Image Source: Cisco Systems Inc – Third Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

On May 18, Cisco Systems Inc (CSCO) reported third quarter earnings for fiscal 2022 (period ended April 30, 2022) that missed consensus top-line estimates but beat consensus bottom-line estimates (specifically for its non-GAAP performance). One of the biggest updates from this earnings report was that Cisco Systems reduced its full year guidance for fiscal 2022. The news initially sent shares of CSCO sharply lower, though Cisco Systems remains a free cash flow cow with a pristine balance sheet.

It was an incredibly noisy earnings report for the firm for reasons we will cover in this article. We include Cisco Systems as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios and continue to like the name.

Key Considerations

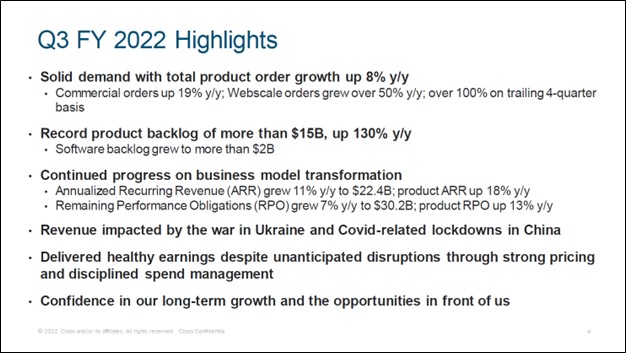

Now, Cisco Systems expects its revenues will grow by 2%-3% annually in fiscal 2022 versus 5.5%-6.5% previously. Additionally, Cisco Systems expects its non-GAAP EPS will come in at $3.29-$3.37 (up 3% year-over-year at the midpoint) versus $3.41-$3.46 previously. Please note that this is not the first time Cisco Systems has reduced its guidance for fiscal 2022, though past adjustments were largely marginal. Cisco Systems’ guidance for the current fiscal quarter was also downbeat as the firm incorporated the impact of the Ukraine-Russia crisis and recent coronavirus (‘COVID-19’) related lockdowns in China.

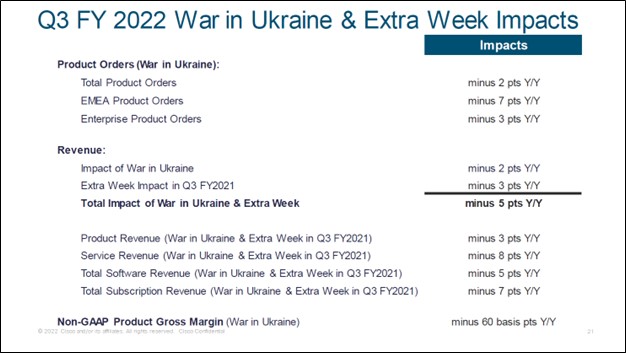

Please note that Cisco Systems’ fiscal 2021 was a 53-week reporting period as compared to a 52-week period in fiscal 2022. The third quarter of fiscal 2022 included 13 weeks versus 14 weeks in the same quarter in fiscal 2021. Cisco Systems notes that this has been reflected in its guidance.

Here is what Cisco Systems’ management team had to say on the firm’s revised outlook during the firm’s latest earnings call (emphasis added):

“We believe that our revenue performance in the upcoming quarters is less dependent on demand and more dependent on the supply availability in this increasingly complex environment. While certain aspects of the current situation are largely out of our control, our teams have been working on several mitigation actions to help alleviate many of the component issues that we’ve been facing. We believe that we will begin to see the benefits of these actions in the first half of next fiscal year.” — Chuck Robbins, CEO of Cisco Systems

Management stressed that the Russian invasion of Ukraine posed a serious near-term headwind during the earnings call. Additionally, the recent COVID-lockdowns in China “resulted in an even more severe shortage of certain critical components” which “in turn prevented us from shipping products to customers at the levels we originally anticipated heading into [the fiscal third quarter].” We are keeping a close eye on recent events.

On a positive note, Cisco Systems generated $9.2 billion in free cash flow during the first nine months of fiscal 2022 while spending $4.7 billion covering its dividend obligations and another $5.3 billion buying back its stock through its repurchase program (this figure does not include the $0.5 billion in ‘shares repurchased for tax withholdings on vesting of restricted stock units’ during this period).

At the end of April 2022, Cisco Systems had a net cash position of $10.7 billion (inclusive of short-term debt). Its pristine balance sheet and stellar free cash flow generating abilities indicate Cisco Systems has the capacity to boost its payout while buying back “gobs” of its stock going forward.

