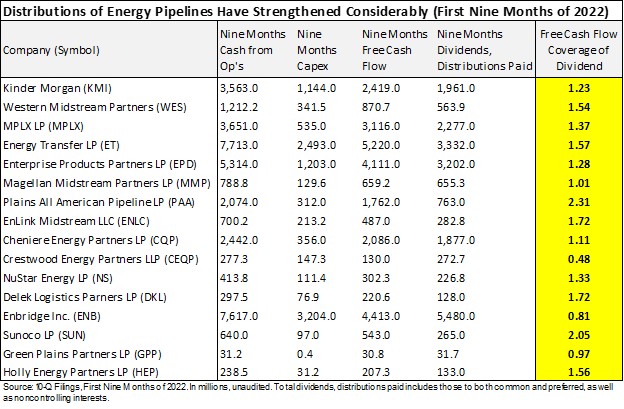

Image: Midstream energy companies have significantly improved their free cash coverage of their payouts in recent years. We’ve taken note. Source: Relevant 10-Q filings.

By Brian Nelson, CFA

As of our last check, no longer are the vast majority of energy pipeline players not covering their dividends/distributions with traditional free cash flow, as measured by cash flow from operations less all capital spending. Said another way, free cash flow after dividends, distributions is positive for a great many energy pipeline players these days.

We’re pleased by the developments across midstream, and we expect to make some moves in the simulated newsletter portfolios to potentially add the Alerian MLP (AMLP) ETF to the simulated newsletter portfolios as a result. This is a huge change from the doldrums of a number of years ago, and frankly, we’re blown away by the group’s significantly improved free cash flow coverage.

Since we added Exxon Mobil (XOM) and Chevron (CVX) to the simulated newsletter portfolios in June 27, 2021, both of them have soared! According to data from Morningstar, shares of Exxon Mobil have advanced 72%, while shares of Chevron have soared 66%. We may look to trim these “positions” in the simulated newsletter portfolios to make room for the AMLP. We don’t want to be too exposed to energy in the simulated newsletter portfolios.

We can hardly believe how much better things are looking for midstream pipeline companies these days, particularly as it relates to free cash flow coverage of their payouts, but also as it relates to improved financial transparency. Many midstream MLPs continue to be saddled with huge net debt positions, but what a difference a few years have made! Capital discipline is making their dividends/distributions incrementally more attractive, and we’ve taken note.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.