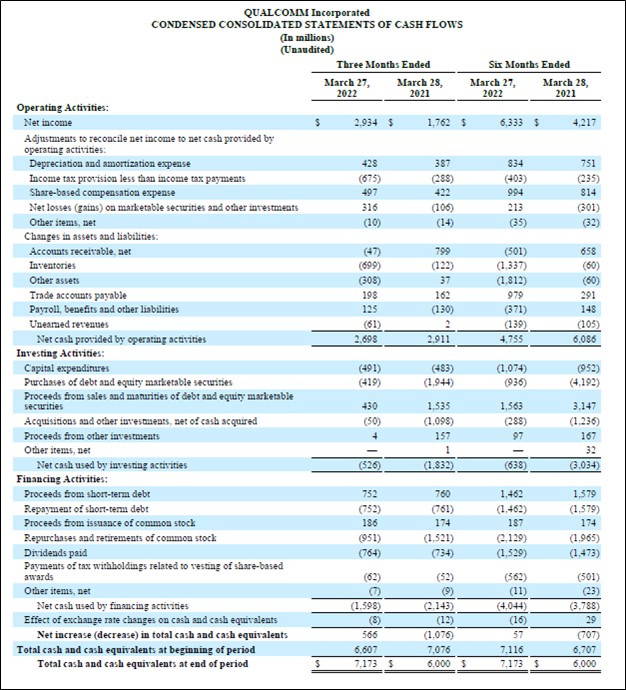

Image Shown: Dividend growth idea Qualcomm Inc has a stellar cash flow profile. Image Source: Qualcomm Inc – 10-Q SEC filing covering the Second Quarter of Fiscal 2022

By Callum Turcan

On April 27, Qualcomm Inc (QCOM) reported second quarter earnings for fiscal 2022 (period ended March 27, 2022) that beat both consensus top- and bottom-line estimates. The company is a leader in the technologies relating to 5G wireless, Internet of Things (‘IoT’) trend, semi-autonomous and autonomous driving, and handset operations. We include Qualcomm as an idea in the Dividend Growth Newsletter portfolio as we view its dividend strength and payout growth outlook quite favorably. Shares of QCOM yield ~2.3% as of this writing. The firm’s latest earnings update and near term guidance reinforces our bullish view towards the name.

Earnings Update

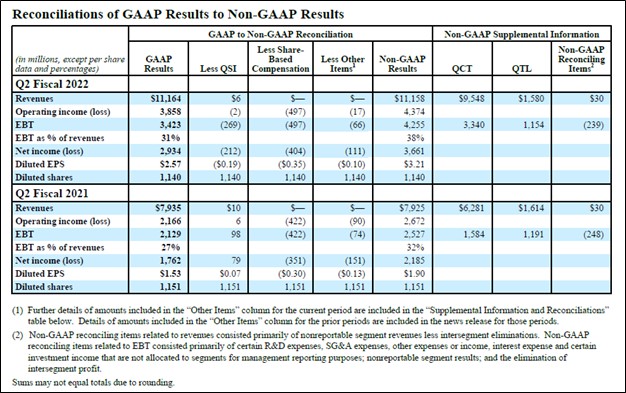

Qualcomm has two core business reporting segments. The first is Qualcomm CDMA Technologies (‘QCT’) which develops and supplies semiconductors and the second is Qualcomm Technology Licensing (‘QTL’) which licenses its technology. Qualcomm’s GAAP revenues rose 41% and its GAAP operating income rose 78% year-over-year last fiscal quarter, with strength seen across the board.

In the fiscal second quarter, QCT revenues grew by 52% year-over-year with its IoT (up 61%), handsets (up 56%), automotive (up 41%), and radio frequency front-end (up 28%) offerings all performing well. Pivoting to its QTL segment, revenues here were down marginally year-over-year though this business remains a major profit engine for Qualcomm due to its high margins. Last fiscal quarter, QCT generated $9.5 billion in revenues and $3.3 billion in EBT and QTL generated $1.6 billion in revenues and $1.2 billion in EBT on a non-GAAP basis.

Image Shown: Qualcomm’s business put up strong performance across the board last fiscal quarter. Image Source: Qualcomm – Second Quarter of Fiscal 2022 Earnings Press Release

Qualcomm spent roughly 18% of its revenues on R&D expenses during the fiscal second quarter. The company’s ample pricing power, which so far has enabled Qualcomm to stay ahead of major inflationary pressures and preserve its strong margins, is a product of its focus on innovation and its leading market position in key technologies. At times, Qualcomm will also utilize acquisitions to firm up its market position.

