Image Source: FedEx

By Brian Nelson, CFA

On June 25, FedEx (FDX) reported better than expected fourth quarter results for fiscal 2024. Revenue advanced 0.9% on a year-over-year basis in the fourth quarter, while adjusted operating income expanded to $1.87 billion from $1.77 billion in the same period a year ago. Net income increased to $1.34 billion in the fiscal fourth quarter from $1.25 billion in last year’s quarter. Adjusted diluted earnings per share came in at $5.41, up from $4.94 in the same period a year ago.

Management had the following to say about the quarterly performance:

We made significant progress in fiscal 2024 and ended the year strong, delivering four consecutive quarters of expanding operating income and margin in a challenging revenue environment. These results are unprecedented in this current environment, reflecting our continued execution of our DRIVE initiatives and our resolve to transform FedEx while we deliver outstanding service to our customers. We expect this momentum to continue in fiscal 2025 as we advance our efforts to create the world’s most flexible, efficient, and intelligent network.

During fiscal 2024, the logistics giant returned roughly $3.8 billion to shareholders, with $2.5 billion coming from stock buybacks and the balance from dividend payments. At the end of May, FedEx had $5.1 billion still authorized on its buyback program, and management expects to repurchase $2.5 billion in stock during fiscal 2025.

Image Source: FedEx

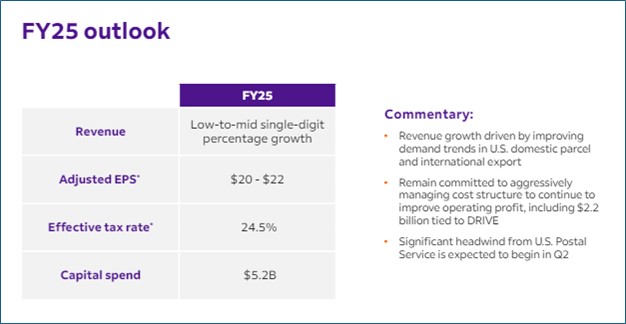

Looking to all of fiscal 2025, FedEx forecasts low-to-mid single-digit percent revenue growth on the year, with earnings expected in the range of $20-$22 before mark-to-market (MTM) retirement plans accounting adjustments and excluding costs associated with its business optimization initiatives. Consensus expectations were for the company to earn $20.75 on the year.

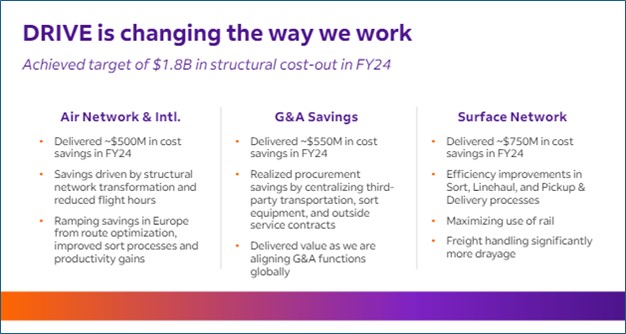

FedEx continues to execute on its DRIVE program, and the firm’s fiscal fourth quarter results showed that performance is improving as a result. FedEx Ground benefitted from its DRIVE initiatives, while FedEx Freight was helped by higher yields and better cost management. FedEx Express faced weaker results due to lower international yields, however. The company continues to focus on becoming more efficient, closing facilities as well as retiring inefficient aircraft. Shares yield ~2.1% at the time of this writing.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.