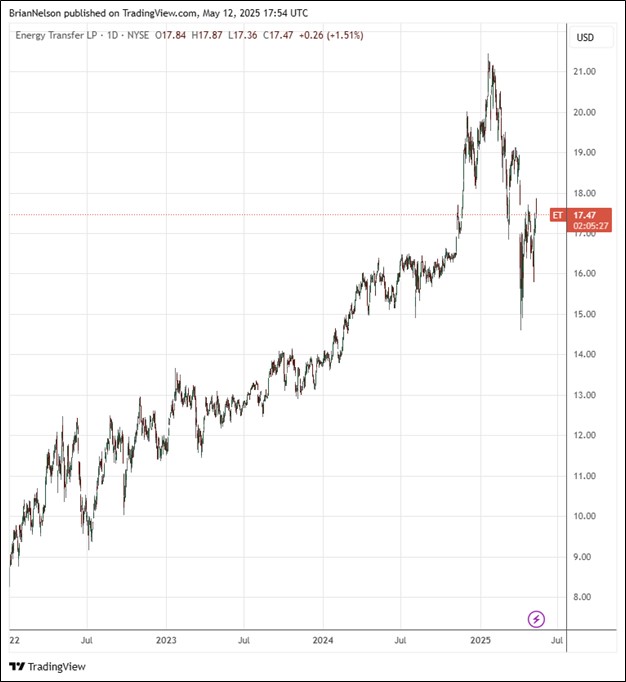

Image Source: TradingView

By Brian Nelson, CFA

Energy Transfer (ET) recently reported mixed first quarter results with revenue coming up short of expectations, but GAAP earnings per share coming in line with the consensus forecast. The pipeline giant reported net income for the three months ended March 31 of $1.32 billion, which compares to $1.24 billion in the same three months last year. Adjusted EBITDA for the first quarter was $4.1 billion compared to $3.88 billion in the same period a year ago.

On an operational basis, interstate natural gas transportation volumes increased 3%, setting a new partnership record. Crude oil transportation volumes were up 10%, while NGL transportation volumes were up 4% and NGL and refined products terminal volumes were up 4%. NGL exports were up 5%, while midstream gathered volumes were up by more than 2%.

Energy Transfer’s distributable cash flow attributable to partners, as adjusted, for the three months ended March 31 was $2.31 billion, compared to $2.36 billion in last year’s quarter. Total distributions to be paid to partners was $1.1 billion in the quarter. Free cash flow in the quarter, calculated as cash flow from operations less all capital spending was $1.69 billion, which covered distributions paid during the period. We continue to like Energy Transfer as an idea in the High Yield Dividend Newsletter portfolio.

In April, Energy Transfer announced a quarterly cash distribution of $0.3275 per common unit, which represented an increase of more than 3% compared to the first quarter of 2024. The partnership ended the quarter with a revolving credit facility of an aggregate of $4.37 billion in available borrowing capacity. As it relates to guidance for 2025, Energy Transfer expects adjusted EBITDA to be between $16.1-$16.5 billion, and growth capital spending to be roughly $5 billion on the year.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.