By Brian Nelson CFA

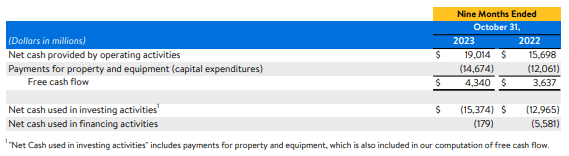

On November 16, Walmart (WMT) reported third quarter results for fiscal 2024 that showed revenue growth of 5.2% and adjusted operating income expansion of 3%. Adjusted earnings per share nudged up 2% in the quarter on a year-over-year basis. Operating cash flow during the first nine months of the year came in at $19 billion (up $3.3 billion from the year ago period), while free cash flow came in at $4.3 billion (up $0.7 billion on a year-over-year basis). The big box retailer ended the period with a ~$43.2 billion net debt position and has bought back 8.7 million shares of stock on a year-to-date basis. Walmart raised its outlook for the remainder of fiscal 2024, but its targets came in a bit shy of expectations. With shares trading down following the report, we think the market is overreacting. We won’t be making any changes to our $160 per share fair value estimate.

Image: Walmart’s free cash flow generation during the first nine months of its fiscal year has shown a nice jump.

Walmart is one of the best-positioned companies for the current market environment, as it offers a wide selection of private label and branded items coupled with its valuable Sam’s Club membership warehouse that captures incremental demand from those seeking the convenience of bulk buying. Despite a warning from Walmart about some softness in consumer spending in the back half of October, we think the consumer remains quite resilient given a slowing pace of inflation and even disinflation across many items (e.g. eggs). Consumers continue to look to save money by eating more at home as menu prices at restaurants have soared, and while Walmart was somewhat cautious with its outlook for the remainder of fiscal 2024, it still raised its fiscal year guidance. Net sales growth for fiscal 2024 is now targeted in the range of 5%-5.5% (was 4%-4.5%), while adjusted earnings per share is now targeted in the range of $6.40-$6.48 per share (was $6.36-$6.46 per share). The market had been looking for more, but we think Walmart remains in good shape.

———-

Tickerized for WMT, TGT, COST, DLTR, DG, BBY, PSMT, OLLI, BJ, XRT.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and range.