Image Source: Ford

By Brian Nelson, CFA

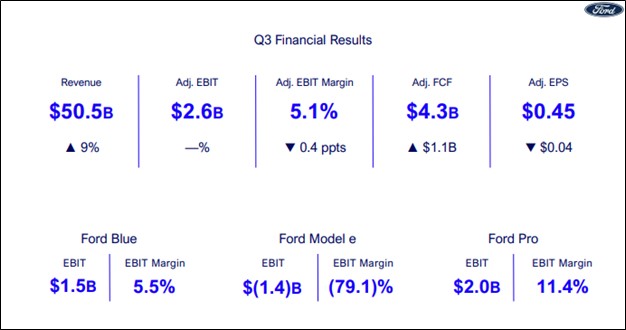

On October 23, Ford (F) reported better than expected third quarter results. In the quarter, revenue hit a record $50.5 billion (up 9% year-over-year), net income was $2.4 billion (up from $0.9 billion in the year-ago period), while adjusted EBIT came in at $2.6 billion (flat compared to last year’s quarter), inclusive of $0.7 billion of adverse net tariff-related impacts. Operating cash flow was $7.4 billion (up from $5.5 billion last year), with adjusted free cash flow coming in at $4.3 billion, up from $3.2 billion in last year’s quarter. Adjusted diluted earnings per share was $0.45, down from $0.49 in the same period a year ago, but $0.09 better than expectations.

Management had the following to say about the results:

Ford posted another strong quarter, delivering more than $50 billion in revenue powered by our incredible products and services, the durability of Ford Pro and our disciplined focus on cost and quality. We are heading into 2026 as a stronger and more agile company. We will continue to focus on execution and on quickly making the right strategic calls on propulsion, partnerships and technology that will create tremendous value for our customers.

The strength of our underlying business was evident in our third quarter results. Adjusting for tariffs, year-over-year adjusted EBIT improved by $0.7 billion. Ford is determined to become higher-growth, higher-margin, more capital efficient and durable as we deliver great products, software and physical services to customers around the world.

Looking to full-year 2025, Ford noted that its business is performing at the high end of the guidance range previously outlined in February, despite absorbing a $1 billion net tariff headwind. It also said that between 2025 and 2026, Ford expects the Novelis fire to be a headwind of $1.0 billion or less. Ford now expects full-year 2025 company adjusted EBIT of $6-$6.5 billion, adjusted free cash flow of $2-$3 billion and capital expenditures of ~$9 billion. Ford is working to navigate the Novelis fire impact as well as tariff headwinds, but record revenue speaks to resilience. Ford yields 4.3% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.