Earnings Update

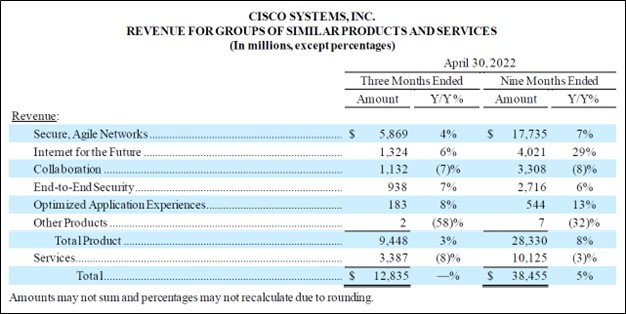

Last fiscal quarter, Cisco Systems’ GAAP revenues grew marginally versus the same period the prior fiscal year as 5% growth in the Americas geographical region offset 6% declines at both its Europe, Middle East, and Africa (‘EMEA’) and Asia Pacific, Japan, and China (‘APJC’) geographical regions. As it concerns the difficult year-over-year comparisons given the extra week in the same period a fiscal year ago, Cisco Systems noted that equated to roughly 300 basis points of revenue growth.

The company suspended its business in Russia and Belarus in March 2022 following the Russian invasion of Ukraine in February 2022 and is working to provide cybersecurity and other services to customers in Ukraine. In the near term, this will pose a headwind for Cisco Systems’ financial performance, but we appreciate the company taking a stand on this issue. Last fiscal quarter, this move shaved an estimated $0.2 billion off the firm’s revenues.

Image Shown: An extra reporting week last fiscal week combined with the Ukraine-Russia crisis produced a noisy earnings report for Cisco Systems. Image Source: Cisco Systems – Third Quarter of Fiscal 2022 IR Earnings Presentation

Cisco Systems’ ‘Product’ sales were up 3% year-over-year and its ‘Service’ sales were down 8% year-over-year last fiscal quarter. Its Product sales were supported by growth at its Optimized Application Experiences, End-to-End Security, Internet for the Future, and Secure, Agile Networks offerings. As the global workforce steadily resumes in-person activities, Cisco Systems’ offerings in the realm of collaboration, such as Webex, have faced sizable headwinds though its other offerings are performing quite well.

Image Shown: Many of Cisco Systems’ Product offerings performed well last fiscal quarter. Image Source: Cisco Systems – Third Quarter of Fiscal 2022 Earnings Press Release

The company’s GAAP gross margins dropped by ~65 basis points year-over-year to reach 63.3% in the fiscal third quarter. However, Cisco Systems’ GAAP operating income climbed higher 4% year-over-year and its GAAP operating margin rose by ~105 basis points to reach 28.1% last fiscal quarter. Its GAAP diluted EPS rose to $0.73 last fiscal quarter versus $0.68 in the same period in fiscal 2021, aided by a 2% year-over-year drop in its outstanding diluted share count.

Cisco Systems had $30.2 billion in remaining performance obligations (‘RPO’) last fiscal quarter, up 7% year-over-year, with 54% of that expected to be realized within the next twelve months. Its annualized recurring revenue (‘ARR’) stood at $22.4 billion last fiscal quarter, up 11% year-over-year, aided by 18% growth at its Product ARR. Demand for its Product offerings remains strong with Cisco Systems securing 8% year-over-year total Product order growth last fiscal quarter. The firm exited the fiscal third quarter with a record Product backlog worth more than $15.0 billion (its software backlog stood north of $2.0 billion).

Exogenous shocks negatively impacted the company’s software and subscription revenues, which were both down modestly year-over-year last fiscal quarter, according to recent management commentary. When Cisco Systems’ software and subscription revenues can resume their growth trajectories in earnest, that should go a long way in supporting the company’s outlook. Pivoting towards recurring revenues is a big part of Cisco Systems corporate strategy, and we like the move, though recent events have unfortunately gotten in the way of its plans.

Concluding Thoughts

Overall, it was an incredibly noisy quarter for Cisco Systems. Shares of CSCO initially sold off sharply when the firm’s latest earnings report was published, but after looking through its update, it does not appear that our thesis towards Cisco Systems has been fundamentally altered. The company is a stellar free cash flow generator with a vast backlog and a pristine balance sheet. Cisco Systems has the capacity to continue pushing through dividend increases and buying back “gobs” of its stock while riding out the storm. Its pivot towards recurring revenues will further strengthen its already strong cash flow profile, given the highly visible nature of those future sales.

We continue to like Cisco Systems. Our fair value estimate sits at $62 per share, though the lower rung of our fair value estimate range sits at $50 per share. The kneejerk reaction in its share price in the wake of its latest earnings report may see Cisco Systems step up its share buybacks in the near term to take advantage of the discount shares of CSCO are trading at relative to their intrinsic value.

As it concerns Cisco Systems’ dividend strength, its payout is rock-solid. We give the firm a Dividend Cushion ratio of 2.8, earning Cisco Systems an “EXCELLENT” Dividend Safety rating. We also assign the firm an “EXCELLENT” Dividend Growth rating.

Panicking during times like these is often not a good idea for long-term investors, in our view. We continue to be bullish on US equity markets and the US economy in the longer run.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Tickerized for CSCO, QQQ, XLK, ANET, MCHP, NTGR, COMM, UI, DDOG, NEWR, CIEN, VRT, JNPR, APH, NTAP, FSLY, FFIV, DELL, PANW, EXTR, HPE, PSTG, SPLK, VMW

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.