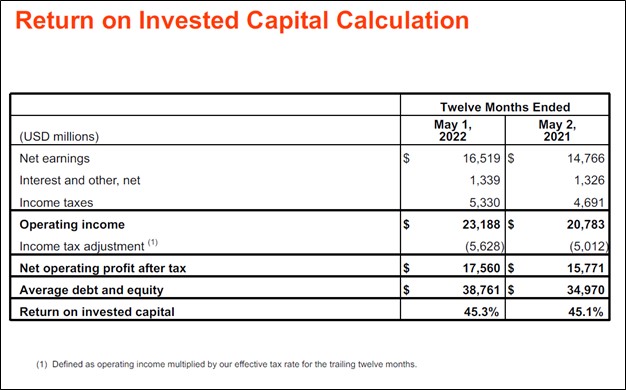

Image Shown: Dividend growth idea Home Depot Inc is a tremendous generator of shareholder value due to its stellar return on invested capital performance. Image Source: Home Depot Inc – First Quarter of Fiscal 2022 Non-GAAP Reconciliation Financial Package

By Callum Turcan

On May 17, Home Depot Inc (HD) reported first quarter earnings for fiscal 2022 (period ended May 1, 2022) that beat both consensus top- and bottom-line estimates. Demand from professionals remains robust, offsetting waning demand from do-it-yourself (‘DIY’) customers. In the wake of its strong fiscal first quarter performance, Home Depot boosted its fiscal 2022 guidance in conjunction with its latest earnings report. We are big fans of Home Depot’s income growth potential and include shares of HD as an idea in the Dividend Growth Newsletter portfolio. Shares of HD yield ~2.6% as of this writing.

Earnings Update

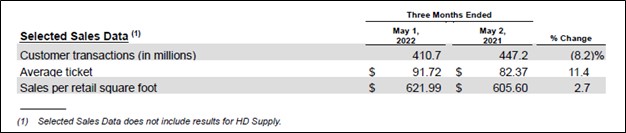

While Home Depot reported that its customer transactions dropped by 8% year-over-year last fiscal quarter, its average ticket size rose by 11%. In turn, that enabled its sales per retail square foot to climb higher by 3% year-over-year. Home Depot’s comparable sales were up 2% year-over-year last fiscal quarter. Please note that these figures do not include the performance of HD Supply, a maintenance, repair, and operations (‘MRO’) business Home Depot acquired for ~$8 billion in December 2020. Management noted during Home Depot’s latest earnings call that “inflation from core commodity categories positively impacted our average ticket growth by approximately 240 basis points” with an eye towards lumber and copper prices, among other items.

Image Shown: While customer transactions shifted meaningfully lower last fiscal quarter, Home Depot more than made up for those losses due to a sharp increase in its average ticket size aided by robust demand from its professional customer base. Image Source: Home Depot – First Quarter of Fiscal 2022 Earnings Press Release

Inflation played a role in boosting Home Depot’s performance in the fiscal first quarter, but there is more to the story here. Strength from Home Depot’s ‘Pro’ customer base, particularly as it concerns demand for pipes, fittings, gypsum, and fasteners, supported the company’s financial performance last fiscal quarter with comparable transactions worth more than $1,000 up 12% year-over-year. Additionally, management noted that “Pro sales growth outpaced DIY” sales growth last fiscal quarter.

Management also noted during the company’s latest earnings call that 11 of Home Depot’s 14 merchandising segments posted positive comparable store sales growth rates in the fiscal first quarter led by building materials, paint, plumbing, and millwork. However, seasonal sales faced major headwinds last fiscal quarter due to Spring weather arriving later than normal. Comparable sales of its appliances were down due to timing effects from promotional events, though management noted when removing those effects, Home Depot’s appliance sales would have posted positive comparable sales growth.

Home Depot’s GAAP revenues rose 4% year-over-year in the fiscal first quarter to reach $38.9 billion, a record for the firm. Inflationary pressures and other factors are a concern as its GAAP gross margin shifted lower by ~20 basis points year-over-year last fiscal quarter, dropping down to 33.8%, though we appreciate Home Depot’s ability to largely offset these pressures via pricing increases. The company’s GAAP operating income rose 3% year-over-year to hit $5.9 billion while its GAAP operating margin dropped by ~20 basis points to reach 15.2%, largely due to the pressures facing its gross margins. Economies of scale and digital initiatives are potential sources of upside going forward, especially as Home Depot continues to improve its e-commerce operations.

Management noted that Home Depot’s digital sales rose 4% year-over-year last fiscal quarter during its latest earnings call, with over 50% of its online sales fulfilled through its stores. It is much more economical for Home Depot to meet demand through its physical stores than through home delivery options.

Aided by a 4% year-over-year reduction in its outstanding diluted share count, Home Depot’s GAAP diluted EPS rose 6% to $4.09 in the first quarter of fiscal 2022. The company notes that it generated a 45.3% return on invested capital (‘ROIC’) last fiscal quarter. Historically, Home Depot has generated a ROIC (with or without goodwill) that has substantially exceeded its estimated weighted average cost of capital (‘WACC’), and we forecast that will continue being the case over the coming fiscal years. Home Depot is a tremendous generator of shareholder value.

