Image: Cisco put up excellent fiscal third quarter results.

By Brian Nelson, CFA

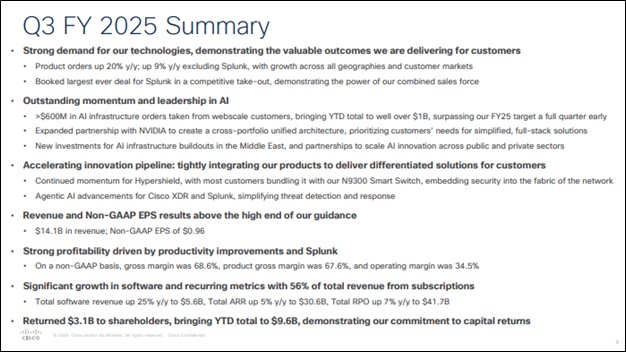

On May 14, Cisco Systems (CSCO) reported better than expected third quarter fiscal 2025 results, with both revenue and non-GAAP earnings per share coming in higher than the consensus forecast. Revenue increased 11% year-over-year, while non-GAAP earnings per share increased 9% year-over-year, to $0.96 per share, above the high end of its guidance range ($0.90-$0.92). Product orders expanded 20% from the same period a year ago (9% excluding Splunk), while AI infrastructure orders taken from webscale customers exceeded $600 million.

Management had the following to say about the quarter:

Cisco once again had strong quarterly results with clear demand for our technologies. The momentum we are seeing with AI is fueled by the power of our secure networking portfolio, our trusted global partnerships, and the value we bring to our customers.

Another quarter of solid execution in Q3 drove revenue, margins and EPS above our guidance ranges. Our innovation positions us well for future growth and our operational discipline is generating strong cash flows, enabling us to deliver significant shareholder returns.

Cisco’s non-GAAP operating income was $4.9 billion, up 12% with a non-GAAP operating margin of 34.5%. Non-GAAP net income was $3.8 billion, an increase of 8%. Cisco returned $3.1 billion to shareholders through stock buybacks ($1.5 billion) and dividends ($1.6 billion). Cisco has $15.4 billion remaining under its share repurchase program. The company ended the quarter with cash and cash equivalents of $15.6 billion, compared with $17.9 billion at the end of fiscal 2024. Total debt at the end of the quarter was $29.3 billion. Remaining Performance Obligations (RPO) were $41.7 billion, up 7% in total, and ahead of consensus.

Looking to the fourth quarter of fiscal 2025, Cisco’s revenue is expected to be between $14.5-$14.7 billion, with non-GAAP earnings per share targeted in the range of $0.96-$0.98. For all of fiscal 2025, revenue is expected to be in the range of $56.5-$56.7 billion (was $56-$56.5 billion) and non-GAAP earnings per share in the range of $3.77-$3.79 (was $3.68-$3.74). We continue to like Cisco as a holding in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. The high end of our fair value estimate range stands at $74 per share.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.