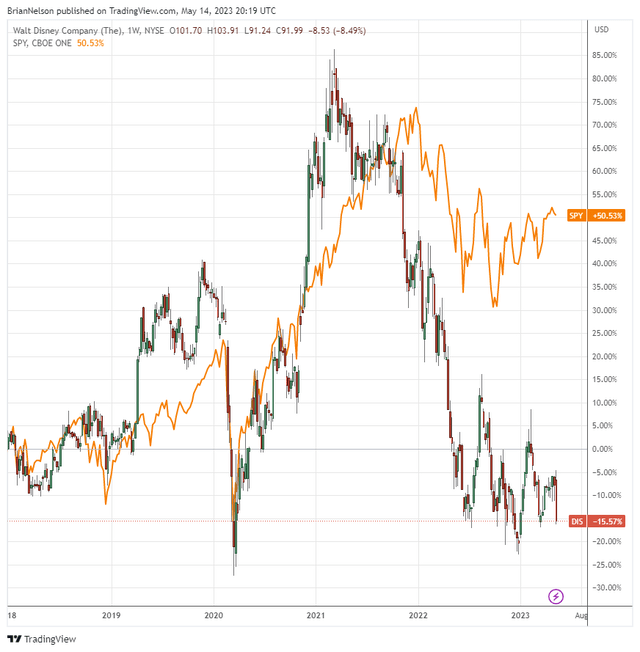

Image: Since the beginning of 2018, Disney’s shares have fallen, while the S&P 500 has surged. Though we liked the company more recently, we no longer include shares in the Best Ideas Newsletter portfolio.

By Brian Nelson, CFA

On May 10, Walt Disney Company (DIS) reported improved second-quarter results for fiscal 2023 that showed solid double-digit consolidated revenue growth and substantial cash flow improvement on a year-over-year basis. Though the market had previously shown some love for shares upon CEO Bob Iger’s return, investors are now having to face reality. The advertising market remains difficult for linear television these days, and subscription growth in the streaming market has become even more challenging. Our fair value estimate for Disney stands at $94 per share (modestly higher than where shares are trading at the time of this writing), and while we like the improved cash-flow trends in the quarter, we see no reason to add back the company as an idea in the Best Ideas Newsletter portfolio.

For starters, Disney continues to be distracted by Florida Governor Ron DeSantis’ war of words, and investors simply do not need the trouble. When politics enters business, the results typically suffer, and that could be part of what’s ailing Disney these days. Another problem is the firm’s streaming operations. Rival Paramount Global (PARA) cut its payout due to the difficult market environment, and while Iger has brought greater cash-flow performance at Disney, the firm’s loss of 4 million Disney+ subscribers in the quarter on a sequential basis (157.8 million versus 161.8 million) and 40%+ decline in ‘Media and Entertainment Distribution’ operating income are still concerning.

Looking past the subscriber churn and reduced income in its ‘Media and Entertainment Distribution’ division, however, Iger is largely doing what he was brought back to do. Disney’s revenue growth expanded a solid 13%+ in the quarter from the same period a year ago, while cash flow from operations increased 83%, to $3.24 billion. Free cash flow grew to $1.99 billion in the quarter, up from $686 million in the same period last year. During the past six months, free cash flow burn has slowed to just ~$170 million, a vast improvement on a year-over-year basis and much better than the massive cash burn during the first quarter of its fiscal year.

The market, however, just couldn’t get comfortable with how things are performing in Disney’s ‘Media and Entertainment Distribution’ segment, as profitability with respect to linear television suffered from higher sports programming and production costs and lower advertising revenue. Disney’s ‘Parks, Experiences and Products’ division performed great in the second quarter of fiscal 2023, revealing a 17% increase in revenue growth and a 23% advance in operating income as its parks and experiences business continues to expand nicely. The draw of Disney remains strong with consumers who are not balking at price increases at its parks and resorts.

That said, Disney has its hands full with its feud with Florida Governor DeSantis, a weakening linear television market, and intense rivalries in the streaming market. All of this won’t be solved overnight and might even worsen. From where we stand, investors simply don’t need the complexity of the Disney story at this time, and the company’s 5-year returns tell the story of a troubled company. With shares of Disney largely fairly valued, we won’t be adding the company back to the Best Ideas Newsletter portfolio anytime soon.

NOW READ: The Real Reason Why Moats Matter

———-

Tickerized for DIS, PARA, PARAA, NFLX, AMZN, WBD, CMCSA, LGF, LGF.A, LGF.B, SONY, AMC, CNNWQ, CNK, IMAX, NCMI, FOX, FOXA, WMG, SIRI, NXST, SBGI, CSSE, CHTR, T, DISH, VZ, ATUS, CABO, GTN, TGNA, SSP, TTD, MGNI, PUBM, CRTO, ROKU

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.