Image Shown: Cisco Systems Inc is a very shareholder friendly company. Image Source: Cisco Systems Inc – Second Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

On February 16, Cisco Systems Inc (CSCO) reported second quarter earnings for fiscal 2022 (period ended January 29, 2022) that smashed past both consensus top- and bottom-line estimates. Shares of CSCO surged higher initially after its earnings were made public as the company offered up promising near term guidance, indicating that its positive momentum seen of late is expected to continue. We include shares of CSCO as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios.

Cisco announced a 3% sequential increase in its quarterly dividend in conjunction with its latest earnings update, bringing it up to $0.38 per share or $1.52 per share on an annualized basis. The company also announced it had increased its share repurchasing capacity by $15 billion, bringing its total repurchasing capacity up to ~$18 billion. Shares of CSCO yield ~2.8% as of this writing at its new payout level and we view its dividend strength as rock-solid due to its pristine balance sheet and stellar free cash flows.

Our fair value estimate for Cisco sits at $62 per share with room for upside as the high end of our fair value estimate range sits at $74 per share. That is meaningfully above where shares of CSCO are trading at as of this writing (~$56 per share each), and we view the company’s capital appreciation upside potential quite favorably.

Earnings Update

In the fiscal second quarter, Cisco posted $12.7 billion in GAAP revenue, up 6% year-over-year. Sales growth at its ‘Product’ offerings offset declines at its ‘Services’ offerings. The company’s ‘Secure, Agile Networks’ and ‘End-to-End Security’ products both grew their sales by 7% year-over-year last fiscal quarter, while its ‘Internet for the Future’ products posted 42% sales growth and its ‘Optimized Application Experiences’ products posted 12% sales growth. On a geographical basis, Cisco posted revenue growth across the board.

The company’s GAAP gross margin came in at 63.3% last fiscal quarter, down from 65.1% in the same period in fiscal 2021. Inflationary pressures and supply chain hurdles are weighing on Cisco’s margins, something we covered in our November 2021 article Cisco Systems Posts Solid Earnings Update; Supply Chain Hurdles Impacting Near Term Outlook that can be viewed here.

Cisco reported $3.4 billion in GAAP operating income in the fiscal second quarter, up 8% year-over-year due to a combination of revenue growth and a sharp decline in its ‘restructuring and other charges’ line-item. The firm also posted $0.71 in GAAP diluted EPS, up 18% year-over-year, aided by a smaller provision for corporate income taxes and share buybacks that reduced its diluted outstanding share count.

Pivoting to Cisco’s balance sheet, it had a net cash position of $9.6 billion (inclusive of short-term debt) as of January 29. We are huge fans of the company’s fortress-like balance sheet.

Cisco generated $5.7 billion in free cash flow during the first half of fiscal 2022 while paying out $3.1 billion covering its dividend obligations along with another $5.1 billion buying back its stock through its repurchase program. Some of these activities were funded by its balance sheet, though we view Cisco’s share repurchases as a good use of capital given that shares of CSCO have been trading well below their fair value estimate for some time and continue to do so as of this writing.

Image Shown: We are huge fans of Cisco’s pristine balance sheet. The firm had a nice net cash position on hand as of January 29, 2022. Image Source: Cisco – Second Quarter of Fiscal 2022 Earnings Press Release

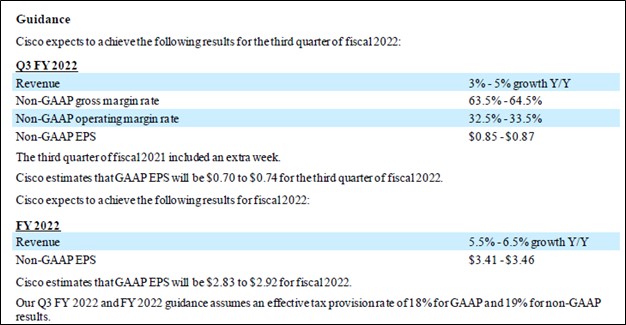

Guidance

Cisco released updated guidance for fiscal 2022 along with guidance for the current fiscal quarter in conjunction with its latest earnings report. As it concerns its fiscal 2022 guidance, the midpoint of its updated revenue growth forecast (calls for annual growth of 5.5%-6.5%) was the same as its previous forecast (5%-7% annual revenue growth), though the range was tightened modestly. The company’s non-GAAP EPS forecast for fiscal 2022 was raised to $3.41-$3.46 from $3.38-$3.45 previously, which represents 7% annual growth at the midpoint of guidance. Cisco also raised its GAAP EPS forecast to $2.83-$2.92 from $2.77-$2.89 previously. Additionally, its guidance for the current fiscal quarter is decent.

