Image Source: Cisco

By Brian Nelson, CFA

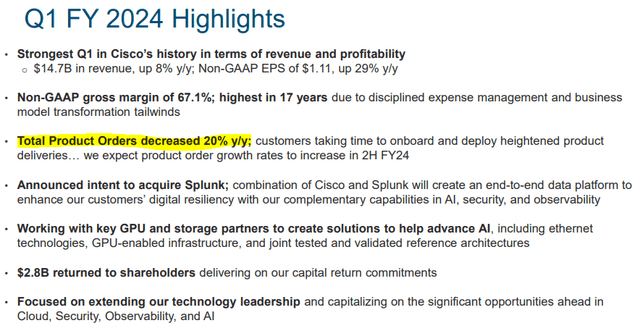

On November 15, Cisco Systems (CSCO) reported strong first quarter results for its fiscal 2024, but the company surprisingly lowered its outlook for the remainder of its fiscal year on a slowdown in new orders. We’re not rushing to judgement of the company, but the revision was rather sizable, and we’ll be taking a close look at our valuation model following the report. We continue to be fans of Cisco’s intent to purchase Splunk, and there may have been some hiccups in the sales cycle as the firm works to close this strategic deal. For now, we’re giving the firm the benefit of the doubt that things will improve in the back half of its fiscal 2024. Cisco remains an idea in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

Cisco’s first-quarter report for fiscal 2024 wasn’t all that bad. In fact, it was pretty good. The company put up its strongest fiscal first quarter results in history, with revenue advancing 8% on a year-over-year basis and the firm growing non-GAAP earnings per share 29%. Total annualized recurring revenue [ARR] came in at $24.5 billion, up 5% year-over-year, and the company’s free cash flow remained robust, despite some headwinds related to the timing of tax payments. Cash and cash equivalents stood at $23.5 billion at the end of the first quarter of fiscal 2024 against short- and long-term debt of ~$990 million and ~$6.7 billion respectively, showcasing a net cash position on the books.

The bad news came in Cisco’s outlook, however. The company is now guiding fiscal 2024 revenue to the range of $52.8-$55 billion, down from $57-$58.2 billion previously, and non-GAAP earnings in the range of $3.87-$3.93 per share, below the consensus forecast. Cisco is largely saying it is a victim of its own success as customers are now implementing products that it recently shipped. We’re withholding judgment on whether there may be something more to the story here, but for now, we’re okay taking Cisco at its word that “product order growth rates (will) accelerate in the second half of the year.” We expect a modest downward revision in our fair value estimate and more substantial changes to our valuation model following the closure of the Splunk deal.

———-

Tickerized for CSCO, SPLK, ANET, JNPR.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and range.