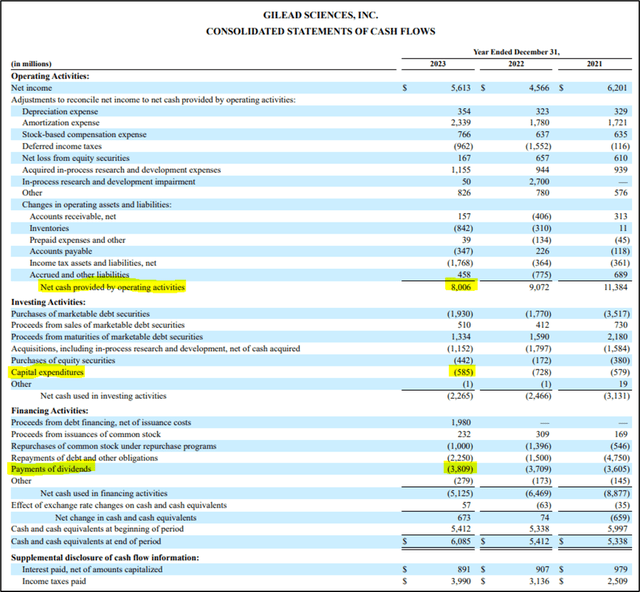

Image: Gilead’s coverage of its dividend with free cash flow remains rock-solid.

By Brian Nelson, CFA

On February 6, Gilead Sciences (GILD) reported mixed fourth-quarter results with revenue coming in better than expected, despite a decline, and non-GAAP earnings per share coming in a bit light relative to expectations. Our fair value estimate of Gilead Sciences stands at $96 per share, well above where they are currently trading, and Gilead’s 4%+ dividend yield is backed by a healthy Dividend Cushion ratio of 1.9.

The company’s fourth-quarter revenue fell 4% on a year-over-year basis as COVID-19 related sales faded as the world has largely moved past the global pandemic. The weakness in that area, however, was partially offset by higher oncology sales, an area that Gilead continues to look to capitalize on opportunities. Diluted earnings per share fell to $1.14 in the quarter from $1.30 in the same period a year ago. On a non-GAAP basis, earnings advanced to $1.72 per share from $1.67 in the same period last year.

In the press release, management was optimistic about its pipeline:

This was another strong year of revenue growth for Gilead’s base business, driven by both HIV and Oncology. The strength of the business provides a solid foundation as we enter a new catalyst-rich phase for the company. We are expecting several milestones in 2024, including updates on long-acting HIV prevention and treatment, Cell Therapy and Trodelvy.

Looking at its full year 2024 outlook, management expects total product sales to come in between $27.1-$27.5 billion and between $25.8-$26.2 billion, excluding Veklury. Excluding acquisition costs associated with its deal for CymaBay Therapeutics (CBAY), announced February 12, non-GAAP diluted earnings per share is targeted between $6.85-$7.25 per share. The CymaBay deal, however, will reduce that guidance range by roughly $3.35-$3.45 per share.

At the end of 2023, Gilead had $8.4 billion in cash and cash equivalents, while short-and long-term debt totaled ~$25 billion, so Gilead operates with a net debt position. Acquisitions such as its $4.3 billion deal for CymaBay Therapeutics may further add to its net debt stance, as Gilead looks to reinvigorate its pipeline.

What we like about Gilead is that the company remains a very strong free cash flow generator, with the measure coming in at $7.4 billion during 2023 versus dividend payments of $3.8 billion. On a free cash flow coverage basis, Gilead 4%+ dividend yield looks rock-solid, and for this, we think investors may be wise to get paid to wait for upcoming catalysts within Gilead’s HIV and oncology pipeline.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.