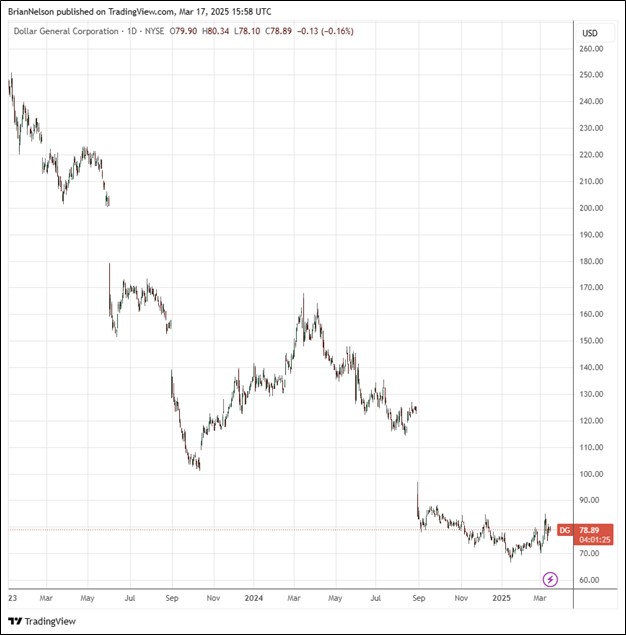

Image Source: TradingView

By Brian Nelson, CFA

On March 13, Dollar General (DG) reported mixed fourth quarter fiscal 2024 results with revenue outpacing the consensus forecast, but GAAP earnings per share coming up a bit light. Fourth quarter net sales advanced 4.5%, while same store sales increased 1.2% in the quarter, the latter better than the consensus estimate of 0.9%. Fourth quarter operating profit dropped 49.2% and fourth quarter diluted earnings per share dropped 52.5%, which included charges associated with its store portfolio review.

Despite the mixed report, management was pleased with the results:

We were pleased with the underlying performance of the business in the fourth quarter, including improved execution and solid top-line results. As we reflect on our full fiscal 2024 year, we believe our Back to Basics work is resonating with customers, as demonstrated by higher customer satisfaction scores and healthy market share gains.

I (Todd Vasos, Dollar General’s chief executive officer) want to thank each of our associates for their dedication to fulfilling our mission of Serving Others every day. Looking ahead, we believe we are well-positioned to deliver our unique combination of value and convenience at a time when our customers need it most. We have fortified the foundation of this business over the last year and are confident in our plans and initiatives for 2025 and beyond, as we look to further build on this base and create sustainable long-term value for our shareholders.

Looking to fiscal 2025, Dollar General expects net sales to grow 3.4%-4.4% and same store sales growth to be in the range of 1.2%-2.2% versus the consensus forecast of 1.8%. Diluted earnings per share is targeted in the range of $5.10-$5.80, while capital spending is anticipated in the range of $1.3-$1.4 billion. Dollar General will be busy with real estate projects during fiscal 2025, including opening roughly 575 new stores in the U.S. and up to 15 new stores in Mexico. It plans to fully remodel approximately 2,000 stores, remodel approximately 2,250 stores, and relocate 45 stores.

ESG Matters

Excerpt From A Message From Our CEO:

…we undertook a number of actions designed to better serve our existing communities and expand the number of communities we serve. For example, we increased the number of our stores offering fresh produce to more than 5,000, and we plan to further expand that number…We also opened our first three Mi Súper Dollar General stores in Mexico, continuing our focus on serving the underserved.

Additionally, we worked to advance and refine our sustainability efforts in areas such as recycling and reforestation, reduce our emissions, implement new policies such as our environmental and palm oil policies, pilot new technologies and expand the benefits and training offerings available to our employees. I believe our continued progress has positioned us well for future success.

Concluding Thoughts

Dollar General updated its long-term financial framework for the next five years. Its annual goal includes net sales growth of 3.5%-4%, same-store sales growth of 2%-3%, adjusted operating margin of 6%-7% beginning in 2028-2029, adjusted diluted earnings per share growth of 10%+ beginning in 2026, new unit growth of approximately 2% and capital spending of approximately 3% of net sales. Though its long-term plans look achievable, Dollar General is no longer an idea in any of the newsletter portfolios. Shares yield 3% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.