Image: Dick’s Sporting Goods’ shares have soared since the doldrums of the COVID-19 meltdown.

By Brian Nelson, CFA

On March 14, Dividend Growth Newsletter portfolio holding Dick’s Sporting Goods (DKS) reported better-than-expected top and bottom-line performance for the fourth quarter and issued a solid outlook for fiscal 2024. Shares of Dick’s Sporting Goods have done fantastic since the worst of the COVID-19 meltdown years ago, and the momentum behind its business remains strong, as evidenced by a nice 10% increase in its quarterly dividend. We expect to raise our fair value estimate of Dick’s Sporting Goods upon our next valuation model update, and the company remains a key idea in the Dividend Growth Newsletter portfolio.

Management’s commentary in the quarterly report was fantastic:

We are very pleased with our results and accomplishments in 2023 and are excited to continue to redefine the future of retail. We are proud of our progress in repositioning our portfolio through House of Sport, our next generation 50,000 square foot DICK’S store and Golf Galaxy Performance Center. Our growth opportunities are significant, and we continue to prioritize investments in our future to fuel long-term omnichannel growth. I’d like to thank all our teammates for their hard work and unwavering dedication to our business…

…With our industry-leading assortment and strong execution, we capped off the year with an incredibly strong fourth quarter and holiday season. Even excluding the extra week, this was the largest sales quarter in the history of the Company, and during the fourth quarter, we drove significant gross margin and EBT margin expansion. Our full year comps increased 2.4%, driven by growth in transactions, and we continued to gain market share…

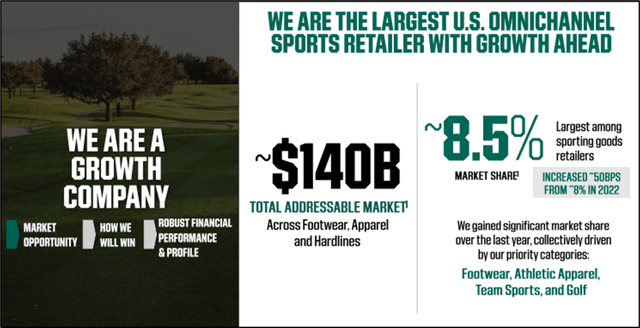

…We are guiding to another strong year in 2024. We plan to grow both our sales and earnings through positive comps, higher merchandise margin and productivity gains. With the continued success of our new store formats and our omnichannel experience, we will accelerate our investment in our growth strategies to drive our business forward and continue gaining market share in a fragmented $140-billion-dollar industry.

Management told the story of its strong quarter and outlook as well as we could have done, and the firm topped off the report with a 10% increase in its annualized dividend, to $4.40 per share, implying a forward estimated dividend yield of ~2%. Dick’s Sporting Goods ended its fiscal year with ~$1.8 billion in cash and ~$1.5 billion in total debt, good for a modest net cash position, though it does have meaningful operating lease liabilities on the books. Net inventories were roughly flat versus levels of a year ago.

Image: Dick’s Sporting Goods continues to gain share in a huge total addressable market.

Dick’s Sporting Goods’ free cash flow advanced to ~$940 million in its fiscal year (compared to ~$351.2 million in cash dividends paid), up from $557.8 million last year (compared to $163.1 million in cash dividends paid). Looking to fiscal 2024, comp store sales are expected to grow 1%-2%, and earnings per share is targeted in the range of $12.85-$13.25, implying shares are trading at a very reasonable ~16.3x at the high end of the range at the time of this writing. We continue to like Dick’s Sporting Goods as a key idea in the Dividend Growth Newsletter portfolio.

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

———-

Tickerized for holdings in the DKS, HIBB, NKE, YETI, ASO, FL, ADDYY, UA, UAA, GOLF, MODG, BGFV, SPWH, HBI, PMMAF, FIGS, LULU, BFIT, PTON, COLM.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.