Image Source: Cisco

By Brian Nelson, CFA

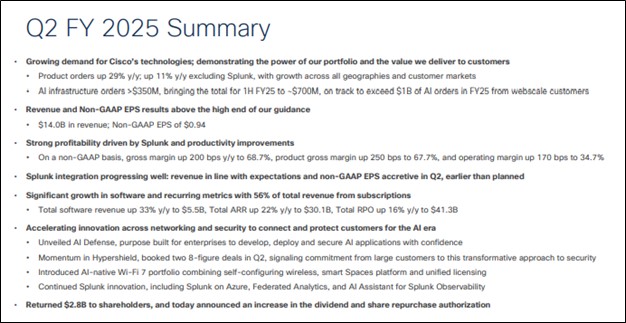

On February 12, Cisco Systems (CSCO) reported strong fiscal second quarter results with a beat on both the top and bottom lines. Revenue of $14.0 billion advanced 9% on a year-over-year basis, above the high end of the company’s guidance range. Non-GAAP earnings per share increased 8% year-over-year, to $0.94 per share, also coming in above the company’s guidance range. Product orders were up 29% from the same period last year, while they advanced 11%, excluding Splunk. AI Infrastructure orders were more than $350 million, bringing the total for the first half of its fiscal year to roughly $700 million.

Management was upbeat in the press release:

Cisco’s strong quarterly results were driven by accelerating customer demand for our technology. As AI becomes more pervasive, we are well positioned to help our customers scale their network infrastructure, increase their data capacity requirements, and adopt best-in-class AI security.

Q2 was another quarter of solid execution which drove revenue and EPS above our guidance ranges. Splunk continues to perform in line with our expectations on the top line, and was accretive to Q2 non-GAAP EPS, earlier than we had planned. Our strong cash flows have led us to increase our annual dividend again this year, as well as our overall share repurchase authorization.

Cisco raised its quarterly dividend to $0.41 per share, up 2.5%, and authorized an additional $15 billion in stock repurchases, bringing current authorization to approximately $17 billion. Cash flow from operating activities was $2.2 billion in the second quarter of 2025, up materially from $0.8 billion in the same period last year. The company ended the second quarter with $16.9 billion of cash and investments and $31 billion in short- and long-term debt.

Looking to fiscal third quarter guidance, Cisco’s revenue is expected to be between $13.9-$14.1 billion, and non-GAAP earnings per share to be between $0.90-$0.92. For all of fiscal 2025, management expects revenue in the range of $56-$56.5 billion (was $55.3-$56.3 billion) and non-GAAP earnings per share in the range of $3.68-$3.74 (was $3.60-$3.66 per share). We continue to like Cisco as a holding in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. The high end of our fair value estimate range stands at $73 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.