Image Source: Costco

By Brian Nelson, CFA

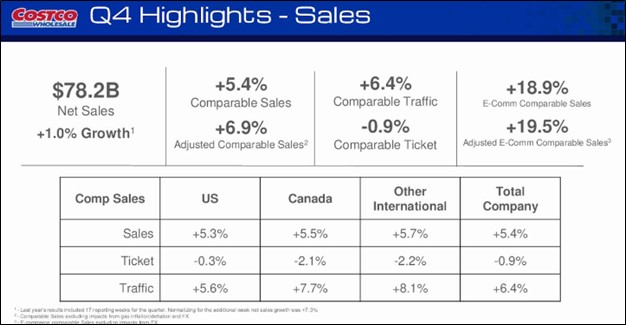

Costco Wholesale (COST) reported fiscal fourth-quarter results on September 26 where revenue came up a bit short relative to forecasts, while the company beat on the bottom line. For the 16-week fourth quarter, Costco reported a net sales increase of 1% compared to the 17-week fourth quarter of last fiscal year.

Total company adjusted comparable store sales were 6.9% in the 16-week period, better than the consensus estimate of 6.4%. E-commerce adjusted comparable store sales were 19.5% in the quarter. Net income for the 16-week period was $5.29 per diluted share, compared with $4.86 per diluted share in the 17-week fourth-quarter period of a year ago.

Management spoke of its international opportunity on the conference call, among other items:

We also continue to see significant opportunities worldwide, and our fiscal 2025 plan has 12 of our planned 29 openings coming outside of the US, including our fifth building in Spain, which opened in Zaragoza two weeks ago. With three of these warehouses being relocations, we expect to add 26 net new buildings in fiscal 2025.

Traffic or shopping frequency increased 6.4% worldwide and 5.6% in the US. Our average transaction, or ticket was negative 0.9% worldwide and negative 0.3% in the US. This includes the headwinds from gas deflation and FX. Adjusted for those items, ticket would have been positive 0.5% worldwide and positive 0.6% in the US. Moving down the income statement to membership fee income, we reported membership fee income of $1.512 billion, an increase of $3 million, or 0.2%, on one less week year-over-year.

We liked Costco’s fiscal 2024 fourth quarter performance, despite the slight miss on the top line. Based on its adjusted comp performance in the period, we think Costco is gaining share against other big box retailers, too. The only problem with Costco, however, at the moment is its valuation, which remains elevated, with shares trading at 45-50 times next year’s earnings. Costco is a great company, but our fair value estimate is substantially below its share price, meaning we won’t be interested in shares unless they drop significantly.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.