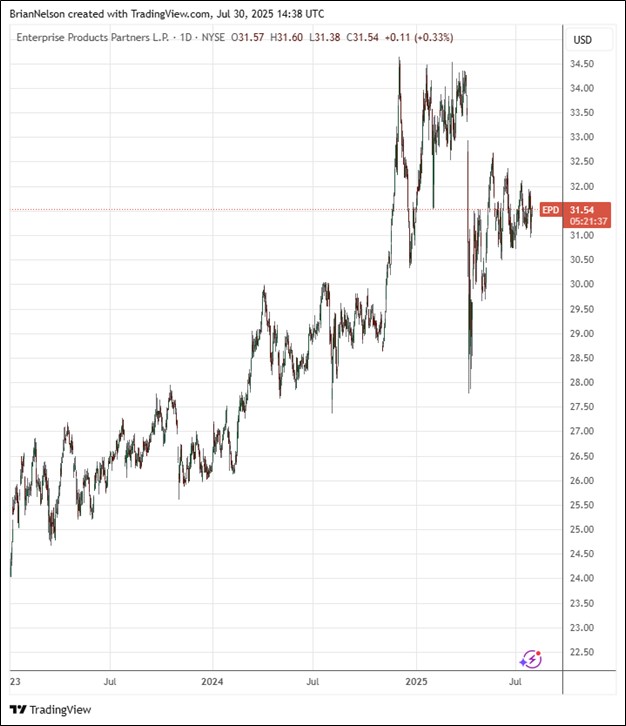

Image Source: TradingView

By Brian Nelson, CFA

On July 28, Enterprise Products Partners (EPD) reported mixed second quarter results with revenue missing the consensus forecast, but GAAP earnings per share edging out what the Street was looking for. Enterprise reported net income of $1.4 billion and $0.66 per common unit, an increase of 3% compared to $0.64 per common unit in the second quarter of 2024. Distributable cash flow (DCF) was $1.9 billion in the second quarter, up 7% from the same period a year ago, and provided 1.6x coverage of the distribution declared for the second quarter of this year.

Management had a lot to say about the results:

In a seasonally weaker quarter challenged with macroeconomic, geopolitical, and commodity price headwinds, Enterprise reported solid earnings and cash flow. Our assets continued to perform setting five new operating records. Notably, driven by the Permian and Haynesville Basins, we reported record natural gas processing plant inlet volumes of 7.8 Bcf/d, record natural gas pipeline volumes of 20.4 TBtus/d, and record crude oil pipeline volumes of 2.6 million BPD. Additionally, our refined products and petrochemical pipelines had record volumes of 1.0 million BPD.

The performance of our fee-based assets and natural gas marketing more than offset lower earnings in our crude oil marketing businesses and the effect of lower commodity prices and margins on our natural gas processing and octane enhancement activities…

… We are excited for the opportunities the second half of 2025 is poised to present with approximately $6 billion of our organic growth capital projects slated to enter commercial service. This includes a significant expansion of our natural gas processing infrastructure in the Permian Basin with the recent commissioning of two new 300 MMcf/d processing facilities. With the addition of Mentone West 1, Enterprise now has the capacity to process over 2.5 Bcf/d of natural gas and extract more than 330 MBPD of NGLs in the Delaware Basin. With the addition of Orion, we now have the capacity to process 1.9 Bcf/d of natural gas and extract more than 270 MBPD of NGLs in the Midland Basin. Enterprise’s continued investment in natural gas processing infrastructure supports our producer customers’ needs and brings additional volume into our highly integrated NGL value chain.

Further downstream, we are beginning service at the Neches River Terminal (“NRT”) in Orange County, Texas. The NRT dock and a 120 MBPD ethane refrigeration train were commissioned in mid-July, enabling loading operations at Phase 1 of this major project. The successful commercialization of the NRT facility reflects the robust growing global demand for U.S. hydrocarbons and highlights Enterprise’s ability to quickly and economically expand its footprint to meet the needs of international markets. Finally, we look forward to the upcoming commissioning of Frac 14 and the Bahia pipeline in the fourth quarter of this year,

In the second quarter, Enterprise Products Partners’ adjusted cash flow from operations was $2.1 billion, and it was $8.6 billion for the twelve months ended June 30. The pipeline giant bought back roughly $110 million of its common units on the open market in the second quarter of 2025. Enterprise paid out 57% of its adjusted cash flow from operations as distributions and common unit buybacks for the twelve months ended June 30. Total capital investments were $1.3 billion in the second quarter of 2025, while total debt principal outstanding was $33.1 billion at the end of the quarter. Enterprise had consolidated liquidity of $5.1 billion as of June 30. Enterprise remains a holding in the High Yield Dividend Newsletter portfolio, and we continue to like its DCF coverage of the distribution. Shares yield 6.9% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.