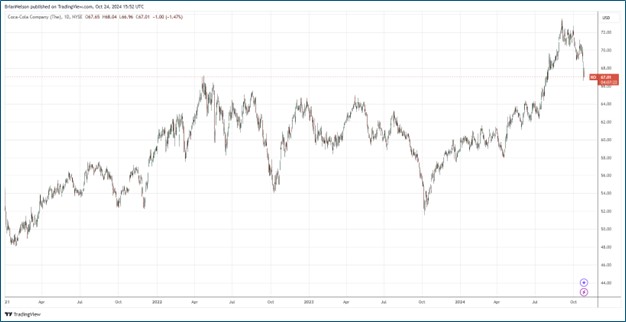

Image: Coca-Cola’s shares have done quite well the past couple years.

By Brian Nelson, CFA

Coca-Cola (KO) reported better than expected third quarter results October 23. Net revenue fell 1% in the quarter, but organic sales on a non-GAAP basis grew 9%. Comparable currency neutral operating income grew 14% in the quarter, as its comparable non-GAAP operating margin advanced 1 percentage point, to 30.7%. Reported earnings per share declined 7%, but comparable non-GAAP earnings per share increased 5%, to $0.77.

On a consolidated basis, concentrate sales dropped 2%, while the company benefited from a 10% gain in price/mix in the third quarter. Organic revenue was particularly strong in Latin America (+24%) and North America (+12%) in the quarter, and the firm leveraged that strong top-line growth into solid comparable currency neutral operating income growth, 32% and 16%, respectively. In the quarter, comparable currency neutral operating income was solid in its Asia Pacific division (+12%), too.

Looking to the full year 2024, Coca Cola expects to deliver organic revenue (non-GAAP) growth of roughly 10%, “which consists of operating performance at the high end of the company’s long-term growth model and the anticipated pricing impact of a number of markets experiencing intense inflation.”

For the full year 2024, the company expects to deliver comparable currency neutral earnings per share growth of 14%-15% and comparable earnings per share (non-GAAP) growth of 5%-6%. Excluding an IRS tax litigation deposit, cash flow from operations is expected to be $11.4 billion, and after factoring in capital spending of $2.2 billion, free cash flow is targeted at $9.2 billion for the year.

Coca-Cola’s organic growth continues to be impressive, and the firm’s non-GAAP numbers show expansion in the core business. Still, it’s hard for us to get excited about a company reporting unadjusted net revenue declines, with global unit case volume also declining in the period. We think Coca-Cola retains its place as a top blue chip stock, but we think there are better ideas for consideration in the newsletter portfolios. Our fair value estimate stands at $61 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.