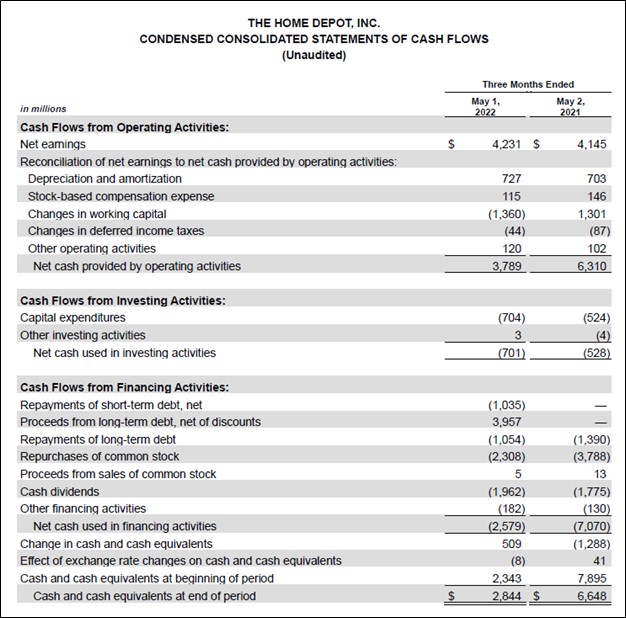

One of the reasons why we are big fans of Home Depot is its strong cash flow generating abilities in almost any operating environment. The firm generated $3.1 billion in free cash flow last fiscal quarter while spending $2.0 billion covering its dividend obligations. Over the long haul, Home Depot intends to spend ~2% of its annual revenues on its capital expenditures.

Image Shown: Home Depot is a rock-solid free cash flow generator. Image Source: Home Depot – First Quarter of Fiscal 2022 Earnings Press Release

Home Depot’s share buybacks, which historically have been quite substantial, are one of the reasons why it has a sizable net debt load. In the fiscal first quarter, Home Depot spent $2.3 billion repurchasing its common stock, part of which was covered by its balance sheet. As of May 1, Home Depot had $38.8 billion in net debt on the books (inclusive of short-term debt), though its $2.8 billion in cash and cash equivalents position on hand at the end of this period provides it with ample liquidity to meet its near term funding needs. We expect Home Depot will retain access to capital markets at attractive rates going forward due to its relatively strong financial position.

Guidance Update

In the wake of its outperformance at the start of this fiscal year, Home Depot boosted its guidance for fiscal 2022. The firm now forecasts its total sales and comparable sales will both grow by ~3% and that its diluted EPS will grow by mid-single digits in fiscal 2022 versus fiscal 2021 levels. Additionally, Home Depot forecasts that its operating margin will come in around 15.4% in fiscal 2022, indicating it expects its margin performance will firm up a bit from fiscal first quarter levels going forward.

For reference, Home Depot previously guided for “slightly positive” total and comparable sales growth in fiscal 2022 versus fiscal 2021 levels, a flat operating margin compared to fiscal 2021 levels (its GAAP operating margin stood at 15.2% last fiscal year), and low single-digit diluted EPS growth in fiscal 2022 on a year-over-year basis.

Its expected corporate tax rate for fiscal 2022 was kept the same at 24.6%, though Home Depot now forecasts its annual net interest expense will come in at $1.6 billion in fiscal 2022, up from previous forecasts calling for $1.5 billion in annual net interest expense. The net interest expense forecast may include expectations for a modest amount of interest and investment income in fiscal 2022. Home Depot’s net interest expense came in at $1.3 billion in fiscal 2021.

We appreciate that Home Depot now forecasts its comparable store sales, total revenues, operating margins, and diluted EPS metrics should perform better than previously expected in fiscal 2022. Home Depot had $25.3 billion in merchandise inventories on hand as of May 1, up from $22.1 billion on January 20, indicating it should be able to keep up with robust demand going forward.

Management noted during Home Depot’s latest earnings call that the firm’s performance in March and April was relatively soft for a few reasons, including tough year-over-year comparisons due to federal US stimulus spending in calendar year 2021 and the later-than-usual Spring weather. However, the company remains confident that its outlook for fiscal 2022 is quite bright.

Concluding Thoughts

Home Depot is not immune to inflationary pressures and supply chain hurdles, though its pricing power and ample inventories on hand should enable the company to maintain its growth trajectory. Back in January 2022, Home Depot announced it had pushed through a 15% sequential increase in its dividend in conjunction with its fiscal fourth quarter earnings update. We continue to be huge fans of Home Depot and see ample room for additional dividend increases over the coming years.

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Tickerized for HD, WMT, LOW, ITB, DHI, KBH, PHM, TOL, MAS, OC, SHW, LL, XHB, NAIL, HOMZ, LEN, FND, RDFN, Z, ZG, BZH, NVR, MTH, WHR, PKB, VMC, MLM, EXP, SUM, WSC

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Berkshire Hathaway Inc Class B shares (BRK.B), Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.