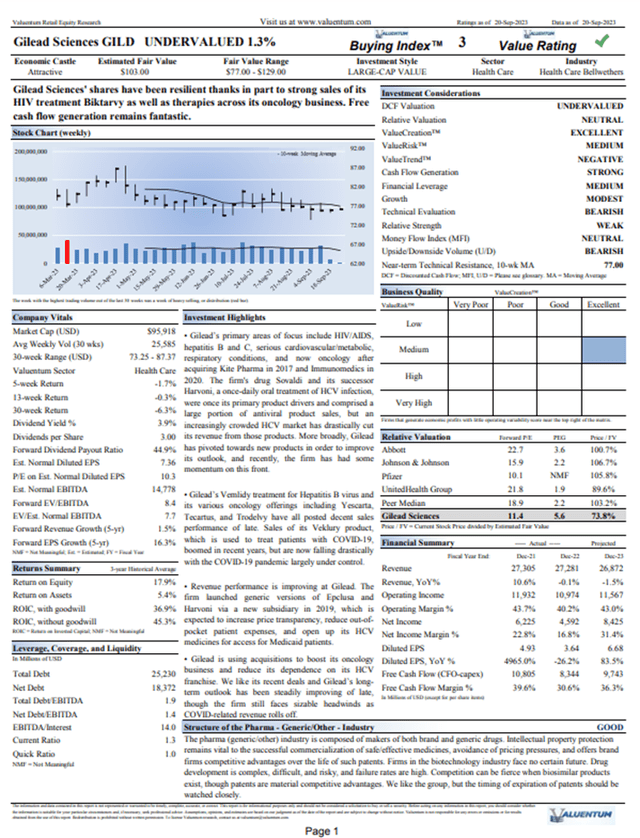

Please select the image below to download its 16-page stock report.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and range