Acquisition Update

In April 2022, Qualcomm completed the acquisition of Veoneer’s Arriver business from SSW Partners (included Veoneer’s key driving technologies) after SSW Partners acquired Veoneer. For reference, SSW Partners is a New York-based investment fund that is now looking for a buyer for Veoneer’s non-Arriver business, and Qualcomm effectively helped fund the entire deal for Veoneer. Qualcomm gained Arriver’s “Computer Vision, Drive Policy and Driver Assistance assets” and Qualcomm is now integrating those offerings into its Snapdragon ride platform. Snapdragon Ride is a suite of offerings that enable assisted driving, advanced assisted driving, and fully autonomous driving services.

According to Qualcomm’s 10-Q SEC filing covering the fiscal second quarter, the transaction for Veoneer totaled $4.7 billion including “approximately $4.6 billion for amounts paid in respect of Veoneer’s outstanding capital stock and equity awards and amounts to be paid to settle Veoneer’s outstanding convertible senior notes due 2024” and a ~$0.1 billion termination fee paid to Magna International Inc (MGA) as Magna’s deal for Veoneer was terminated in favor of the SSW Partners-Qualcomm deal.

Furthermore, Qualcomm’s latest 10-Q SEC filing had this to say on the deal:

We funded substantially all of the cash consideration payable in the transaction in exchange for (i) the Arriver business and (ii) the right to receive a majority of the proceeds upon the sale of the Non-Arriver businesses by SSW Partners. We have also agreed to provide certain funding of approximately $300 million to the Non-Arriver businesses while SSW Partners seeks a buyer(s). Such amounts, along with cash retained in the Non-Arriver business, are expected to be used to fund working and other near-term capital needs, as well as certain costs incurred in connection with the close of the acquisition.

Until the non-Arriver business of Veoneer’s is sold by SSW Partners, Qualcomm is consolidating the financial performance of these operations with a one-quarter reporting lag as Qualcomm has determined that it is the “primarily beneficiary” of these assets. Qualcomm does not intend to operate the non-Arriver business until SSW Partners sells these assets. We are keeping a close eye on the divestment process.

Rock-Solid Financials, Promising Guidance

During the first half of fiscal 2022, Qualcomm generated $3.7 billion in free cash flow while spending $1.5 billion covering its dividend obligations and $2.1 billion buying back its common stock. As of March 27 (before its deal with SSW Partners and Veoneer closed), Qualcomm had a net debt load of $4.1 billion (inclusive of short-term debt). We view Qualcomm’s net debt load as manageable given that it had $11.5 billion in cash, cash equivalents, and current marketable securities on hand at the end of its fiscal second quarter.

Qualcomm issued favorable guidance for the current fiscal quarter during its latest earnings update. The firm expects to generate $10.5-$11.3 billion in revenues and $2.75-$2.95 in non-GAAP diluted EPS in the fiscal third quarter. At the midpoint, that represents 35% year-over-year revenue growth and 48% year-over-year non-GAAP diluted EPS growth. We appreciate that Qualcomm’s near term outlook is quite bright, and its longer term growth runway remains rock-solid and supported by numerous secular tailwinds (proliferation of the IoT trend, the rise of autonomous vehicles, the spread of 5G wireless technologies, robust demand for smartphones, and more).

Image Shown: Qualcomm’s near term guidance indicates its growth runway remains intact. Image Source: Qualcomm – Second Quarter of Fiscal 2022 Earnings Press Release

Concluding Thoughts

We continue to be huge fans of Qualcomm. Due to its promising growth outlook, immense pricing power, and stellar cash flow profile, we see ample room for Qualcomm to grow its dividend over the coming years. There is not much that will get in the way of Qualcomm’s income growth story, in our view. We value shares close to $180 each, and the company’s Dividend Cushion ratio stands at a very healthy 3.7. There’s plenty to like about this idea, in our view.

Qualcomm’s 16-page Stock Report (pdf) >>

Qualcomm’s Dividend Report (pdf) >>

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Related: ASML, MGA

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long DIS and FB call options. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. ASML Holding NV (ASML), Meta Platforms, Oracle, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.