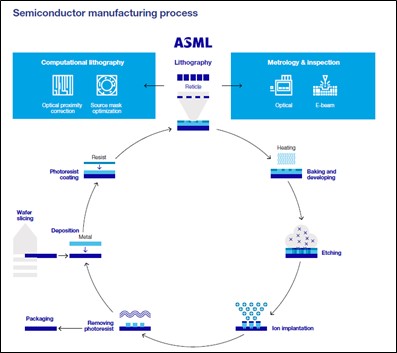

Image Shown: How ASML Holding Inc’s photolithography systems are used to produce semiconductor components, including the most cutting edge “chips” along with more mature semiconductor components. Image Source: ASML Holding Inc – Fiscal 2021 Annual Report

By Callum Turcan

The maker of advanced photolithography systems that are used to produce the most cutting edge semiconductor components or “chips” is the Dutch firm ASML Holding NV (ASML). It has a virtual monopoly at the high-end of this market due to its technological prowess in this space and focus on R&D. The firm also produces photolithography systems to make more mature chips and offers services that are primarily geared towards its installed systems base. ASML Holding reported first quarter earnings for fiscal 2022 (period ended April 3, 2022) on April 20 that beat both consensus top- and bottom-line estimates and its order backlog remains robust.

We include ASML Holding as an idea in the ESG Newsletter portfolio and view its capital appreciation upside quite favorably. The company’s semi-annual dividend program (paid out in Euros) offers incremental income growth upside for investors with shares of ASML yielding a modest ~0.6% as of this writing. ASML Holding complies with rigorous ESG investing practices with our propertiary scoring system assigning an ESG rating of 94 (on a scale of 1-100, with 100 being the best).

For some background before we dig in, ASML Holding reports its financial performance in accordance with U.S. GAAP accounting practices and in Euros. Please note that we periodically provide updates on ASML Holding’s fair value estimate via our webinars (contact Valuentum for more information).

Earnings Update

In the first quarter of this fiscal year, ASML Holding reported €3.5 billion in GAAP net sales (at the high-end of its internal guidance) after selling 59 new photolithography systems and three used photolithography systems. ASML Holding’s GAAP gross margin stood at 49.0% last fiscal quarter, which was weighed down in part by inflationary pressures (rising fuel costs are driving up transportation expenses and labor expenses are on the rise as well) and supply chain hurdles (keeping the Ukraine-Russia crisis and how that is impacting air travel routes in mind) according to recent management commentary. That gross margin performance was still within its internal guidance.

As an aside, the firm refurbishes older systems, which helps it comply with ESG investing practices and makes good money in the process doing so, though most of its business is geared towards selling new systems and servicing its installed systems base.

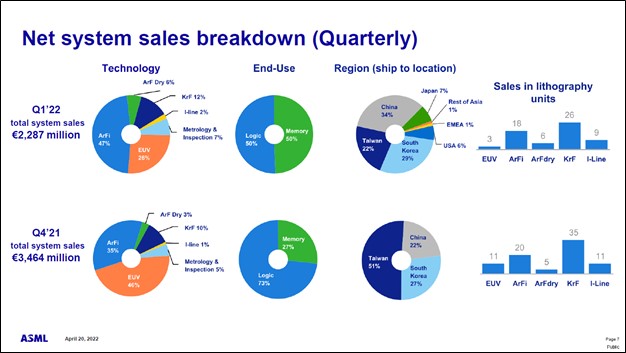

Image Shown: Most of ASML Holding’s business involves shipping systems and providing services to customers in Taiwan, China, and South Korea though that could change over time as the US, Europe, and Japan intend to bulk up their semiconductor supply chains. Image Source: ASML Holding – First Quarter of Fiscal 2022 IR Earnings Presentation

Please note that year-over-year comparisons are “noisy” as ASML Holding shipped new photolithography systems to its customers as fast as possible last fiscal quarter to stay ahead of supply chain hurdles and has yet to book those as sales as of the end of the first quarter of fiscal 2022. ASML Holding did not book these shipments as sales due to the need to complete testing and final certification activities.

For that reason, ASML Holding’s GAAP net sales and net income declined year-over-year last fiscal quarter, though that is not reflective of underlying demand for its offerings. According to management commentary during ASML Holding’s latest earnings call, the firm shipped nine of its cutting edge extreme ultraviolet (‘EUV’) systems and recognized revenues from three of those systems in the fiscal first quarter. The company also recorded €7.0 billion in net bookings the last fiscal quarter.

According to management commentary provided during ASML Holding’s first quarter of fiscal 2022 earnings call, the firm has a backlog of approximately €29 billion which was an all-time high. Additionally, ASML Holding forecasts that it will generate 20% annual revenue growth in fiscal 2022 and that “does not include the full shipment value of systems out for this year due to a number of fast shipments, which will result in a delayed revenue into [fiscal] 2023.” The firm also noted that “(it is) running at maximum capacity and expect(s) demand to exceed supply well into next year,” which highlights the incredible demand for ASML Holding’s offerings.

In terms of its margin performance, management expects ASML Holding’s full fiscal year gross margin to come in around ~52% due to its strong expected performance during the second half of fiscal 2022. Growth at its installed systems base is expected to drive its field option and service revenues significantly higher this fiscal year. Management expects the firm to spend around ~14% of its annual revenues in fiscal 2022 on R&D expenses.

