Image Source: Energy Transfer

By Brian Nelson, CFA

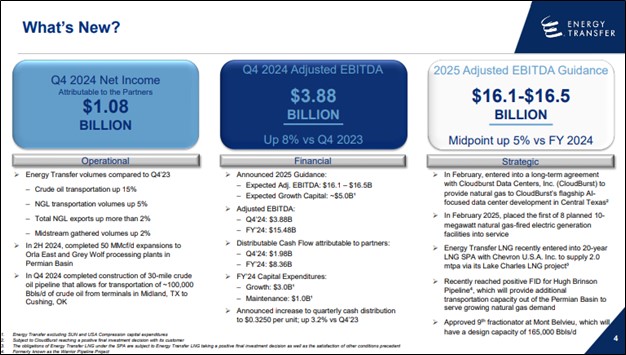

Energy Transfer (ET) recently reported fourth quarter results that were shy of Street expectations. Net income attributable to partners for the three months ended December 31 2024 was $1.08 billion, or $0.29 per unit. Adjusted EBITDA for the three months ended December 31, 2024 was $3.88 billion compared to $3.6 billion for the same period a year ago, an increase of 8%. Distributable cash flow attributable to partners, as adjusted, for the quarter was $1.978 billion, or $0.57 per diluted unit. Growth capital spending was $1.22 billion in the fourth quarter, while maintenance capital expenditures were $309 million.

Energy Transfer’s volumes performed well in the quarter. Crude oil transportation volumes were up 15%, NGL transportation volumes were up 5%, NGL exports were up more than 2%, midstream gathered volumes increased 2%, while interstate natural gas transportation volumes were up 2%. Looking to 2025, Energy Transfer expects adjusted EBITDA to be in the range of $16.1-$16.5 billion. For the year, the midstream giant expects its growth capital expenditures to be roughly $5 billion, with maintenance capital spending for 2025 to be approximately $1.1 billion.

Energy Transfer announced a quarterly cash distribution of $0.3250 per common unit during the fourth quarter (3.2% higher than the fourth quarter of 2023), a distribution that was well-covered by distributable cash flow in the period. At the end of the quarter, Energy Transfer had $2.21 billion of available borrowing capacity. For 2024, Energy Transfer hauled in $11.5 billion in cash from operating activities and spent $4.2 billion in capital expenditures, resulting in free cash flow of $7.3 billion, in excess of the $6.4 billion it distributed to partners, noncontrolling interests, and redeemable noncontrolling interests. We like Energy Transfer’s newfound free cash flow coverage of the payout.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.