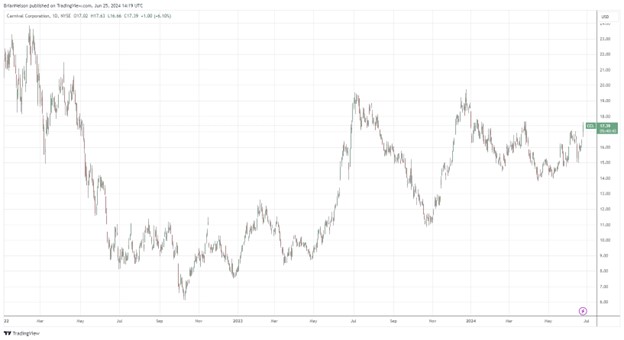

Image: Carnival Corp.’s shares have bounced from its 2022 lows, but the company has yet to return to new highs, despite strong bookings demand.

By Brian Nelson, CFA

On June 25, Carnival Corp. (CCL) reported better-than-expected second quarter results for fiscal 2024. Total revenue advanced to $5.78 billion from $4.91 billion in the same period a year ago, while operating income expanded to $560 million from $120 million in last year’s quarter. Net income swung to a profit of $92 million from a net loss of $407 million in the second quarter of fiscal 2023.

Management commentary was upbeat in the press release:

We have made incredible strides in improving our commercial operations, strategically reallocating our portfolio composition and formulating growth plans, while strengthening even further our global team, the best in the business. Off the back of that effort, we closed yet another quarter delivering records, this time across revenues, operating income, customer deposits and booking levels, exceeding our guidance on every measure…

…Based on continued strong demand trends, we are taking up our expectations for the year with net yields now forecasted to top ten percent and propelling us towards double-digit returns on invested capital. On our upwardly revised guidance, we will be on average around two-thirds of the way to achieving our three 2026 SEA Change targets after just one year. With two years remaining, it certainly gives us even more conviction in achieving these deliverables…

…We are very pleased with the continued acceleration of demand for 2025 and beyond, which builds upon the fantastic achievements in 2024 thus far. This positive trajectory is a testament to the successful execution of our demand generation efforts and the delivery of exceptional vacation experiences once onboard…

…Looking forward, we expect substantial free cash flow driven by our ongoing operational execution and the lowest newbuild order book in decades to deliver continued improvements in our leverage metrics and balance sheet.

Carnival Corp. is experiencing strong bookings momentum and generated record booking volumes for 2025 sailings. The strong demand is facilitating higher prices (in constant currency) for orders taken during 2024 and its most recently completed second quarter, in particular. Looking to 2024, the company expects net yields up ~10.25%, adjusted EBITDA of $5.83 billion, up 40% on a year-over-year basis, and adjusted net income of $1.55 billion, an increase from its March guidance by ~$275 million. Adjusted ROIC is targeted at 10% for the year.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Tickerized for CCL, RCL, VIK, NCLH

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.