Image Source: Valuentum

By Brian Nelson, CFA

The Walt Disney Company (DIS) has had a rough go at it of late. The firm suffered tremendously during the worst of the COVID-19 pandemic, which forced consumers to stay at home and its parks to close. The firm eliminated its dividend to shore up cash, and recently-ousted CEO Bob Chapek may have sent the company on a crash course with Netflix (NFLX). Former CEO Bob Iger is back, however, and activist Nelson Peltz has conceded that Disney is working to get back on track. With 7,000 jobs on the chopping block and a still-yet-to-be-reinstated dividend, Disney’s wounds have yet to heal, and we remain skeptical the entertainment and media giant will ever fully recover to its glory days of 2021.

On February 8, Disney reported improved first-quarter fiscal 2023 results, with revenue in the quarter advancing 8% and diluted earnings per share from continuing operations increasing to $0.70 from $0.63 in the prior-year quarter. Though the top- and bottom-line performance came in better than expectations, total segment operating income still declined 7%, or by $215 million, and free cash flow generation was atrocious. Disney burned through $2.16 billion in cash in the quarter ended December 31, 2022, which was even worse than the $1.19 billion it burned through in the same period a year ago. Investors cheered CEO Bob Iger’s return and Peltz conceded that Disney is now back on track, but we’re not entirely sure.

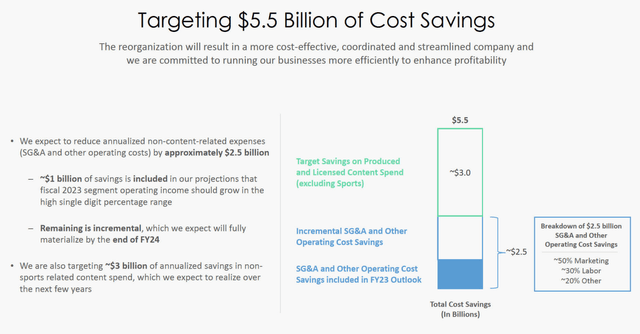

Total Disney+ subscribers fell 1% in the period, to 161.8 million, and Disney will likely de-emphasize spending in this area to shore up its balance sheet and work toward putting an end to its cash burn. Expectations for Disney to cede ground in this area is partly why shares of Netflix have been soaring during the early months of 2023. Shares of Netflix have advanced nearly 18% to start the year. The Disney brand may be as strong as ever, and the company’s planned reorganization is targeting $5.5 billion of cost savings, but we remain skeptical that the firm can cut this deep and still thrive. Creative content is king for Disney, and cutting expenses to the bone to please near-term investors will likely hurt performance in the medium- to long-term.

Image Source: Disney

Disney’s creativity hasn’t been as strong the past few years, perhaps ever since the first release of Frozen in 2013. The 2022 film Avatar: The Way of the Water was the fourth-biggest film of all time globally, but filmmaking will always be hit or miss, and our confidence that Disney will continue to deliver big in this area has waned. We’ll be closely watching the performance of the February 17 release of Ant-Man and the Wasp: Quantumania (Marvel) and the June 30 release of Indiana Jones and the Dial of Destiny (Lucasfilm). A few upcoming Disney+ and Hulu releases we’ll be keeping our eye on, too, are the May 19 release of White Men Can’t Jump and Great Expectations, an adaption of the Charles Dickens classic.

Image Source: Disney

Image Source: Disney

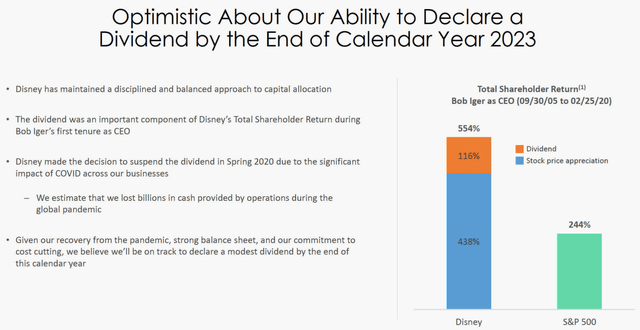

Disney has a lot of work to do. The company’s Parks, Experiences and Products segment has recovered nicely from the worst of the COVID-19 pandemic, but pricing increases may put the experience out of reach for many. Disney+ subscribers may have peaked given that the company will begin to cut costs to the bone in an effort to stop the billions in cash burn. Disney ended the year with $8.47 billion in cash and equivalents and a massive $48.4 billion debt load. Investors are happy that Bob Iger is back and with the company’s plans to re-instate a modest dividend later this year, but we think former CEO Bob Chapek may have gotten a bad shake. Chapek took over the week of the huge COVID-driven market crash in February 2020 and led the firm through a once-in-a-century pandemic, only to be shown the door before his investments could ever be given a chance of bearing fruit. There’s more to this story than we’ll ever know, and we doubt that Disney or Iger will have much to say about it.

Disney’s 16-page Stock Report (pdf) >>

Tickerized for DIS, NFLX, CMCSA, PARA, PARAA, AMZN, WBD, AMC, CNNWQ, CNK, IMAX, MCS, RDI, NCMI, ROKU, FOX, FOXA, SONY

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.