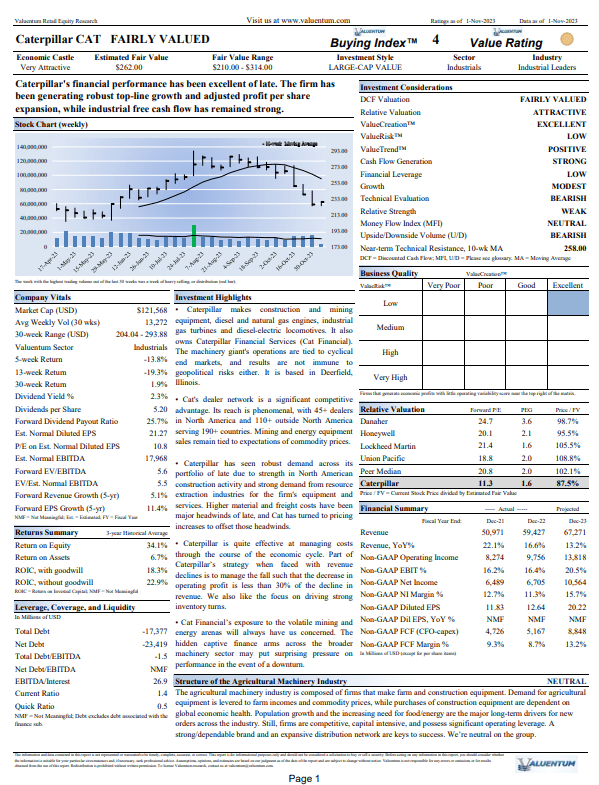

Image: Price realization remains a key driver behind Caterpillar’s strong performance.

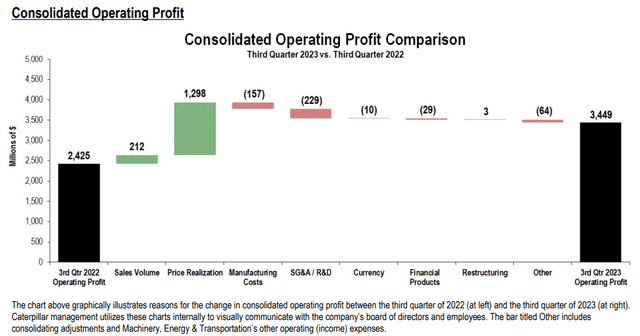

On October 31, Caterpillar (CAT) reported better-than-expected third-quarter results, with revenue advancing 12% and non-GAAP diluted earnings per share handily beating the consensus forecast. Caterpillar continues to benefit from significant pricing power, but the firm is also experiencing volume increases.

The firm’s adjusted operating profit margin expanded to 20.8% in the third quarter compared to 16.5% for the third quarter of 2022. Caterpillar ended the third quarter with $6.5 billion in cash and cash equivalents, short-term borrowings of ~$4.2 billion, and long-term debt of ~$1 billion and ~$7.6 billion in its ‘Machinery, Energy & Transportation’ and ‘Financial Products’ divisions, respectively. Its balance sheet, while not showcasing a net cash position, remains very healthy, in our view, especially in the context of its free cash flow generation.

Through the first nine months of 2023, the maker of mining and construction equipment’s cash flow from operations soared to ~$8.9 billion, as it shelled out just ~$1.06 billion in capital expenditures, a number that excludes equipment leased to others (~$1.2 billion). Free cash flow generation at the firm remains excellent, and we like that it continues to focus on dividend growth. We continue to like the pricing power witnessed within Caterpillar’s operations of late, and we’re sticking with our above-market $262 fair value estimate for now.

Please select the image below to download its 16-page stock report.

NOW READ: Raising Our Fair Value Estimate of Dividend Aristocrat Caterpillar

Tickerized for CAT, DE, MTW, AGCO, CNHI, and for holdings in the XME.

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, QQQ, and SCHG. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.