Member LoginDividend CushionValue Trap |

Fourth Quarter Bank Earnings Roundup: MS, GS, BAC, C, WFC, JPM

publication date: Jan 28, 2021

|

author/source: Brian Nelson, CFA

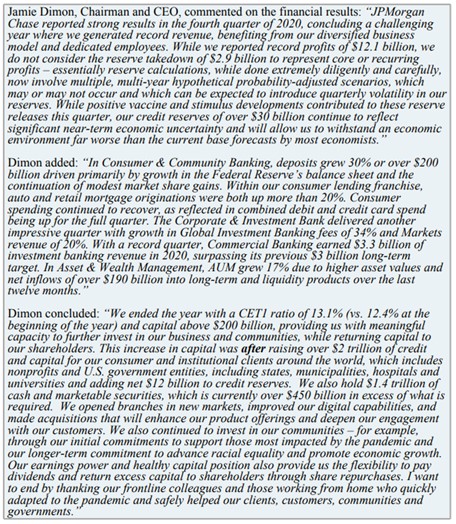

Executive Summary: Though we’re generally cautious on banking business models due to the arbitrary nature of cash-flow generation within the banking system and the difficulty in valuing such entities on the basis of a free-cash-flow-to-the firm framework, we like Morgan Stanley--and its return on tangible equity of 17.7% during the fourth quarter of 2020 speaks to solid economic-value creation. Goldman’s annualized return on total equity (ROTE) was an impressive 22.5% during its fourth quarter, helping drive the full-year measure to 11.1% for 2020. Bank of America had been an idea in the Best Ideas Newsletter portfolio in the past, but we removed the company June 11, 2020. We continue to view the banking system more as utility-like serving as an extension of the federal government, and as such, we generally don’t think they’ll be able to muster above-average returns in the longer-run. We still include diversified exposure to the financial sector in the Best Ideas Newsletter portfolio via the Financial Select Sector SPDR (XLF), but only for diversification purposes. Citigroup remains among our least favorite banking entities. Wells Fargo used to be a well-run bank, but consumer perception has certainly changed with its “fake account scandal” that cost it $3 billion to settle criminal and civil charges. JP Morgan's return metrics were solid like Morgan Stanley’s and Goldman’s, with return on equity (ROE) coming in at 19% and return on total common equity (ROTCE) coming in at 24% in the quarter. The banking system remains on stable ground. By Brian Nelson, CFA Morgan Stanley (MS) On January 20, Morgan Stanley (MS) reported fourth-quarter earnings that revealed revenue growth of 25.6%, and pre-tax income expansion north of 62%. Net income soared to $1.81 per share in the quarter, up from $1.30 in the year-ago period. Full year 2020 net revenue set a record of $48.2 billion compared with $41.4 billion in the year-ago period. Here’s what CEO James Gorman had to say in the press release: (Morgan Stanley) produced a very strong quarter and record full-year results, with excellent performance across all three businesses and geographies. I am extremely proud of how our employees came together to support each other and our communities and deliver for our clients in an incredibly challenging year. (Morgan Stanley’s) unique business model continues to serve us well as we further execute on our long-term strategy with the acquisitions of E*TRADE and Eaton Vance. We enter 2021 with significant momentum, and I am very confident in our competitive position and our opportunities for continued growth. Though we’re generally cautious on banking business models due to the arbitrary nature of cash-flow generation within the banking system and the difficulty in valuing such entities on the basis of a free-cash-flow-to-the firm framework, we like Morgan Stanley--and its return on tangible equity of 17.7% during the fourth quarter of 2020 speaks to solid economic-value creation. Shares trade at 1.64x tangible book equity and roughly in-line with our $65 per share fair value estimate. The bank yields ~2% at the time of this writing. Goldman Sachs (GS) On January 19, Goldman Sachs (GS) reported solid fourth-quarter performance that came in ahead of the consensus estimate for revenue and earnings. Net revenue advanced 17.9% in the period, while fourth-quarter GAAP earnings per share of $12.08 beat expectations by a sizable margin. Goldman’s annualized return on total equity (ROTE) was an impressive 22.5% during the fourth quarter, helping drive the full-year measure to 11.1% for 2020. Here’s what CEO David M. Solomon had to say about recent performance: It was a challenging year on many fronts, and I am deeply proud of how our people helped clients respond to the economic disruption brought on by the pandemic and the extreme market volatility experienced over the past months. Our people responded admirably to a series of professional and personal challenges, while working from home or in offices that were reshaped dramatically. Thanks to their perseverance, we were able to help clients navigate a difficult environment, and, as a result, achieved strong results across the franchise, while advancing