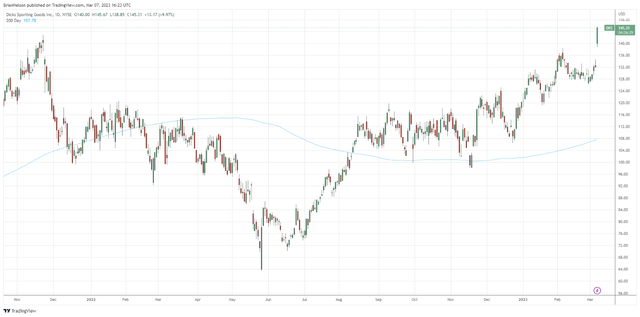

Image Source: Dick’s Sporting Goods’ shares are breaking out of a very nice technical cup-and-handle pattern, and we continue to like shares as an idea in the Dividend Growth Newsletter portfolio. Image: TradingView

By Brian Nelson, CFA

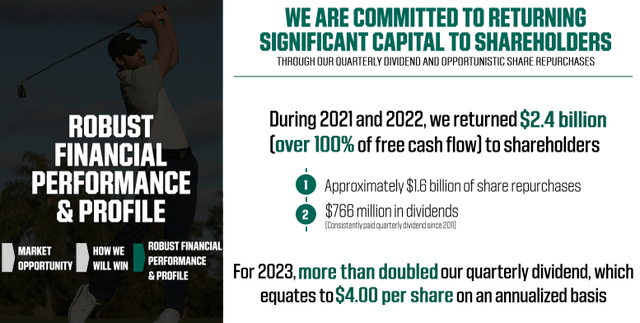

We include Dick’s Sporting Goods (DKS) as an idea in the Dividend Growth Newsletter portfolio. On March 7, the company reported its fourth-quarter results for the three months ended January 28, 2023. Comparable store sales growth in the quarter came in at 5.3%, which was more than double that which consensus was looking for. The executive team also more than doubled its dividend (105%+), to $4.00 per share on an annualized basis, resulting in a ~2.8% forward estimated dividend yield on the basis of where shares are trading of late. We expect to update our dividend report shortly.

Image Source: Dick’s Sporting Goods

Here’s what Executive Chairman Ed Stack had to say about the performance:

Our 2022 results provide a strong foundation upon which we will build in 2023 and well into the future. In 2023, we will grow both our sales and earnings through positive comps, a return to square footage growth and higher merchandise margin. Our consistent performance and financial strength position us to increase the rate of investment in our business to fuel long-term growth opportunities, and also return significant capital to shareholders. The step-change increase in our dividend clearly reflects our strong conviction in our structurally higher sales and earnings. Our fourth quarter was a strong ending to another strong year. We achieved record quarterly sales and our comps grew 5.3% as we continued to gain market share. As planned, we continued to address targeted inventory overages, and as a result our inventory is in great shape as we start 2023. We couldn’t be more excited about our spring assortment.

We’re reiterating our $163 per-share fair value estimate of shares, and we continue to like them in the Dividend Growth Newsletter portfolio. Up ~10% during the trading session March 7, shares are trading at ~$145 as of the publishing of this note. Looking ahead to 2023, the executive team expects comparable store sales to grow in the range of flat to positive 2% and full-year earnings per diluted share to be in the range of $12.90-$13.80, implying that shares are trading at ~10.6x next year’s earnings at the time of this writing (at the high end of the guidance range).

NOW READ: Markets Bounce Off Technical Support But Not Out of the Woods

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.