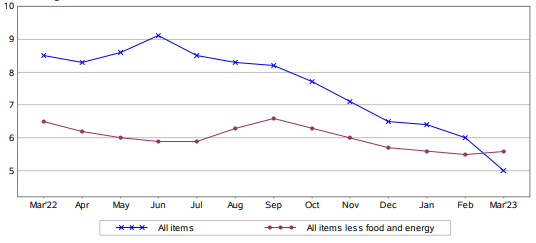

Image: CPI-U, not seasonally adjusted. The 12-month percent change in the pace of inflation for all items has fallen from north of 9% in June 2022 to 5% in March 2023. Image Source: BLS

By Brian Nelson, CFA

The Bureau of Labor Statistics (BLS) released the Consumer Price Index for All Urban Consumers (CPI-U) on April 12, and it showed that the Fed is winning its fight against inflation. The CPI-U rose just 0.1% in March on a seasonally adjusted basis, down 0.3 percentage points from the increase in February. During the past 12 months, the all-items index has advanced 5.0% before any seasonal adjustments, a level that is still higher than the Fed’s long-term target, but not one indicative of runaway inflation or a worsening of the strain on consumer budgets. Though the news is but one data point that will influence the Fed’s rate decision next meeting, we’re viewing the news positively.

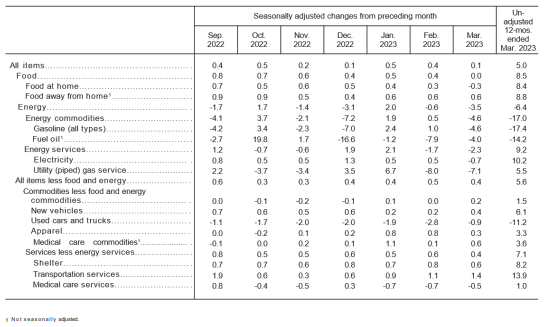

Image Source: BLS

Items showing declining prices during March 2023 on a seasonally-adjusted sequential basis were food-at-home (-0.3%), gasoline (-4.6%), fuel oil (-4.0%), utility (piped) gas service (-7.1%), used cars and trucks (-0.9%), and medical care services (-0.5%). We especially liked that the food-at-home index fell during the period, which marked the first decline since September 2020 and an easing that should help consumer sentiment and take some pressure off budgets. Prices for meats, poultry, fish, and eggs fell 1.4% in March, while egg prices fell a welcome 10.9%. As we witnessed more recently with General Mills’ (GIS) most recent report, however, prices for cereal and bakery products continue to advance, as elasticities remain positive for such producers.

The market’s focus on inflation is two-fold. First, inflation has a direct impact on (and is embedded within) the 10-year Treasury rate, which is used in benchmark pricing for both stocks and bonds. The higher the rate of expected inflation, the higher the 10-year Treasury rate, the higher the discount rate in equity valuation models, and the lower the prices for stocks, all else equal. Bond prices are also inversely related to inflation and interest rates, as in the event of higher inflation and higher interest rates, bond prices generally have to fall in order to offer the equivalent higher prevailing yield, all else equal. Second, with higher inflationary pressures, corporate margins tend to get squeezed as input costs from labor to freight to commodities and beyond tend to advance at a faster pace than most companies can raise prices.

The first reason–movements in the 10-year Treasury rate–is the big driver behind stock prices these days, while the second reason–the impact of rising input prices on margins–is the big reason why earnings are expected to fall meaningfully during the first quarter of 2023. The Fed seems to be winning the battle against inflation, however, and with the regional banking system now against the ropes due to massive held-to-maturity (HTM) unrealized loan losses, implicit credit tightening across the economy has likely ensued even beyond the rate hikes already completed by the Fed. At its next meeting, the Fed will have to consider all of this and more, but for now, we’re viewing the March CPI report as a good one, which could pave the way for a further advance in the equity markets.

Tickerized for GIS, CHWY, SJM, XLP, CPB, PG, K, PG, FRPT, BRBR, SOVO, MDLZ, HSY, BYND, HAIN, HRL, TSN, DONOY, DOLE, MKC, WMT, COST, BJ, TGT, KR, ACI, GO, PBJ, THS, STKL, LW, WEST, MGPI, POST, LWAY, LANC, BRID, CELH, COCO, PEP, FIZZ, SFM, KO, CALM

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.