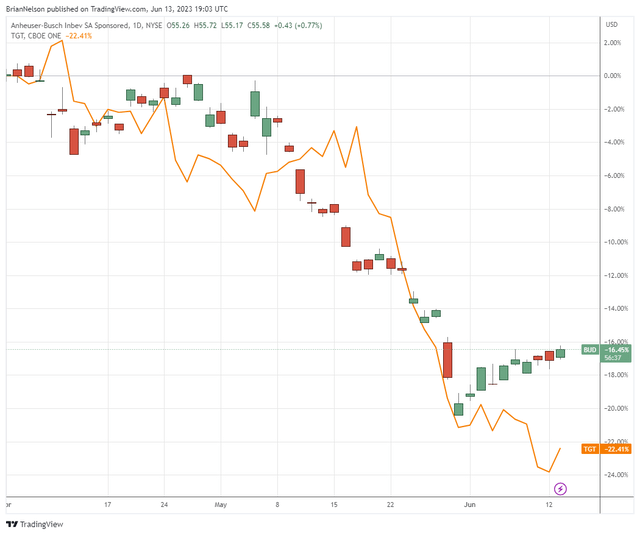

Image: Shares of Anheuser-Busch Inbev (BUD) and Target (TGT) have fallen 16%+ and 22%+, respectively, since the beginning of April.

By Brian Nelson, CFA

When it comes to investing, Environmental [E], Social [S], and Governance [G] considerations are an absolute must. If a company pollutes the environment, shareholders suffer as the stock reels from fines and other liabilities. If a company doesn’t treat its workers and customers well, its culture will suffer and so eventually will its service and profits. If the company’s corporate oversight is not at or approaching best practices, wrongdoing at the top becomes much more likely. Whether investors pursue ESG investing outright, or assess such considerations indirectly outside the ESG context, the core components of ESG remain critical for investors.

That said, according to a blurb from Seeking Alpha, so far in 2023, capital has been moving away from ESG investing and many ETFs focused on this type of investing have closed (e.g. RBND, RDMX, REMG, IVLC). Based on data provided by Seeking Alpha, seven popular ESG focused ETFs have collectively witnessed negative fund flows to the tune of ~$8.35 billion through the first 5-6 months of 2023 so far. Most of the outflows can be attributed to giant iShares ESG MSCI USA ETF (ESGU), which had ~$14.1 billion in net assets as of mid-June, but the trend nonetheless endures. Anti-ESG ETFs such as the anti-ESG ETF B.A.D. (BAD), which targets stocks in the “sin” space, has even attracted new capital this year, according to Seeking Alpha. The ETF, however, remains a fraction of the size of its larger pro-ESG rivals.

Executives understand the importance of ESG investing, but they have also taken a step back in emphasizing it during their conference calls. According to the same blurb by Seeking Alpha referencing FactSet data, the number of companies citing the term ‘ESG’ on conference calls has steadily fallen in recent quarters and stands at about half of its peak during late 2021. We think the weak year of equity-price performance during 2022 is one of the reasons why top brass is now putting strategic and financial initiatives front and center on investor calls, but there may be another reason for the fade in ESG as a top focus.

For starters, the fallouts at Anheuser-Busch InBev (BUD) and Target (TGT) may have some executives reassessing the risk-reward of the various ways to drive brand awareness and growth to serve their customers. Many may even feel as though they are walking a tightrope with their marketing initiatives these days. As the share prices of BUD and TGT have recently shown (see image above), the consumer backlash for any marketing missteps could be disastrous. Target has taken flak for first promoting Pride merchandise and then relocating it or removing it at its stores, while Anheuser-Busch Inbev’s brand Bud Light is suffering over boycotts stemming from a promotion with a trans influencer.

ESG investing is facing numerous challenges during 2023 as investors look to reallocate funds to other areas, including higher-yielding bonds and AI-levered big cap tech. Social dynamics have also become increasingly more difficult to navigate as companies seek to extend their brands, and the missteps at BUD and TGT mean that C-suites have to pay more attention to how they incorporate social issues into their messaging than ever before. Regardless of the weak fund flows at ESG-focused financial instruments during 2023, the concepts embedded within ESG remain absolutely critical to an investor’s success.

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

———-

Tickerized for ESGU, BAD, BUD, TGT, RBND, RDMX, REMG, IVLC

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.