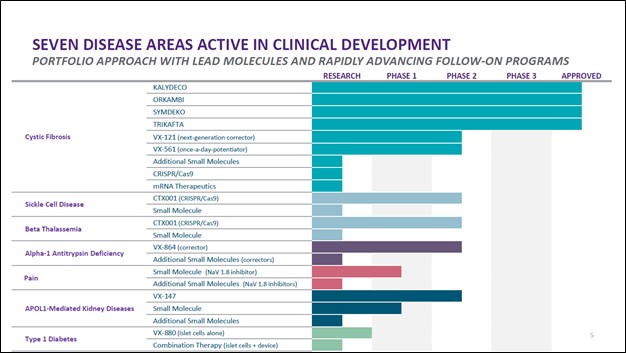

Image Shown: An overview of Vertex Pharmaceuticals Inc’s drug pipeline and commercialized drug portfolio. Image Source: Vertex Pharmaceuticals Inc – Fourth Quarter of 2020 IR Earnings Presentation

By Callum Turcan

Several pharmaceutical and biotech companies showcased the resilience of their business models last year when faced with severe exogenous headwinds created by the coronavirus (‘COVID-19’) pandemic. For broad-based diversified exposure tied to secular growth tailwinds across the largest drug development companies in the world (and their robust pipelines of drugs and therapies), we include the Health Care Select Sector SPDR ETF (XLV) in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. We like this broad exposure to the sector, particularly within diversified portfolios.

Eli Lilly (LLY)

When Eli Lilly and Company (LLY) reported fourth quarter earnings for 2020 on January 29, the firm beat both consensus top- and bottom-line estimates. Eli Lilly reported that its diabetes (such as TRULICITY and JARDIANCE) and oncology (such as VERZENIO and RETEVMO) treatments, among various others, posted solid revenue growth last year. Additionally, Eli Lilly’s bamlanivimab offering that received emergency authorization to treat adult patients and children patients over the age of 12 with mild to moderate cases of COVID-19 played a role in supporting its revenue growth last year. On a GAAP basis, Eli Lilly’s revenues climbed higher by 10% annually and its operating income grew by 22% annually in 2020.

The pharmaceutical company lowered its GAAP EPS estimate for 2021 during its latest earnings report due to “recent business development activities” though Eli Lilly maintained its non-GAAP adjusted EPS estimate for 2021 of $7.75-$8.40 versus the $7.93 in non-GAAP adjusted EPS the firm posted in 2020 (which was up 31% year-over-year). Expectations that demand for the firm’s diabetes, oncology and COVID-19 treatments will be quite strong this year underpins management’s assumptions that Eli Lilly will post $26.5-$28.0 billion in sales in 2021, up from $24.5 billion in 2020 (on a GAAP basis).

As Eli Lilly left its 2021 guidance unchanged save for its GAAP EPS performance, it appears the firm’s underlying financial outlook remains promising. We caution that $1.0-$2.0 billion of Eli Lilly’s forecasted 2021 revenues is expected to come from its COVID-19 treatments, a source of revenue that will fade as global health authorities work to bring the pandemic under control (a process that should one day be made possible via ongoing vaccine distribution activities). As of this writing, shares of LLY are trading well above our fair value estimate range and yield ~1.7% as of this writing.

Vertex Pharmaceuticals (VRTX)

On February 1, Vertex Pharmaceuticals Inc (VRTX) reported fourth quarter earnings for 2020 that beat consensus top-line estimates but missed consensus bottom-line estimates. We are big fans of Vertex Pharma and added the stock to the Best Ideas Newsletter portfolio January 12 (link here). Members that have not yet done so are strongly encouraged to read our January 2020 note Best Idea Vertex Pharma Is an Intriguing Biotech Play which covers Vertex Pharma’s commercialized drug portfolio, drug pipeline, and outlook in detail (that article can be viewed here). Please note that its cystic fibrosis (‘CF’) offerings represent the only commercialized part of Vertex Pharma’s drug portfolio at this time.

