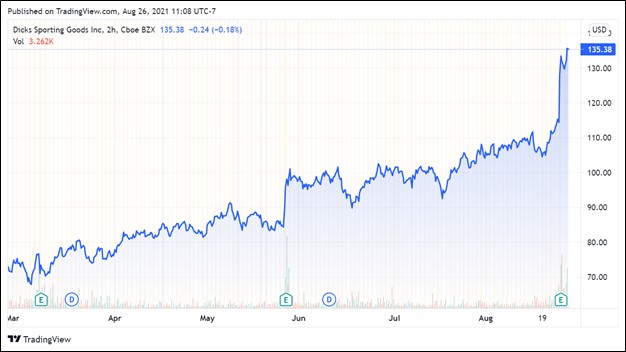

Image Shown: Dividend Growth Idea Dick’s Sporting Goods Inc has put up tremendous performance of late.

By Callum Turcan

On August 25, Dick’s Sporting Goods Inc (DKS) reported second quarter earnings for fiscal 2021 (period ended July 31, 2021) that soared past consensus top- and bottom-line estimates. Furthermore, Dick’s Sporting Goods raised its full-year guidance for fiscal 2021, doubled its minimum share buyback program to $0.4 billion for fiscal 2021, increased its regular quarterly dividend by 21% on a sequential basis to $0.4375 per share (bringing its annualized payout up to $1.75 per share), and announced a special dividend of $5.50 per share during its latest earnings update. We are incredibly pleased with the company’s performance of late. Dick’s Sporting Goods is included as an idea in the Dividend Growth Newsletter portfolio.

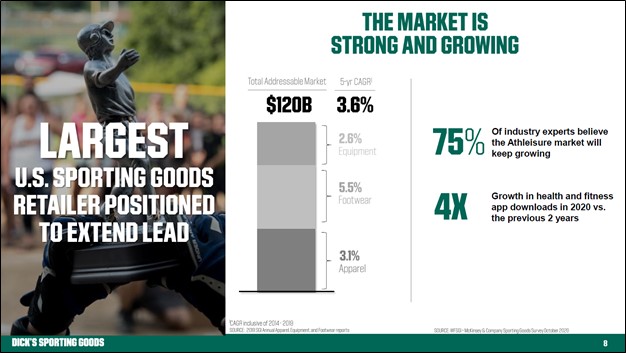

The retailer is now guiding for its net sales to grow by 18%-20% annually in fiscal 2021 (up from 8%-11% previously) and non-GAAP adjusted diluted EPS of $12.45-$12.95 (up from $8.00-$8.70 previously). For reference, Dicks’ Sporting Goods posted $3.69 and $6.12 in non-GAAP adjusted diluted EPS in fiscal 2019 and fiscal 2020, respectively. Dick’s Sporting Goods is catering to a sizable total addressable market (‘TAM) that is expected to grow at a decent clip going forward.

Image Shown: A look at the opportunities Dick’s Sporting Goods’ is targeting across the domestic sporting goods retail industry. Image Source: Dick’s Sporting Goods – August 2021 IR Presentation

According to an August 2021 IR presentation, Dick’s Sporting Goods estimates that it has 7% market share of the sporting goods retailers industry (in what appears to be the US) and that 8.5 million new athletes started shopping at its stores in 2020. Through a combination of strategic partnerships with established brands across the sporting goods industry along with its own private label brands, the retailer views its growth trajectory quite favorably, aided by the potential for market share gains. Recent and ongoing upgrades to its brick-and-mortar locations and its impressive digital and mobile presence alongside its stellar operational execution lends credence to this optimistic view of its growth runway.

Stellar Earnings Update

Dick’s Sporting Goods has tremendous omni-channel selling capabilities and a well-run customer loyalty program that the firm continues to improve which has translated into stellar financial performance of late. The company’s consolidated same store sales rose by 19.2% in the second quarter of fiscal 2021 on a year-over-year basis after growing by 20.7% on a year-over-year basis in the second quarter of fiscal 2020. During the company’s latest earnings call, management noted that Dick’s Sporting Goods reported double-digit sales growth at each of its hardlines, apparel, and footwear categories along with increases in both its average ticket sizes and number of transactions which led to its strong same store sales growth performance in the fiscal second quarter.

The retailer’s GAAP revenues surged higher 21% and its GAAP gross margin rose by almost 540 basis points year-over-year last fiscal quarter. Economies of scale and significant gross margin improvements enabled Dick’s Sporting Goods to grow its GAAP operating margin almost 585 basis points year-over-year last fiscal quarter as its GAAP operating income rose 70% year-over-year during this period.

