Image: Lockheed Martin’s shares have been bolstered by a robust share buyback program during the fourth quarter of 2022. Though we still expect shares to be resilient, some technical consolidation may be necessary. Image Source: TradingView

By Brian Nelson, CFA

We added Lockheed Martin (LMT) to the Dividend Growth Newsletter portfolio all the way back in January 2020 before the COVID-19 meltdown. Shares had lagged the S&P 500 for some time after surfacing the portfolio idea, but certainly not during 2022. Lockheed Martin’s shares have surged more than 35% during 2022, beating the market by a huge margin. We continue to like shares, but we would expect some share-price consolidation during 2023 after the huge gains.

When Lockheed Martin reported third-quarter results in October, the company showed how much it appreciates its shareholder base by upping its quarterly dividend rate 7%, to $3 per share on a quarterly basis, and increasing its share buyback authorization by $14 billion. During the third quarter, free cash flow was robust, coming in at $2.7 billion compared to $1.6 billion in the same period a year ago. CEO James Taiclet had the following to add in the press release:

Lockheed Martin delivered a solid quarter, highlighted by strength in free cash flow, orders, and operating margins, that positions us well to achieve our full-year commitments. Our continuing ability to deliver strong financial performance in turn enables further investments in the 21st Century Security technologies essential to support our customers in conducting effective Joint All-Domain Operations. These technologies include hypersonics, directed energy, and autonomy, as well as cutting edge digital capabilities in our evolving 5G.MIL open standards-based architecture. In addition, we are investing in production and sustainment capacity for the solutions needed now to defend our allies and our nation, including F-35, Javelin and HIMARS.

Readers should note that our fair value estimate of Lockheed Martin stands at ~$412 per share with the high end of the fair value estimate range just north of $505. With the company’s equity trading at ~$480 at the time of this writing and management spending as much as $4 billion in buybacks during the fourth quarter of 2022 alone, we’re not expecting a huge 2023 as it relates to returns for the company.

That said, we are expecting continued share-price resilience in light of the firm’s strong fundamentals, free cash flow generation and dividend yield, which stands at ~2.5% at the moment. Defense stocks, in general, have held up quite well, amid the wreckage across the broader equity markets during 2022 and that may continue into 2023, too.

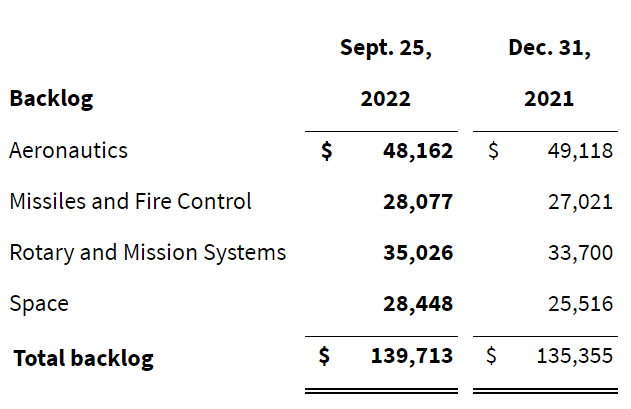

Image: Lockheed’s backlog has firmed up since the end of last year. Image Source: Lockheed Martin

As Lockheed closes the books on 2022, the firm expects cash flow from operations greater than $7.9 billion and capital spending of $1.9 billion to result in free cash flow greater or equal to $6 billion. Through the first three quarters of 2022, free cash flow came in at $4.9 billion, which was up from $4.0 billion during the same time period in the year-ago period. Lockheed ended the third quarter with backlog of $139.7 billion, up from $135.4 billion at the end of 2021.

Concluding Thoughts

Lockheed Martin’s aggressive buybacks during the fourth quarter of 2022 may have driven its price up to lofty levels, but we continue to like shares in the Dividend Growth Newsletter portfolio heading into 2023. The company’s free cash flow generation remains robust, its backlog has firmed up, and geopolitical tensions around the globe continue to intensify. The company’s equity yields ~2.5% at the time of this writing.

Tickerized for LMT, NOC, LHX, KAMN, GD, RTX, LDOS, TDG, AJRD, HXL, ITA, PPA, DFEN, ROKT, XAR, HII, TXT, RKLB, SPCE, ARQQ, VLD, MAXR, ASTR, VORB, BA, UFO, ARKX, LLAP, PLTR

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Be Careful With Celebrity Endorsement of Investment Products >>

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.