The company’s GAAP revenues advanced 49% annually and its GAAP operating income surged by 239% on an annual basis last year, aided by the ongoing strength at its CF drug portfolio as the firm continues to increase the potential patient pool (primarily by securing regulatory approval that allows for additional application of its CF treatments). Vertex Pharma exited 2020 with a net cash position of ~$6.1 billion (inclusive of finance lease liabilities), providing the biotech with ample financial firepower to ride out the storm caused by the pandemic and more recently, manic trading activity. We will have more to say on Vertex Pharma’s financial position when it publishes its 10-K filing covering 2020.

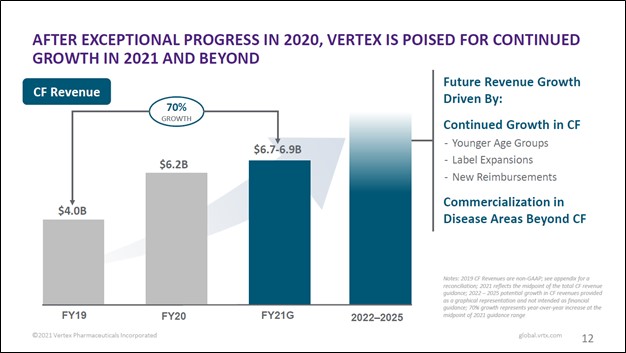

In the upcoming graphic down below, Vertex Pharma lays out its guidance for 2021 which management issued in conjunction with the fourth quarter earnings report. Management expects Vertex Pharma’s product revenues year (~10% annually at the midpoint) and core operating expenses (up ~14% annually at the midpoint) will continue to grow at a brisk clip this year. Rising CF product revenues is being utilized to fund the development of drug candidates currently at various stages of the clinical trial and pre-clinical trial process, while also bulking up Vertex Pharma’s sales, marketing and other corporate-level operations as the firm scales up.

Image Shown: Vertex Pharma expects its product revenues will grow at a brisk pace in 2021 on the back of ongoing strength seen at its CF drug portfolio. Image Source: Vertex Pharma – Fourth Quarter of 2020 IR Earnings Presentation

Vertex Pharma’s growth outlook is promising and underpinned by more than just its CF offerings. The company has a strategic partnership with CRISPR Therapeutics AG (CRSP) that aims to develop gene-edited therapies for transfusion-dependent beta thalassemia (‘TDT’) a blood disorder, and sickle cell disease (‘SCD’), a group of red blood cell disorders. CTX001, as the treatment is known, has been given to more than 20 patients across two clinical trials and completion of both studies are expected by the end of this year, according to commentary provided in Vertex Pharma’s latest earnings press release. We are very intrigued by the upside this potential therapeutic could bring.

Image Shown: Vertex Pharma views its long-term revenue growth trajectory quite favorably, which supports our positive sentiments towards the name. Image Source: Vertex Pharma – Fourth Quarter of 2020 IR Earnings Presentation

The top end of our fair value estimate range for Vertex Pharma is $321 per share, and we continue to view its capital appreciation upside quite favorably. Vertex Pharma’s pristine balance sheet combined with its incredibly promising growth outlook underpins why we are big fans of the biotech company. We continue to like exposure to Vertex Pharma in the Best Ideas Newsletter portfolio. Please note Vertex Pharma does not pay out a common dividend at this time.

Concluding Thoughts

There are many attractive opportunities in the healthcare sector. Vertex Pharma is our favorite biotech play, and we are intrigued by the potential upside its strategic partnership with CRISPR Therapeutics could generate. Additionally, we like the broad exposure to an attractive sector the XLV ETF provides the newsletter portfolios. The end of the COVID-19 pandemic will make conducting non-COVID-19-related clinical trials an easier task over the long haul, which supports the outlook for the pharmaceutical and biotech industries.

We are also big fans of Johnson & Johnson (JNJ), which is included in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Members interested in reading about Johnson & Johnson should check out our coverage of its latest earnings report by clicking this link here. On a final note, we are big fans of UnitedHealth Group Inc (UNH) and include the firm in our Dividend Growth Newsletter portfolio. Members can view our coverage of UnitedHealth Group’s latest earnings report by clicking this link here.

—–

Health Care Bellwethers Industry – JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Related: CRSP, XLV

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.