our strategic priorities. We hope this year brings much needed stability and a respite from the pandemic, but we remain ready to handle a wide range of outcomes and are poised to meet the needs of our clients. Goldman’s book value per share stood at $236.15 at the end of the year, up 8.1% from last year’s mark. Shares are trading at ~$276 per share at the moment, implying a price-to-book ratio of 1.17x. The high end of our fair value estimate for Goldman Sachs stands at ~$270, just below where shares are trading, but we’re not going to pull the trigger on the company anytime soon. Goldman yields ~1.8% at the time of this writing. Bank of America Corp. (BAC) On January 19, Bank of America (BAC) reported fourth-quarter results that didn’t stack up favorably against the performance of its peers in this market environment. Revenue, net of interest expense, fell 10% in the quarter and pre-tax pre-provision income dropped to $6.2 billion from $9.1 billion, despite lower credit loss provisions. Diluted earnings per share fell to $0.59 in the period from $0.74 in the fourth quarter of 2019. Management remains positive, however. Here’s what CFO Paul Donofrio had to say in the press release: Despite one of the worst economic environments in modern memory, we ended the year stronger than before the health crisis and well positioned to support our clients. We grew deposits by $361 billion, improved our capital ratios and increased liquidity to record levels, exceeding loans. Because of the responsible way we have operated the company over many years, we were able to support the economy by raising $772 billion in capital on behalf of clients, invest in our franchise and still be in a position to return $4.8 billion in capital to our shareholders in the first quarter of 2021 in the form of common stock repurchases and dividends. Bank of America had been an idea in the Dividend Growth Newsletter portfolio in the past, but we removed the company June 11, 2020. We continue to view the banking system more as utility-like serving as an extension of the federal government, and as such, we generally don’t think they’ll be able to muster above-average returns in the longer-run. We still include diversified exposure to the financial sector in the Best Ideas Newsletter portfolio via the Financial Select Sector SPDR (XLF), but only for diversification purposes. That said, our fair value estimate for Bank of America stands at $35 per share, comfortably above where shares are trading, but fundamentals at the bank just aren’t as attractive as we had once hoped. Its yield stands at ~2.4%. Citigroup Inc. (C) As with Bank of America, Citigroup (C) didn’t quite fare as well as its peers during the fourth quarter, results released January 15. Revenue dropped to $16.5 billion in the period from $18.4 billion in the prior-year quarter and net income per share fell to $2.08 from $2.15 per share. Citigroup remains among our least favorite banking entities. CEO Michael Corbat had a lot to say about performance during 2020 in the press release: We ended a tumultuous year with a strong fourth quarter. As a sign of the strength and durability of our diversified franchise, our revenues were flat to 2019, despite the massive economic impact of COVID-19. For the year, we generated $11 billion in net income despite our credit reserves increasing by $10 billion as a result of the pandemic and the impact of CECL. We remain very well capitalized with robust liquidity to serve our clients. Our CET 1 ratio increased to 11.8%, well above our regulatory minimum of 10%. Our Tangible Book Value per share increased to $73.83, up 5% from a year ago. Given the Federal Reserve decision regarding share repurchases as we have excess capital we can return to shareholders, we plan to resume buybacks during the current quarter. Looking back, I am proud of the progress the firm has made since I became CEO. We have streamlined our consumer business and embraced the shift to digital so we can serve our clients the way they want to be served. We have re-established Citi as a go-to bank for our institutional clients through our global network. Before the pandemic slowed our progress, we had steadily improved our returns and dramatically increased the return of capital to our shareholders. Notably, we went from having a one penny dividend to returning over $85 billion in capital since 2013 and we have reduced our share-count by 30%. Jane has a