Image Source: Gilead

By Brian Nelson, CFA

Gilead Sciences (GILD) reported better than expected second quarter results on August 8. Total second quarter revenue increased 5% thanks to higher sales across its HIV, Liver Disease and Oncology portfolio, while non-GAAP diluted earnings per share came in at $2.01 in the second quarter of 2024, compared to $1.34 in the same quarter of 2023. Total product sales increased 6%, excluding its COVID-19-related treatment Veklury.

Management had the following to say about the quarter:

Gilead has had another strong quarter with 6% year-over-year growth in our base business. This was driven by sales of our therapies for HIV, Oncology and Liver Disease, including 8% growth for Biktarvy. One of the key highlights of the quarter was interim data from the Phase 3 PURPOSE 1 trial showing 100% efficacy for lenacapavir in HIV prevention for cisgender women. We look forward to additional clinical readouts in the coming months, and to potentially launching seladelpar for primary biliary cholangitis in the United States.

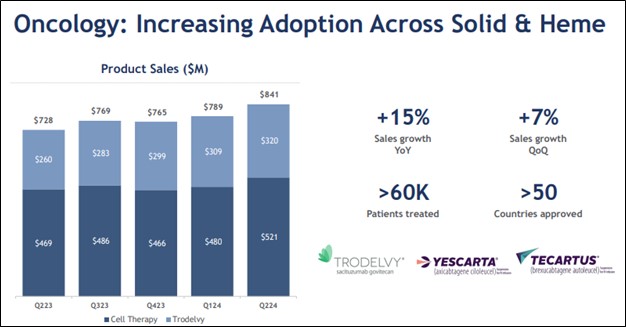

In the quarter, HIV product sales increased 3% led by Biktarvy, where sales increased 8%, to $3.2 billion, offset in part by sales weakness of Descovy, where sales dropped 6% due to lower average realized price. Revenue in its Liver Disease portfolio increased 17% as the firm experienced higher average realized price due to channel mix in the U.S. and higher demand in products for hepatitis C virus, hepatitis B virus, and hepatitis D virus. Cell Therapy product sales advanced 11% thanks to strength for Yescarta and Tecartus. Sales in its Oncology portfolio increased 15% in the quarter.

Looking to full-year 2024, Gilead expects total product sales of $27.1-$27.5 billion, unchanged from its prior outlook. Non-GAAP diluted earnings per share is now targeted in the range of $3.60-$3.90, compared to $3.45-$3.85 previously. At the end of the quarter, Gilead had $2.8 billion in cash and cash equivalents, which was down from the $8.4 billion mark as of the end of last year due to its $3.9 billion acquisition of CymaBay Therapeutics and a $1.75 billion repayment of senior notes. All told, we liked Gilead’s second quarter results and its raised non-GAAP earnings per share guidance. Shares yield 4.2% at the time of this writing.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.