ASML Holding is guiding to generate €5.1-€5.3 billion in net sales with a gross margin of 49.0%-50.0% in the second fiscal quarter. That includes an expected €1.2 billion in net sales from ‘Installed Base Management’ activities (net service and field option sales) and excludes €0.8 billion in net sales associated with “fast shipments to subsequent quarters,” which means the shipment of photolithography systems that have yet to be fully tested (and thus booked as revenue).

Very Shareholder Friendly

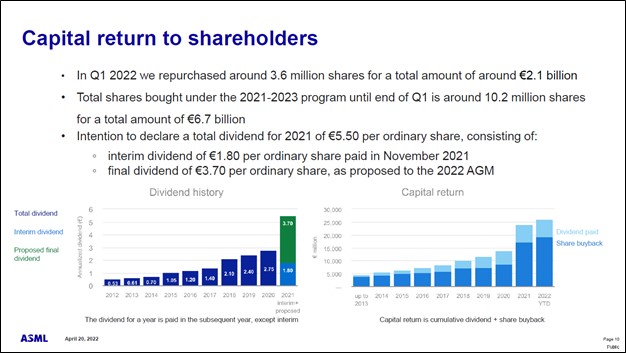

The company exited the fiscal first quarter with €0.8 billion in net cash on hand, though as ASML Holding did not break down its current liabilities line item, that does not include potential short-term debt considerations. In any event, we are pleased that ASML Holding’s underlying business put up strong performance last fiscal quarter. ASML Holding has been steadily buying back its stock of late and should continue to do so going forward, activities made possible by its strong balance sheet and on a full fiscal year basis, strong free cash flow generating abilities.

In fiscal 2021, ASML Holding generated €9.9 billion in free cash flow which was up sharply from its performance in fiscal 2019-2020 when it generated ~€3.1 billion in free cash flow on average per fiscal year. ASML Holding spent €1.4 billion covering its dividend obligations and €8.6 billion buying back its stock in fiscal 2021.

Image Shown: ASML Holding is very shareholder friendly. Image Source: ASML Holding – First Quarter of Fiscal 2022 IR Earnings Presentation

Longer Term Guidance

What really stood out in ASML Holding’s latest earnings update is management’s commentary regarding the longer term guidance the firm put out during its September 2021 Investor Day event. For reference, the firm guided to generate annual revenues of approximately €24-€30 billion and a gross margin of approximately 54%-56% by (likely fiscal) 2025 and noted that there would be substantial growth opportunities after this period as well. In fiscal 2021, ASML Holding generated €18.6 billion in GAAP net sales and a GAAP gross margin of 52.7%. ASML Holding sees room for 11% annual revenue growth from (likely fiscal) 2020-2030.

ASML Holding is now “looking at [the] feasibility of further increasing (its) capacity beyond what we presented during (its) September 2021 Investor Day” event according to its latest earnings presentation. This is primarily due to strong demand for its offerings and the various secular tailwinds supporting demand growth for high-end chips and thus its most advanced photolithography systems (along with mature chips and its older offerings as well). Again, we would like to stress that at the high-end of the photolithography systems market, ASML Holding has a virtual monopoly.

Furthermore, “in light of the demand and our plans to increase capacity, we expect to revisit our scenarios for 2025 and growth opportunities beyond. We plan to communicate updates in the second half of the year” according to ASML Holding’s latest earnings presentation. We are excited by the potential that the firm will announce an upward revision to its longer term guidance.

The US, Europe, and Japan along with other nations have made securing their national supply chains a priority in the wake of the coronavirus (‘COVID-19’) pandemic. For ASML Holding, that means that its growth runway is set to expand substantially as new semiconductor fabrication sites are built out in these markets. Here is some key commentary from management on this issue from ASML Holding’s latest earnings conference call (emphasis added):

“With multiple countries pursuing technological sovereignty, we are now seeing a number of announcements from customers for new fabs in the coming years in support of this global trend. These announced investments are expected to have a positive impact on the medium-term demand.

As this unprecedented demand is exceeding our capacity, ASML and its supply chain partners are planning to actively add capacity to meet future customer demand as communicated during Investor Day last year. But at that time, we talked about the current capacity ramp is expected to deliver an output capability of over 70 EUV, 0.33 NA systems and around 375 deep UV systems by 2025. As mentioned last quarter, we see a need to further increase our output beyond this level in order to meet the stronger and longer market demand to support an industry that is expected to at least double by 2030.

With the goal of adding more capacity, we’re investigating the feasibility of increasing our annual capacity by 2025 and to around 90 EUV 0.33 NA systems and 600 deep UV systems… We’re also discussing with our supply chain partners to secure a capacity of around 20 EUV 0.55 High-NA systems in the medium term. Bear in mind that this translates to what we currently feel our maximum capacity goal should be and may therefore not be a final output plan.” — Peter Wennink, President and CEO of ASML Holding

ASML Holding’s longer term growth ambitions need to be updated to reflect expectations that demand will keep outstripping supply for its photolithography systems over the coming years, and that is not the worst problem to have.

Concluding Thoughts

We continue to be enormous fans of ASML Holding and like the firm as an idea in the ESG Newsletter portfolio. Shares of ASML moved higher during regular trading hours on April 20 as investors cheered its improving longer term growth trajectory. In our view, we are still in the early innings of ASML Holding’s immense growth story. ASML Holding is incredibly shareholder friendly and backed up by a rock-solid balance sheet and impressive free cash flow generating abilities, offering investors ample capital appreciation upside that also complies with rigorous ESG investing standards.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Related: SONY, SSNLF, EWT, TWN, EWJ, EWY, KORU, FLKR. Tickerized for holdings in the SMH.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long DIS and FB call options. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.