great foundation to build upon and I am certain great things are in store for Citi and all its stakeholders. Citigroup yields ~3.4% at the time of this writing, but we don’t view it as a particularly strong dividend payer (that’s likely why the market assigns it a higher yield than its rivals, too – more risk to the payout). Our fair value estimate of the bank stands at $50 per share, well below the $60 mark where shares are currently trading. Return on average common equity came in at just 5.9% during 2020, suggesting ongoing value-destruction at the bank, justifying a fair value estimate below its tangible book value of $73.83 per share. Citigroup continues to struggle. Wells Fargo (WFC) Wells Fargo (WFC) reported fourth-quarter results January 15 that were roughly in-line with what we were expecting. However, as with Bank of America and Citigroup, revenue fell in the period, but the bank managed to drive diluted earnings per share a bit higher, to $0.64 (better than consensus expectations). The modest improvement in the bottom line, however, was driven more by a reversal in credit loss provisioning. This, however, still failed to drive return on equity (ROE) and return on total common equity (ROTCE) to solid double-digit levels, with both coming in at just 6.4% and 7.7% in the quarter, respectively. While Morgan Stanley and Goldman put up double-digit returns during the period, Wells continues to struggle to put some of its past pitfalls behind it. Here’s what CEO Charlie Scharf had to say in the press release: Although our financial performance improved and we earned $3.0 billion in the fourth quarter, our results continued to be impacted by the unprecedented operating environment and the required work to put our substantial legacy issues behind us. Our agenda is clear and we are making progress. We have prioritized and are moving forward on our risk and control buildout – the recently terminated BSA/AML consent order is just one of many, but it is an important step forward; we have a new management team in place; the disciplines we use to manage the company are completely different than one year ago; we have clarified our strategic priorities and are exiting certain non-strategic businesses; and we have identified and are implementing a series of actions to improve our financial performance. With a more consistent broad-based recovery and as we continue to press forward with our agenda, we expect you will see that this franchise is capable of much more. Wells Fargo used to be a well-run bank, but consumer perception has certainly changed with its “fake account scandal” that cost it $3 billion to settle criminal and civil charges. We don’t like Wells’ corporate governance history, and while we note the bank is working to right the ship, we’re not fans of the banking sector, itself, let alone a bank that has not treated its customers right. Shares yield a modest ~1.3%, and our fair value estimate of $25 per share rests below its share price of ~$31 at the time of this writing. J.P. Morgan (JPM) J.P. Morgan (JPM) reported fourth-quarter results January 15 that came in better than expected thanks largely to a reversal of credit costs. The bank’s return metrics were solid like Morgan Stanley’s and Goldman’s, with return on equity (ROE) coming in at 19% and return on total common equity (ROTCE) coming in at 24% in the quarter. CEO Jamie Dimon had a lot to say about recent performance, which we show in the image that follows.

Image Source: JP Morgan’s fourth-quarter earnings press release. It’s hard not to like a company with CEO Jamie Dimon at the helm, but our fair value estimate of JP Morgan stands at $120 per share (below where shares are trading hands at the time of this writing), so we don’t think it is a bargain at current levels. That said, the bank yields ~2.8%, which may be attractive to some investors given its fortress balance sheet. Regardless of the income opportunity present, JP Morgan remains one of the strongest of the Big 6 banks, in our view, and while other banks may be struggling to keep up, the banking sector as a whole remains healthy, especially considering what could have happened had the Fed and Treasury not stepped in to calm the markets during the COVID-19 crisis in February/March 2020. ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson doesn't own any of the securities mentioned in this article. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment