Image: Energy Transfer covered its distributions with traditional free cash flow in 2023, and the company offers investors an elevated distribution yield.

By Brian Nelson, CFA

Energy Transfer (ET) reported mixed fourth-quarter results on February 14, but the company’s traditional free cash flow metrics continue to hold up well, providing support to its lofty distribution. Years ago, pipeline entities were spending much more than they reasonably could to be able to sustain their distributions at prior levels, and many have readjusted both their capital spending trajectories as well as their distributions over the years. These days, pipeline entities such as Energy Transfer, with their geographically diversified portfolio of assets, are in much better shape to sustain their payouts. Units of Energy Transfer yield ~8.7% at the time of this writing.

Pipeline players operate toll-road-type business models reaping fees on the volumes that flow through their networks, and things have been looking good in this department of late. For example, in the fourth quarter, Energy Transfer’s natural gas liquids (NGL) fractional volumes increased 16%, which set a new record for the partnership. NGL transportation volumes also set a record in the period, up 10% on a year-over-year basis, while NGL exports and interstate natural gas transportation volumes advanced 13% and 5%, respectively. Midstream gathered volumes increased 5% in the period, while crude oil transportation and terminal volumes leapt 39% and 16%, respectively, in the last quarter of 2023.

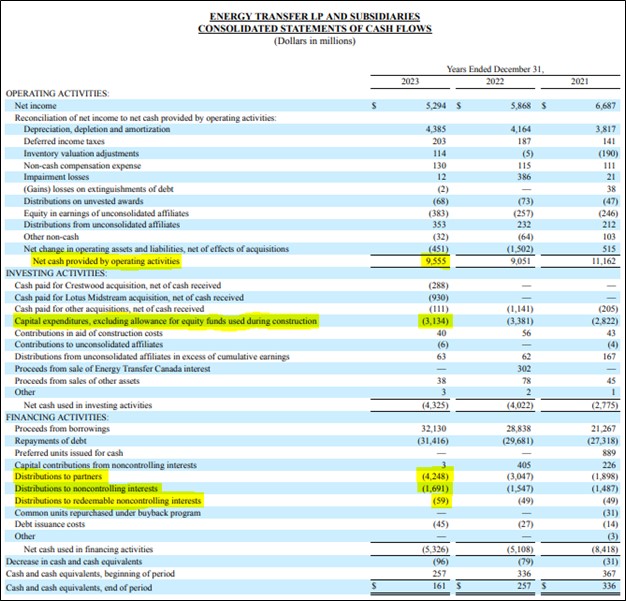

For the fourth quarter, Energy Transfer’s net income increased $172 million, to $1.33 billion, while adjusted EBITDA advanced $165 million, to $3.6 billion. Distributable cash flow increased to $2.03 billion in the fourth quarter versus $1.91 billion in the same period a year ago. For 2023, Energy Transfer generated ~$9.56 billion in cash flow from operations and spent ~$3.13 billion in capital spending, resulting in traditional free cash generation of ~$6.42 billion in the year. Distributions to partners, noncontrolling interests, and redeemable noncontrolling interests totaled ~$6 billion, so Energy Transfer covered its payout obligations with traditional free cash flow by a nice margin during 2023.

Looking out to all of 2024, Energy Transfer is targeting adjusted EBITDA in the range of $14.5-$14.8 billion, which is 7% higher than the adjusted EBITDA mark of $13.7 billion it achieved in 2023. Total capital spending is targeted at $3.35 billion for 2023 at the midpoint, with roughly $835-$865 million expected as maintenance capital spending and the balance growth spending. With adjusted EBITDA expected to expand nicely in 2024, cash flow from operations should follow suit on the year, and the company’s capital spending isn’t too high, where we expect Energy Transfer to cover distributions with free cash flow again in 2024.

In January 2024, Energy Transfer raised its payout 3.3%, to $1.26 per unit on an annualized basis, and we would not be surprised to see another similar increase come next year. Though Energy Transfer retains a massive net debt position of $52.2 billion at the end of 2023, its coverage of its distribution with traditional free cash flow makes it a worthy consideration for income-oriented investors, in our view. Midstream entities have come a long way since the middle of last decade when traditional free cash flow was consistently short of cash distributions paid, and Energy Transfer is doing much better. With a forward estimated distribution yield of ~8.7%, Energy Transfer is one for your radar.

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

———-

Tickerized for ET, SUN, USAC

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.