Image Source: Energy Transfer

By Brian Nelson, CFA

Energy Transfer (ET) reported strong second quarter results on August 7. Net income attributable to partners totaled $1.31 billion in the quarter, up from $911 million in the same quarter a year ago. Net income per common unit on a diluted basis expanded to $0.35 from $0.25 in last year’s quarter. Adjusted EBITDA in its June quarter was $3.76 billion compared to $3.12 billion for the same three months of last year.

Distributable cash flow [DCF] to partners came in at $2.039 billion in the quarter compared to $1.554 billion in last year’s period. Total distributions to be paid to partners was $1.1 billion in the quarter, translating into excellent distribution coverage with distributable cash flow. DCF per diluted unit in the quarter came in north of $0.60 compared to the company’s quarterly cash distribution of $0.32 per unit.

The quarter was solid on an operational basis. Crude oil transportation volumes increased 23%, setting a new partnership record. Crude oil exports were up 11%, NGL fractional volumes increased 11%, while NGL exports and NGL transportation volumes increased to set a new partnership record. Increasing 4% on a year-over-year basis, NGL and refined products terminal volumes also set a partnership record. Refined products transportation volumes increased 9%.

For the six months ended June 30, cash flow from operations expanded to $6.042 billion from $5.9 billion over the same period last year. Capital expenditures were $1.6 billion during the first six months of this year versus $1.7 billion in the year-ago period. Free cash flow was $4.4 billion during the first six months of 2024, above the company’s distributions to partners, noncontrolling interests, and redeemable noncontrolling interests of $3.3 billion over the comparable period. We like Energy Transfer’s ability to cover distributions with traditional free cash flow, as this is a big change from a decade ago.

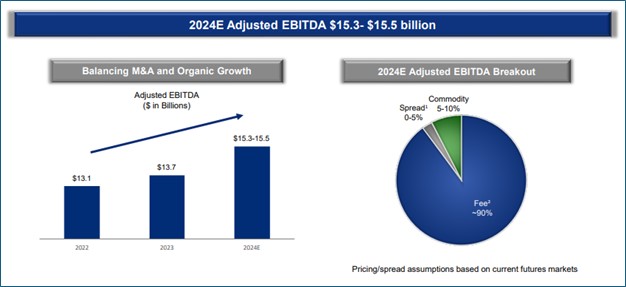

Looking to full-year 2024, Energy Transfer’s adjusted EBITDA is now targeted in the range of $15.3-$15.5 billion, compared to its previous guidance of between $15-$15.3 billion. The updated guidance includes the impact of its WTG Midstream acquisition as well as outperformance in its base business.

Energy Transfer’s fundamental momentum has translated into improved credit ratings, too, with Moody’s upgrading its senior unsecured credit rating to Baa2 in June 2024 (long-term debt totaled $57.4 billion at the end of the quarter). Though its debt level is difficult to get comfortable with, it’s encouraging to see the improved adjusted EBITDA guidance as well as Energy Transfer’s ability to cover distributions with traditional free cash flow. Units yield 7.8% at the time of this writing.

—–

NOW READ: What to Do During This Market Selloff

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.