Image Shown: Cisco modestly adjusted its guidance for fiscal 2022 versus its previous expectations, which on a net basis was favorable. Image Source: Cisco – Second Quarter of Fiscal 2022 Earnings Press Release

At the end of the fiscal second quarter, Cisco had $30.5 billion in remaining performance obligations (‘RPO’), up 8% year-over-year. Cisco views its RPO metric as a useful gauge of its future revenue performance, and this metric has been trending in the right direction of late which speaks favorably towards its outlook. The upcoming graphic down below highlights the trajectory of its remaining RPO in recent fiscal quarters and whether those are short-term (expected to be realized in the next 12 months) or long-term.

Image Shown: Cisco’s RPO metric continues to trend in the right direction, which speaks favorably towards its growth trajectory. Image Source: Cisco – Second Quarter of Fiscal 2022 IR Earnings Presentation

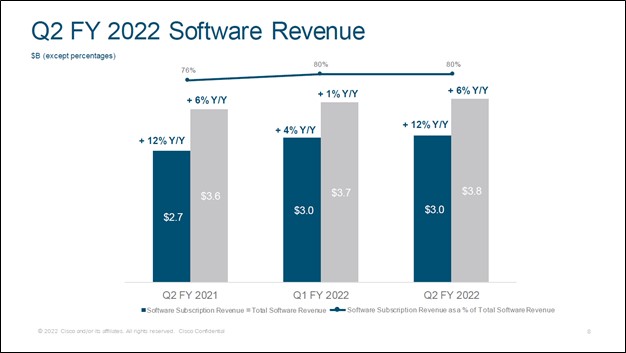

Recurring Revenues

A core part of Cisco’s strategy involves growing its software sales so it can build up a sizable stream of recurring revenues. We are big fans of recurring revenues because those sales provide tremendous visibility as it concerns a company’s future financial performance. Cisco posted $3.8 billion in software revenue last fiscal quarter (up 6% year-over-year), $3.0 billion of which was recurring in nature (up 12% year-over-year). The pace of its software sales growth picked up stream in the fiscal second quarter on a sequential basis as you can see in the upcoming graphic down below.

Image Shown: Cisco’s software sales are growing robustly as is its recurring revenue streams. Image Source: Cisco – Second Quarter of Fiscal 2022 IR Earnings Presentation

When including recurring Services revenue that did not include a meaningful software component alongside its recurring software revenue, 44% of Cisco’s sales last fiscal quarter were recurring in nature (up 7% year-over-year). The company’s annualized recurring revenue (‘ARR’) stood at $21.9 billion in the fiscal second quarter (up 11% year-over-year). Strong performance at its Product ARRs (up 20% year-over-year) and decent performance at its Services ARRs (up 5% year-over-year) were key.

Concluding Thoughts

We liked what we saw in Cisco’s latest earnings update. Cisco is a very shareholder friendly company that offers investors both ample capital appreciation upside, given that its shares are trading meaningfully below our fair value estimate as of this writing, and dividend growth upside as well. The company’s Dividend Cushion ratio sits at a stellar 2.9, earning Cisco an “EXCELLENT” Dividend Safety rating, and we also give Cisco an “EXCELLENT” Dividend Growth rating.

—–

Technology Giants Industry – FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI, SIMO

Tickerized for CSCO, QQQ, XLK, ANET, MCHP, NTGR, COMM, UI, DDOG, NEWR, CIEN, VRT, JNPR, APH, NTAP, FSLY, FFIV, DELL, PANW, EXTR, HPE, PSTG, SPLK, VMW

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Meta Platforms Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Meta Platforms, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.