Digital Strength

While its e-commerce sales dropped year-over-year in the fiscal second quarter as its physical stores reopened and foot traffic resumed in earnest, its e-commerce sales were still up 111% versus levels seen in the same quarter in fiscal 2019 and represented 18% of its sales in the second quarter of fiscal 2021. Dick’s Sporting Goods is seeing strong demand through both its digital and physical selling channels, a promising sign.

Management noted during the firm’s latest earnings call that “(its) stores enabled over 90% of our total sales and (it) fulfilled more than 70% of (its) online sales, either through ship-from-store, in-store pickup or curbside.” This played a key role in supporting the retailer’s margin performance last fiscal quarter as the company can play a larger role in meeting end customer demand instead of relying heavily on third-parties.

Image Shown: An overview of Dick’s Sporting Goods’ past financial and operational performance, and its footprint in the US. Image Source: Dick’s Sporting Goods – August 2021 IR Presentation

Here is some additional commentary from management during the firm’s latest earnings call (emphasis added):

“Turning now to our robust e-commerce business. During the quarter, we were pleased to deliver online sales growth of over 100% when compared to 2019. As planned, this represented a 28% decline versus last year as we anniversaried a nearly 200% online sales increase in Q2 2020, which included a period of temporary store closures.

Most importantly, we continue to drive significant improvement in the profitability of our e-commerce channel by leveraging fixed cost, sustaining asset adoption of in-store pickup and curbside as well as fewer and targeted promotions. In addition, we continued to improve our online shopping experience. This includes our strategy to lead with mobile, which for the first half of 2021, represented over 50% of our online sales as well as faster delivery times and an enhanced shopping and checkout experience.” — Lauren Hobart, President and CEO of Dick’s Sporting Goods

Generous Shareholder Return Strategies

The company’s recently upsized capital return programs are supported by its pristine balance sheet and tremendous free cash flow generating abilities. Dick’s Sporting Goods exited July 2021 with a net cash position of $1.8 billion and no short-term debt on the books, though the firm does have sizable operating lease liabilities to be aware of.

It generated just under $0.9 billion in free cash flow during the first half of fiscal 2021 and spent less than $0.2 billion buying back its stock and less than $0.1 billion covering its dividend obligations during this period. Management noted that the retailer’s special dividend would return almost $0.5 billion to shareholders and would be funded via cash on hand within the firm’s latest earnings press release.

Investing in the Business

Dick’s Sporting Goods is stepping up its investments in its business to keep the momentum going in the right direction. Its gross capital expenditures are expected to come in just below $0.4 billion this fiscal year versus just over $0.2 billion in fiscal 2020. Management noted in the firm’s latest earnings call that the retailer “converted approximately 25 additional Dick’s stores to premium full-service footwear and (it) added 50 new elevated soccer shops” in the fiscal second quarter. These are the types of endeavors that enabled the firm to post year-over-year same store sales growth of 40% last fiscal quarter at its brick-and-mortar stores.

Management also recently noted that the first two locations of the retailer’s Dick’s House of Sport store concepts “are off to a very strong start and have exceeded (its) expectations” and that the firm opened its first Public Lands store concept in late-August 2021. It also continues to optimize its Golf Galaxy business which is “performing extremely well” according to recent management commentary.

We are impressed with the stellar performance of the company’s various initiatives so far, and we appreciate the retailer’s relentless drive to continue innovating. Dick’s Sporting Goods has identified multiple growth avenues, and we view its growth trajectory quite favorably. Even in light of its rising capital expenditure expectations, the retailer remains incredibly free cash flow positive.

Concluding Thoughts

Dick’s Sporting Goods has been firing on all cylinders of late. The company’s strong performance is enabling Dick’s Sporting Goods to generously reward shareholders via regular dividend increases, a large special dividend, an enlarged share buyback program, and meaningful capital appreciation.

Shares of DKS skyrocketed in the wake of its latest earnings report, and we see room for additional upside. At its new annualized payout, excluding its special dividend, shares of DKS yield ~1.3% as of this writing.

Please note that we plan to finetune our enterprise cash flow model covering Dick’s Sporting Goods as we are likely being too conservative with our forecasts for revenue growth and margin expansion potential (especially considering its latest results and various growth initiatives in the works).

Dick’s Sporting Goods remains one of our favorite retailers and dividend growth ideas out there, and we continue to like the company as an idea in the Dividend Growth Newsletter portfolio.

—–

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL, ULTA, LEG, GPC, VFC, CTAS, WSM

Tickerized for DKS, HIBB, BGFV, ASO, NKE, YETI, LULU, FL, UA, UAA, AOUT, NLS, SWBI, VSTO, POWW, ADDYY, SKX, DECK, CROX, ELY, GOLF, MSGN, MSGS, AEO, GPS, PLCE, BKE, JWN, URBN, MVP

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.